Mohamed El-Erian says Fed communication is seen as 'confused and confusing' after it held rates and signaled hikes at the same time

The Federal Reserve's latest policy talk, following its unusual move to hold interest rates and signal hikes at once, has bewildered many in the market, according to Mohamed El-Erian. , the top economist said the central bank's policy communication this week was seen as"confused and confusing," and shared tweets echoing a similar sentiment from journalists and experts including economist David Rosenberg.

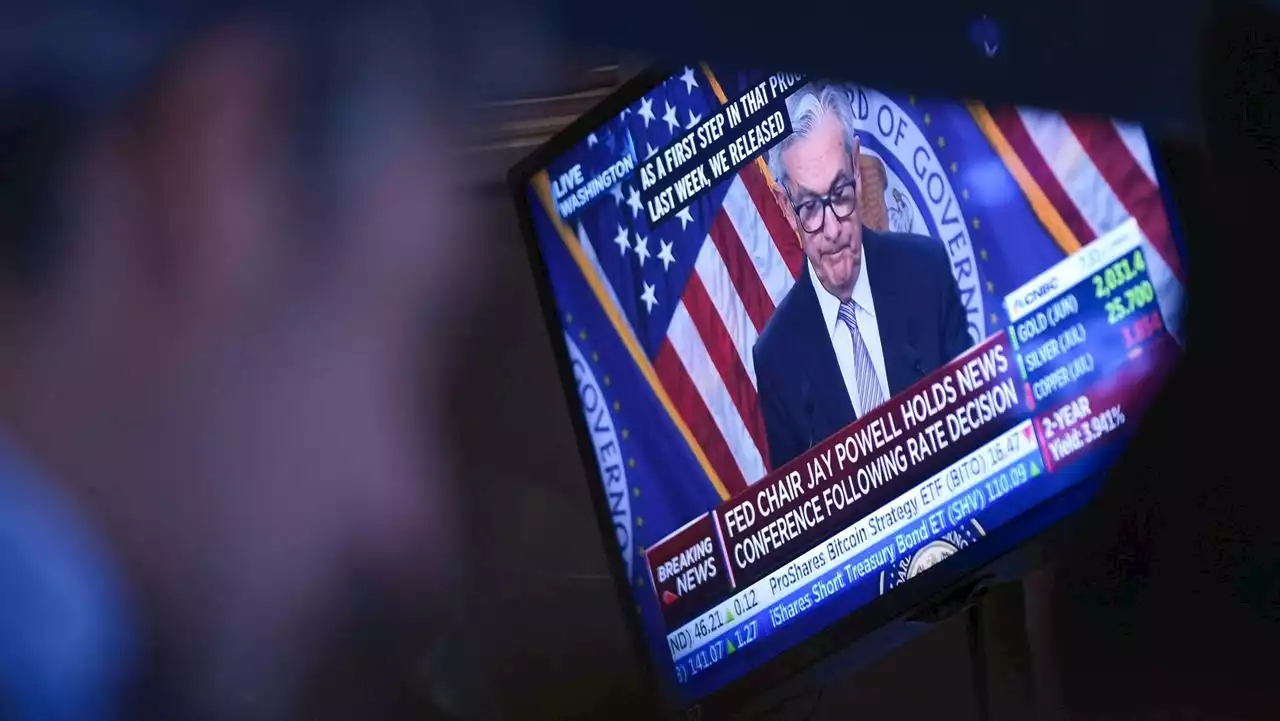

Fed chair Jerome Powell left interest rates unchanged this week for the first time in 11 meetings, but projected two more 25-basis-point increases before year-end - a move that has been seen as a"hawkish pause" by markets. "A sample from quite a set of reactions to what is seen as confused and confusing Fed communication," El-Erian said in the tweet, accompanied by three critical observations the Fed from market commentators including Rosenberg. "Last July, he told us that headline inflation mattered more than the core, because that is what households respond to. Yesterday he switches course and tells us that it is sticky core that matters most. Which is it??" Rosenberg added.

Ex-Treasury Secretary Summers told Bloomberg that the Fed's late decision comes across as inconsistent and confusing, and may have beenThe Fed has been on an aggressive path to cool inflation over the past year, hiking interest rates by 500 basis points to a range between 5%-5.25%. While the hikes have helped tame price pressures from their 40-year highs reached last year, inflation still remains double the Fed's 2% target.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Mohamed El-Erian says AI is an 'equalizer' but overuse could cause havocTop economist Mohamed El-Erian is excited about AI, saying the technology is an 'equalizer' - but warns overconsumption can cause havoc

Lire la suite »

Fed leaves interest rates unchanged for first time in over a yearThe Federal Reserve, having raised interest rates at the fastest pace in four decades, is poised Wednesday to leave rates alone for the first time in 15 months to allow time to gauge the impact of its aggressive drive to tame inflation.

Fed leaves interest rates unchanged for first time in over a yearThe Federal Reserve, having raised interest rates at the fastest pace in four decades, is poised Wednesday to leave rates alone for the first time in 15 months to allow time to gauge the impact of its aggressive drive to tame inflation.

Lire la suite »

CNBC Daily Open: The Fed paused rates — and the rally in marketsDon’t see the Fed leaving interest rates unchanged as something positive.

CNBC Daily Open: The Fed paused rates — and the rally in marketsDon’t see the Fed leaving interest rates unchanged as something positive.

Lire la suite »

CNBC Daily Open: The Fed paused, but so did marketsDon’t see the Fed leaving interest rates unchanged as something positive.

CNBC Daily Open: The Fed paused, but so did marketsDon’t see the Fed leaving interest rates unchanged as something positive.

Lire la suite »

Why the stock market shook off a 'Jekyll and Hyde' Fed meetingStocks slump then recover as Fed signals more tightening in the pipeline than investors expected.

Why the stock market shook off a 'Jekyll and Hyde' Fed meetingStocks slump then recover as Fed signals more tightening in the pipeline than investors expected.

Lire la suite »

Fed leaves rates unchanged, sees two small hikes by end of 2023The Federal Reserve left interest rates unchanged but signaled that borrowing costs may still need to rise by as much as half of a percentage point by the end of this year, as the central bank reacted to a stronger-than-expected economy

Fed leaves rates unchanged, sees two small hikes by end of 2023The Federal Reserve left interest rates unchanged but signaled that borrowing costs may still need to rise by as much as half of a percentage point by the end of this year, as the central bank reacted to a stronger-than-expected economy

Lire la suite »