(Bloomberg) -- Credit investors have decided that they’re more than willing to fight the Federal Reserve as the central bank vows to keep rates high. Most Read from BloombergSpaceX Blast Left Officials in Disbelief Over Environmental DamageTesla Investors to Get $12,000 Each From Musk’s SEC DealPowell Signals Fed Will Raise Rates If Needed, Keep Them HighFIFA Suspends Spanish Football Chief Over World Cup KissAfter 15 Years, a New Private Jet Is America’s Most PopularTotal returns from leveraged

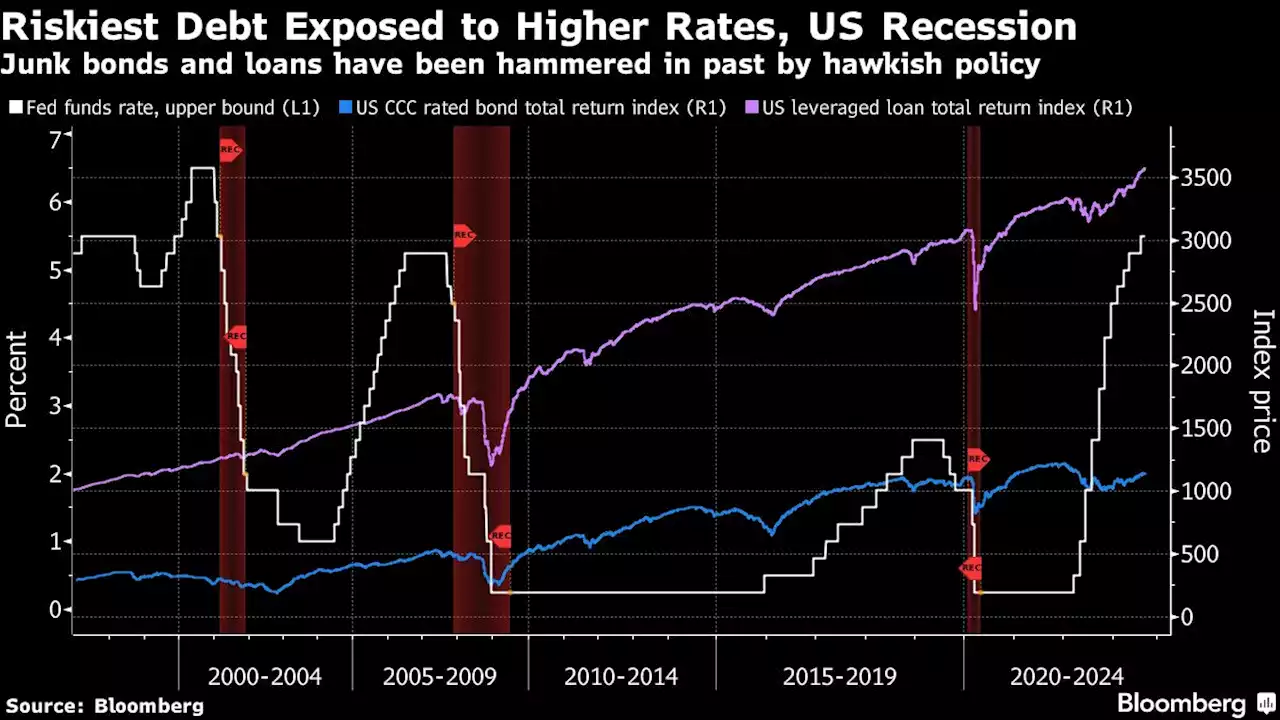

Total returns from leveraged loans and CCC rated junk bonds have rallied strongly this year, outstripping their investment-grade counterparts in recent months as the risk of a severe recession fades. Those gains come even as Fed Chair Jerome Powell has signaled he’s prepared to raise rates even further if he has to.

Strategists from Bank of America Corp. to Pacific Investment Management Co. have written in recent days about the rising likelihood that borrowing costs remain higher as the economy holds up. That’s left the market feeling confident enough to bring several leveraged buyout loans to market in the coming weeks, helping to quench some of the deal supply drought. Deutsche Bank AG, for example, is preparing a $550 million leveraged loan to fund Bain Capital Private Equity’s purchase of Brazilian steakhouse Fogo de Chão.

Junk bond risk premiums are unlikely to widen materially between now and September, in part because of relatively subdued issuance, they wrote. However, spreads “are too tight at these levels due to continuing severe lending standards, deteriorating fundamentals, and a default rate that is likely to rise.”Private equity firm Roark Capital Group expects to borrow nearly $5 billion in a little-known debt market to help permanently fund its investment in US sandwich chain Subway.

UBS Group AG is exploring its first sale of additional tier 1 bonds since its rescue acquisition of collapsed Swiss peer Credit Suisse Group AG.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Bitcoin price range-bound as investors await Fed Chair Powell's speechCryptocurrency prices continued to experience range-bound, sideways trading on Thursday as Fed officials say to expect higher interest rates for longer.

Bitcoin price range-bound as investors await Fed Chair Powell's speechCryptocurrency prices continued to experience range-bound, sideways trading on Thursday as Fed officials say to expect higher interest rates for longer.

Lire la suite »

Oil gains more than 1% as investors await Fed news from Jackson HoleBrent crude rose 97 cents to $84.33 a barrel by 0852 GMT, while U.S. West Texas Intermediate crude was up 93 cents at $79.98

Oil gains more than 1% as investors await Fed news from Jackson HoleBrent crude rose 97 cents to $84.33 a barrel by 0852 GMT, while U.S. West Texas Intermediate crude was up 93 cents at $79.98

Lire la suite »

Junkiest Debt Rallies as Investors Brush Off Fed: Credit WeeklyCredit investors have decided that they’re more than willing to fight the Federal Reserve as the central bank vows to keep rates high.

