Investors see a US recession ahead, sticky inflation, and more rate hikes from the Fed, JPMorgan says

Investors are preparing for a recession and more interest rate hikes if inflation levels continue to stay high, according to JPMorgan.

Meanwhile, the Federal Reserve continues to hike rates in a bid to combat stubbornly high inflation. Although, inflation rates have declined, they remain far above the Fed's 2% target.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

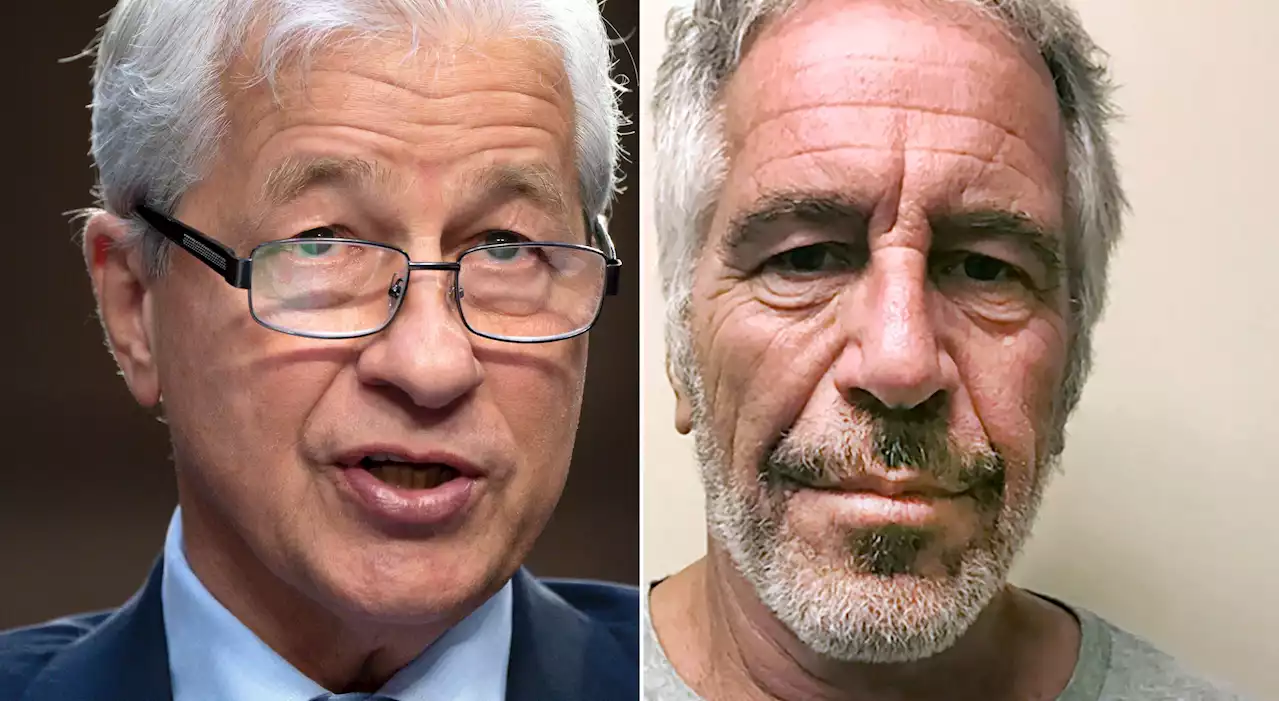

Jamie Dimon, CEO Of JPMorgan Chase, To Be Deposed In Jeffrey Epstein LawsuitA federal judge ruled Dimon must undergo questioning by lawyers handling lawsuits over whether the bank can be held liable over Epstein’s sexual abuse.

Jamie Dimon, CEO Of JPMorgan Chase, To Be Deposed In Jeffrey Epstein LawsuitA federal judge ruled Dimon must undergo questioning by lawyers handling lawsuits over whether the bank can be held liable over Epstein’s sexual abuse.

Lire la suite »

JPMorgan, Citi raise full-year forecasts for China's economyAnalysts at JPMorgan and Citi raised their forecasts for China's full-year growth in 2023 to 6.4% and 6.1%, respectively.

JPMorgan, Citi raise full-year forecasts for China's economyAnalysts at JPMorgan and Citi raised their forecasts for China's full-year growth in 2023 to 6.4% and 6.1%, respectively.

Lire la suite »

Stocks could tumble 15% or more even with a mild recession: JPMorganStocks could tumble 15% or more even with a mild recession, JPMorgan says

Lire la suite »

JPMorgan sees 'non-trivial risk' of a technical default on U.S. Treasuries as debt ceiling loomsJPMorgan expects the U.S. debt ceiling to become an issue as early as next month with the Wall Street bank ascribing a 'non-trivial risk' of a technical default on U.S. Treasuries.

JPMorgan sees 'non-trivial risk' of a technical default on U.S. Treasuries as debt ceiling loomsJPMorgan expects the U.S. debt ceiling to become an issue as early as next month with the Wall Street bank ascribing a 'non-trivial risk' of a technical default on U.S. Treasuries.

Lire la suite »

Debt ceiling jitters lift US credit default swaps to highest since 2011Market jitters over the U.S. debt ceiling lifted the cost of insuring exposure to its debt to the highest level in over a decade on Thursday, while JPMorgan warned of a 'non-trivial risk' of a technical default on U.S. Treasuries.

Debt ceiling jitters lift US credit default swaps to highest since 2011Market jitters over the U.S. debt ceiling lifted the cost of insuring exposure to its debt to the highest level in over a decade on Thursday, while JPMorgan warned of a 'non-trivial risk' of a technical default on U.S. Treasuries.

Lire la suite »

Breakingviews - Bank chiefs move fluttering interest-rate needleBank bosses are adding some dramatic tension to the U.S. monetary policy saga. JPMorgan’s Jamie Dimon and Morgan Stanley’s James Gorman both warned during their first-quarter updates that inflation could prove stickier than expected, and that as a result the Federal Reserve might have to put rates up higher than the market is anticipating. It’s a possibility rather than a prediction, but when Wall Street’s highest and mightiest opine, it pays to listen.

Breakingviews - Bank chiefs move fluttering interest-rate needleBank bosses are adding some dramatic tension to the U.S. monetary policy saga. JPMorgan’s Jamie Dimon and Morgan Stanley’s James Gorman both warned during their first-quarter updates that inflation could prove stickier than expected, and that as a result the Federal Reserve might have to put rates up higher than the market is anticipating. It’s a possibility rather than a prediction, but when Wall Street’s highest and mightiest opine, it pays to listen.

Lire la suite »