The regular cash distributions might entice investors, yet fail to make up for plodding share prices

The result? Long-term returns, in the case of Enbridge , that lag the diversified S&P/TSX Composite Index by a substantial margin., driving the dividend yield to a high of 7.9 per cent, after the Calgary-based pipeline operator announced a deal to acquire three U.S. natural-gas utilities from Dominion Energy Inc. for US$9.4-billion in cash and US$4.6-billion of assumed debt.priced at $44.70 each – marking a 7.2-per-cent discount to the previous day’s closing price.

The 10-year track record looks even worse. With dividends, Enbridge has lagged the index by more than 33 percentage points. This dismal performance raises the question of whether Enbridge’s dividend yield is more of a warning sign than an opportunity to score an impressive source of income.By increasing its exposure to natural gas with its latest deal, Enbridge is diversifying its operations beyond pipelines and betting on fossil fuel as an essential commodity as North America transitions from dirtier sources of energy, such as coal and oil, to cleaner renewables.

Its share price has fallen 40 per cent since the end of June – making bets on fossil fuels look almost safe by comparison.The company is standing by its commitment to raise the payout, which is something it has done each year for the past 28 years. As well, the stock’s high dividend yield may be reflecting concerns from investors about what sort of returns they can expect.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

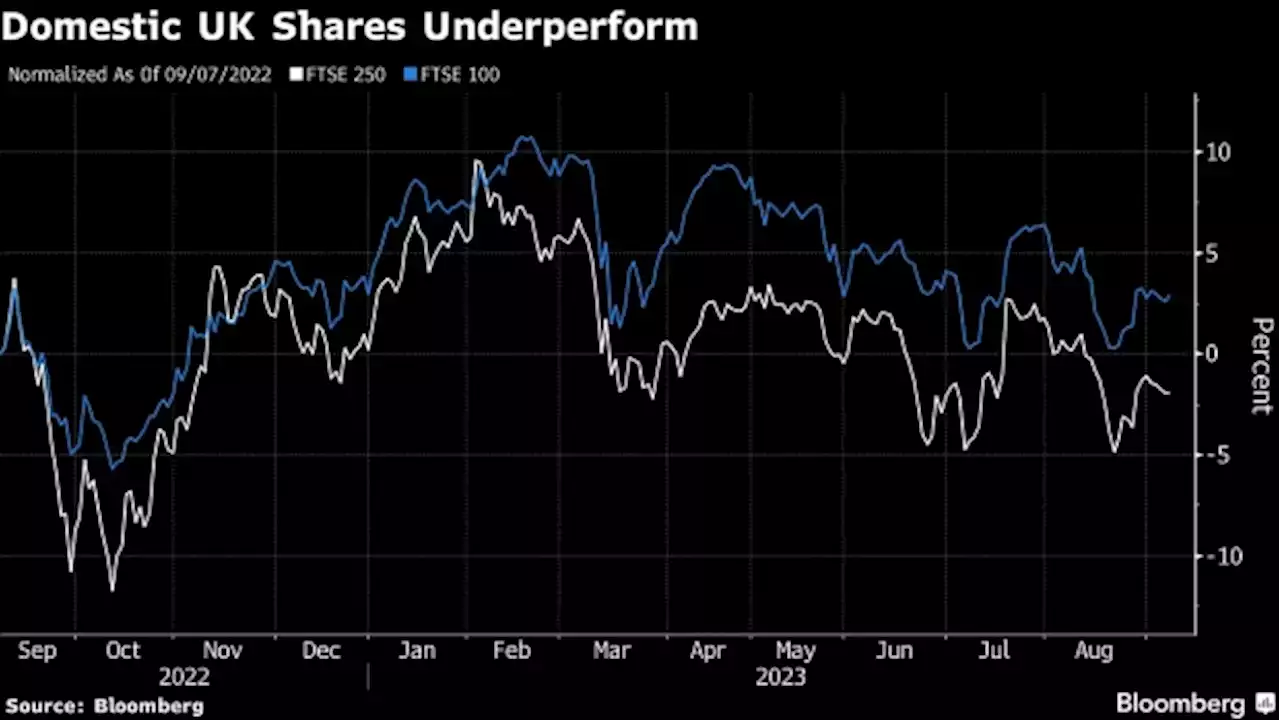

British Investors Lack Faith in Their Own Economy, Liberum SaysBritish investors lack confidence in the economy and have been dumping stocks from their home market — even as US investors have been buying UK stocks, according to Liberum Capital Ltd.

British Investors Lack Faith in Their Own Economy, Liberum SaysBritish investors lack confidence in the economy and have been dumping stocks from their home market — even as US investors have been buying UK stocks, according to Liberum Capital Ltd.

Lire la suite »

Investors should expect the Fed to cut rates in 2024: StrategistMost investors expect the Federal Reserve to hold interest rates where they are at its September meeting. But many are starting to wonder when the Fed will reverse course and start to cut rates again. Citi Global Wealth Head of North American Investments Kristen Bitterly says investors 'should expect a cut in 2024,' specifically in the second half of the year. Bitterly goes on to say that 'we don't need to be in a full-blown recession or to really see something break for the Fed to say 'you know what? maybe we should pull back on rates a little bit.''

Investors should expect the Fed to cut rates in 2024: StrategistMost investors expect the Federal Reserve to hold interest rates where they are at its September meeting. But many are starting to wonder when the Fed will reverse course and start to cut rates again. Citi Global Wealth Head of North American Investments Kristen Bitterly says investors 'should expect a cut in 2024,' specifically in the second half of the year. Bitterly goes on to say that 'we don't need to be in a full-blown recession or to really see something break for the Fed to say 'you know what? maybe we should pull back on rates a little bit.''

Lire la suite »

