Japan's core inflation accelerated in February but an index gauging the broader price trend slowed sharply, data showed, highlighting uncertainty on how soon...

TOKYO - Japan's core inflation accelerated in February but an index gauging the broader price trend slowed sharply, data showed, highlighting uncertainty on how soon the central bank will hike interest rates again.

It accelerated from a 2.0% gain in January due largely to the base effect from the launch of energy subsidies last year. The central bank has described its decision to end negative rates on Tuesday as driven by signs that robust demand and prospects of higher wages were prodding firms to keep hiking prices not just for goods but services.BOJ Governor Ueda said on Tuesday the central bank could hike rates again if inflation overshoots expectations or upside risks to the price outlook heighten significantly.

This dividend stock is finally getting back on the straight and narrow after reporting a stronger bottom line, leading many to grab that dividend! The post 1 Dividend Stock Down 49% to Buy Right Now appeared first on The Motley Fool Canada.

Japan Airlines announced plans to order more Boeing planes Thursday but it’s not the show of confidence investors might initially expect. -- The company planning to take Trump Media & Technology Group public sued to force its biggest investor, ARC Global Investments II, to vote in favor of the deal before a critical deadline this week.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Japan’s $4 Trillion Offshore Funds Will Ignore First BOJ Hike(Bloomberg) -- Japanese money is poised to stay offshore as the central bank creeps toward tighter policy, according to the latest Bloomberg Markets Live...

Japan’s $4 Trillion Offshore Funds Will Ignore First BOJ Hike(Bloomberg) -- Japanese money is poised to stay offshore as the central bank creeps toward tighter policy, according to the latest Bloomberg Markets Live...

Lire la suite »

Japan’s $4 Trillion Offshore Funds Will Ignore First BOJ HikeJapanese money is poised to stay offshore as the central bank creeps toward tighter policy, according to the latest Bloomberg Markets Live Pulse survey.

Japan’s $4 Trillion Offshore Funds Will Ignore First BOJ HikeJapanese money is poised to stay offshore as the central bank creeps toward tighter policy, according to the latest Bloomberg Markets Live Pulse survey.

Lire la suite »

Japan CEOs See Higher Prices, Wages With BOJ Move ‘Just a Matter of Time’Japan’s chief executives are preparing their businesses for the first rate hike since 2007, with the central bank widely expected to end its negative interest rate policy within weeks, or even days.

Japan CEOs See Higher Prices, Wages With BOJ Move ‘Just a Matter of Time’Japan’s chief executives are preparing their businesses for the first rate hike since 2007, with the central bank widely expected to end its negative interest rate policy within weeks, or even days.

Lire la suite »

Japan Money-Market Brokerage Prepares for BOJ to Raise RatesStaff at one of Japan’s major money-market brokerages are getting ready for something that hasn’t happened for 17 years: an increase in the central bank’s benchmark short-term interest rate.

Japan Money-Market Brokerage Prepares for BOJ to Raise RatesStaff at one of Japan’s major money-market brokerages are getting ready for something that hasn’t happened for 17 years: an increase in the central bank’s benchmark short-term interest rate.

Lire la suite »

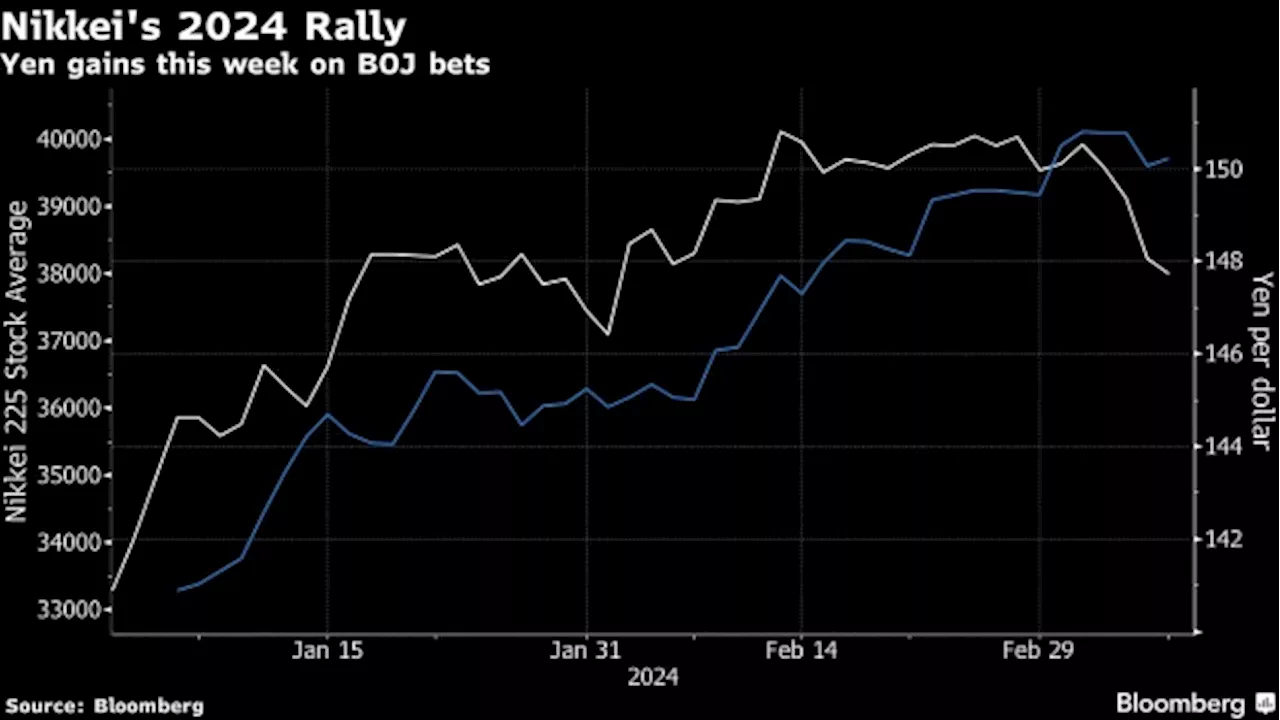

Big Japan Trade Springs Back to Life as BOJ Rate-Hike Bets GrowGold Extends Record Run With $2,200 in Sight After US Jobs DataMarkets today: U.S. stocks suffer 'heat check' as rally hits a wallShasta Ventures Is Pursuing Strip Sale in Liquidity HuntTSX recap: Index dips 0

Big Japan Trade Springs Back to Life as BOJ Rate-Hike Bets GrowGold Extends Record Run With $2,200 in Sight After US Jobs DataMarkets today: U.S. stocks suffer 'heat check' as rally hits a wallShasta Ventures Is Pursuing Strip Sale in Liquidity HuntTSX recap: Index dips 0

Lire la suite »

Big Japan Trade Springs Back to Life as BOJ Rate-Hike Bets GrowMarkets are reckoning with the very real chance that the Bank of Japan will exit the world’s last remaining negative-rate regime and increase borrowing costs as soon as this month.

Big Japan Trade Springs Back to Life as BOJ Rate-Hike Bets GrowMarkets are reckoning with the very real chance that the Bank of Japan will exit the world’s last remaining negative-rate regime and increase borrowing costs as soon as this month.

Lire la suite »