CryptoNews: The founder of CurveFinance, Michael Egorov, received assistance from a number of DeFi figures when his DeFi loan positions were at risk following an attack on decentralized exchange Curve. 🧐

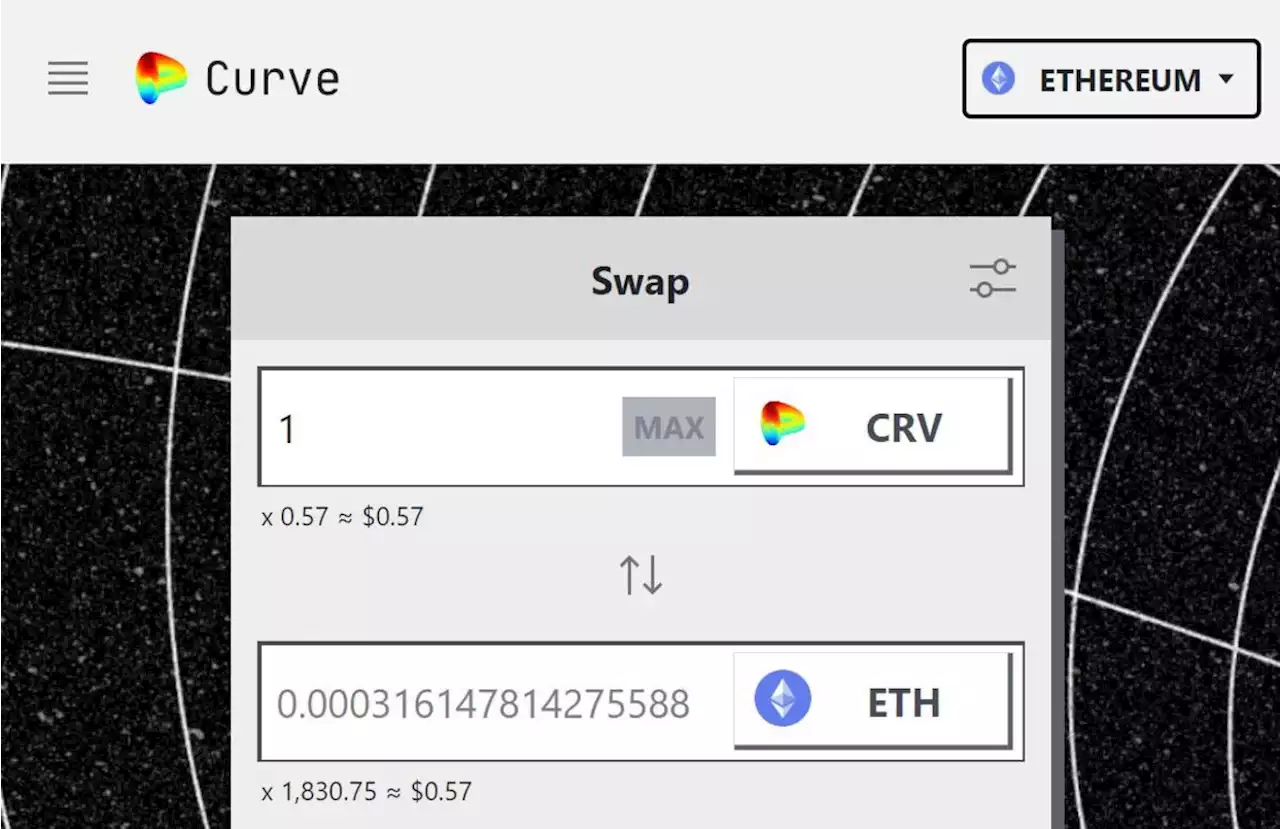

The Vyper programming language vulnerability that Curve Finance experienced earlier this week allowed hackers to steal $52 million worth of cryptocurrency assets, including 7.19 million CRV tokens worth $4.52 million.

Since then, a number of well-known DeFi figures, including the CEO of the Tron Foundation, Justin Sun, DCF God, and Jeffrey Huang, also known as Machi Big Brother, have intervened and purchased CRV directly from Egorov. All told, including the transactions made by those named, Ergorov sold about 50 million CRV for $0.4 each, making close to $20 million. It is speculated that the tokens are subjected to a six-month lockup.Related Articles

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Curve Founder’s $168M Stash Is Under Stress, Creating a Risk for DeFi as a WholeCurve CEO Michael Egorov pledged 34% of $CRV’s total market cap to back loans across DeFi protocols. A forced liquidation would result in selling at a time when prices are already falling. sndr_krisztian, & skesslr report

Curve Founder’s $168M Stash Is Under Stress, Creating a Risk for DeFi as a WholeCurve CEO Michael Egorov pledged 34% of $CRV’s total market cap to back loans across DeFi protocols. A forced liquidation would result in selling at a time when prices are already falling. sndr_krisztian, & skesslr report

Lire la suite »

Curve Finance founder's $100M debt could trigger a DeFi implosion: ReportCurve Finance founder Michael Egorov made attempts to lower his debt and utilization rate by paying 4 million to Fraxlend.

Curve Finance founder's $100M debt could trigger a DeFi implosion: ReportCurve Finance founder Michael Egorov made attempts to lower his debt and utilization rate by paying 4 million to Fraxlend.

Lire la suite »

Bitcoin Falls 1.2% as Curve Chaos Sparks Systemic Crisis Fears in DeFiDespite a modest bounce Tuesday afternoon, crypto markets remain lower, with sentiment dented by $CRV jitters and a potentially negative court ruling for $XRP.

Bitcoin Falls 1.2% as Curve Chaos Sparks Systemic Crisis Fears in DeFiDespite a modest bounce Tuesday afternoon, crypto markets remain lower, with sentiment dented by $CRV jitters and a potentially negative court ruling for $XRP.

Lire la suite »

Crypto Market Unnerved by DeFi Exchange Curve’s Sinking CRV TokenA tumble in the native token of key decentralized cryptocurrency exchange Curve Finance sapped sentiment toward digital assets on concern that the episode could trigger cascading liquidations of positions throughout the embryonic sector.

Crypto Market Unnerved by DeFi Exchange Curve’s Sinking CRV TokenA tumble in the native token of key decentralized cryptocurrency exchange Curve Finance sapped sentiment toward digital assets on concern that the episode could trigger cascading liquidations of positions throughout the embryonic sector.

Lire la suite »

Curve liquidation risk poses systemic threat to DeFi even as founder scurries to repay loans$CRV price briefly improved after DeFi traders stepped in to help reduce the liquidation risk of founder’s loans, but Curve is not out of the clear just yet.

Curve liquidation risk poses systemic threat to DeFi even as founder scurries to repay loans$CRV price briefly improved after DeFi traders stepped in to help reduce the liquidation risk of founder’s loans, but Curve is not out of the clear just yet.

Lire la suite »

Curve founder looks to unexpected counterparties to rescue sinking DeFi loansA CRV fire sale from CurveFinance founder Michael Egorov saw a list of relatively well-known buyers snap up the token at a discount.

Curve founder looks to unexpected counterparties to rescue sinking DeFi loansA CRV fire sale from CurveFinance founder Michael Egorov saw a list of relatively well-known buyers snap up the token at a discount.

Lire la suite »