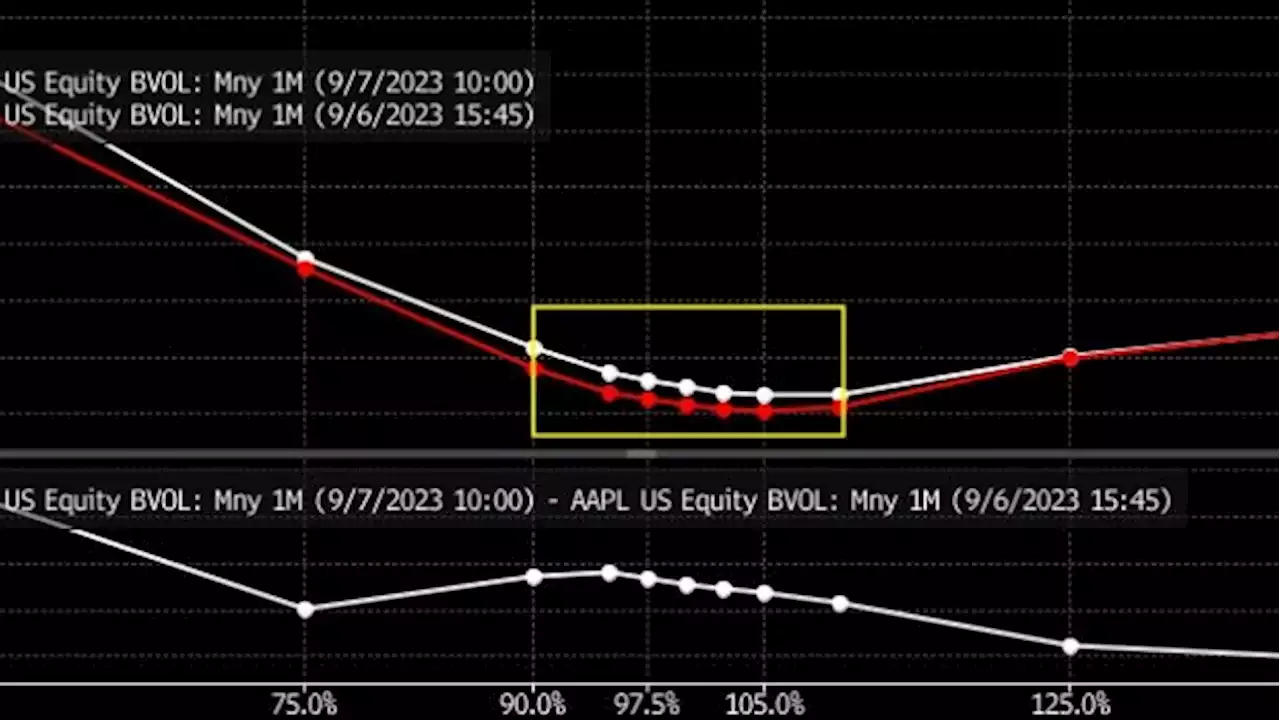

Apple’s Share Slump Has Some Options Investors Bargain HuntingThe slide in Apple Inc.’s shares has taken some $200 billion off the technology giant’s market cap, boosting demand for options to protect against further declines. Still, for some bargain hunters, it’s an opportunity to place some suddenly cheaper bullish bets.

Apple’s Share Slump Has Some Options Investors Bargain HuntingThe slide in Apple Inc.’s shares has taken some $200 billion off the technology giant’s market cap, boosting demand for options to protect against further declines. Still, for some bargain hunters, it’s an opportunity to place some suddenly cheaper bullish bets.

Lire la suite »

Arm touts cloud computing expansion, royalties to IPO investorsBy Echo Wang and Svea Herbst-Bayliss NEW YORK (Reuters) - SoftBank Group Corp's Arm Holdings Plc on Thursday told potential investors in its roughly $5 ...

Arm touts cloud computing expansion, royalties to IPO investorsBy Echo Wang and Svea Herbst-Bayliss NEW YORK (Reuters) - SoftBank Group Corp's Arm Holdings Plc on Thursday told potential investors in its roughly $5 ...

Lire la suite »

Investors sell tech stocks for first time in 11 weeksLONDON (Reuters) - Investors poured money into equities and bonds in the latest week, Bank of America Global Research said on Friday, but signs emerged ...

Investors sell tech stocks for first time in 11 weeksLONDON (Reuters) - Investors poured money into equities and bonds in the latest week, Bank of America Global Research said on Friday, but signs emerged ...