Junkiest Debt Rallies as Investors Brush Off Fed: Credit WeeklyCredit investors have decided that they’re more than willing to fight the Federal Reserve as the central bank vows to keep rates high.

Lire la suite »

Fed 'clearly going to hold through the end of the year': Fed's HarkerFederal Reserve members, including chair Jerome Powell, are sending a clear message - they want to get rates down to two percent. However, some are taking a more hawkish stance than others. Philadelphia Federal Reserve President Patrick Harker wants to let 'things work through the economy.' Harker tells Yahoo Finance's Jennifer Schonberger what he is hearing from people who live in his district that they want to be able to digest all the rate increases the Fed has done this year. However, Harker stresses that 'not raising rates right now still means we are in a restrictive stance, we're still putting pressure on the economy,' and that data will dictate his decisions. Right now, Harker doesn't see a re-acceleration in inflation and that he would like to 'hold and see how things turn out.'The Fed is 'clearly going to hold through the end of the year,' Harker said, and that next year, data will dictate whether or not the Fed cuts rates. In order to get to a point where the Fed will cut, Harker says there needs to be 'clear signs' inflation is moving towards the Fed's two percent target, something he says 'is gong to take some time.' Overall, Harker says a soft landing scenario is the 'most probable,' but it's not guaranteed. Key video moments 00:00:22 Harker's current thinking on rates 00:02:00 Harker's on the September meeting 00:02:19 How long will the Fed keep rates high? 00:03:45 When could the Fed cut rates? 00:04:45 Harker on a soft landing 00:05:30 Relationship between wages and inflation 00:06:45 How demographics are impacting the economy and what the Fed does 00:10:00 Harker discusses what he is hearing at the symposium

Fed 'clearly going to hold through the end of the year': Fed's HarkerFederal Reserve members, including chair Jerome Powell, are sending a clear message - they want to get rates down to two percent. However, some are taking a more hawkish stance than others. Philadelphia Federal Reserve President Patrick Harker wants to let 'things work through the economy.' Harker tells Yahoo Finance's Jennifer Schonberger what he is hearing from people who live in his district that they want to be able to digest all the rate increases the Fed has done this year. However, Harker stresses that 'not raising rates right now still means we are in a restrictive stance, we're still putting pressure on the economy,' and that data will dictate his decisions. Right now, Harker doesn't see a re-acceleration in inflation and that he would like to 'hold and see how things turn out.'The Fed is 'clearly going to hold through the end of the year,' Harker said, and that next year, data will dictate whether or not the Fed cuts rates. In order to get to a point where the Fed will cut, Harker says there needs to be 'clear signs' inflation is moving towards the Fed's two percent target, something he says 'is gong to take some time.' Overall, Harker says a soft landing scenario is the 'most probable,' but it's not guaranteed. Key video moments 00:00:22 Harker's current thinking on rates 00:02:00 Harker's on the September meeting 00:02:19 How long will the Fed keep rates high? 00:03:45 When could the Fed cut rates? 00:04:45 Harker on a soft landing 00:05:30 Relationship between wages and inflation 00:06:45 How demographics are impacting the economy and what the Fed does 00:10:00 Harker discusses what he is hearing at the symposium

Lire la suite »

Jackson Hole roundup: Fed Chair Powell, Fed Presidents, key advisers, and moreFederal Reserve Chair Jerome Powell delivered his annual speech at the Jackson Hole Economic Symposium on Friday morning. Yahoo Finance spoke to experts across the industry to break down Powell's speech, what it means for inflation and interest rates at the Fed meeting in September, the impact on the economy, and more. Video highlights: 00:00:04 - Yahoo Finance's Jennifer Schonberger 00:00:27 - Federal Reserve Board Chair Jerome Powell 00:00:57 - Philadelphia Federal Reserve President Patrick Harker 00:01:18 - Former St. Louis Fed President 00:01:50 - Council of Economic Advisers Chair Jared Berstein 00:02:07 - Boston Fed President Susan Collins 00:02:25 - Former Fed Vice Chair Alan Blinder

Jackson Hole roundup: Fed Chair Powell, Fed Presidents, key advisers, and moreFederal Reserve Chair Jerome Powell delivered his annual speech at the Jackson Hole Economic Symposium on Friday morning. Yahoo Finance spoke to experts across the industry to break down Powell's speech, what it means for inflation and interest rates at the Fed meeting in September, the impact on the economy, and more. Video highlights: 00:00:04 - Yahoo Finance's Jennifer Schonberger 00:00:27 - Federal Reserve Board Chair Jerome Powell 00:00:57 - Philadelphia Federal Reserve President Patrick Harker 00:01:18 - Former St. Louis Fed President 00:01:50 - Council of Economic Advisers Chair Jared Berstein 00:02:07 - Boston Fed President Susan Collins 00:02:25 - Former Fed Vice Chair Alan Blinder

Lire la suite »

Powell says Fed 'prepared to raise rates further' to bring inflation downFed Chair Jay Powell reiterated his message that the Fed will keep monetary policy tight until the Fed brings inflation back to its 2% target.

Powell says Fed 'prepared to raise rates further' to bring inflation downFed Chair Jay Powell reiterated his message that the Fed will keep monetary policy tight until the Fed brings inflation back to its 2% target.

Lire la suite »