Lire la suite »

Apple stock: Should investors be concerned about reported China bans?Apple (AAPL) shares took a hit after reports that China was banning government officials from using iPhones for work. Adding to the company's woes are the announcement of Huwaei's new Mate 60 models which could pose a threat to Apple's dominance in the region. Santosh Rao, Head of Research at Manhattan Venture Partners, joins Yahoo Finance's Brad Smith and Julie Hyman to discuss the future of Apple stock and whether or not investors should be concerned about the recent announcements. Rao says that, in the near-term, the China concerns are more of a 'headline risk.' Rao says this is a 'shot across the bow' from China to the countries that want to put restrictions on the country's exports and activities.

Apple stock: Should investors be concerned about reported China bans?Apple (AAPL) shares took a hit after reports that China was banning government officials from using iPhones for work. Adding to the company's woes are the announcement of Huwaei's new Mate 60 models which could pose a threat to Apple's dominance in the region. Santosh Rao, Head of Research at Manhattan Venture Partners, joins Yahoo Finance's Brad Smith and Julie Hyman to discuss the future of Apple stock and whether or not investors should be concerned about the recent announcements. Rao says that, in the near-term, the China concerns are more of a 'headline risk.' Rao says this is a 'shot across the bow' from China to the countries that want to put restrictions on the country's exports and activities.

Lire la suite »