(Bloomberg) -- Instacart and Klaviyo Inc., reacting to the strong reception of this year’s biggest IPO, have increased the amount of money they want to raise, with the goal of bolstering their cash positions while driving an opening day pop.Most Read from BloombergXi’s Missing Defense Chief Opens Door for US Military TalksHow Auto Executives Misread the UAW Ahead of Historic StrikeTrillion-Dollar Industry Powering Chicago at Risk of LeavingVegas’ Newest Resort Is a $3.7 Billion Palace, 23 Years

The first test comes Monday with the pricing of online grocer Instacart’s initial public offering, which may raise as much as $660 million. Klaviyo, a marketing and data automation provider, may follow suit this week, targeting up to $557 million.

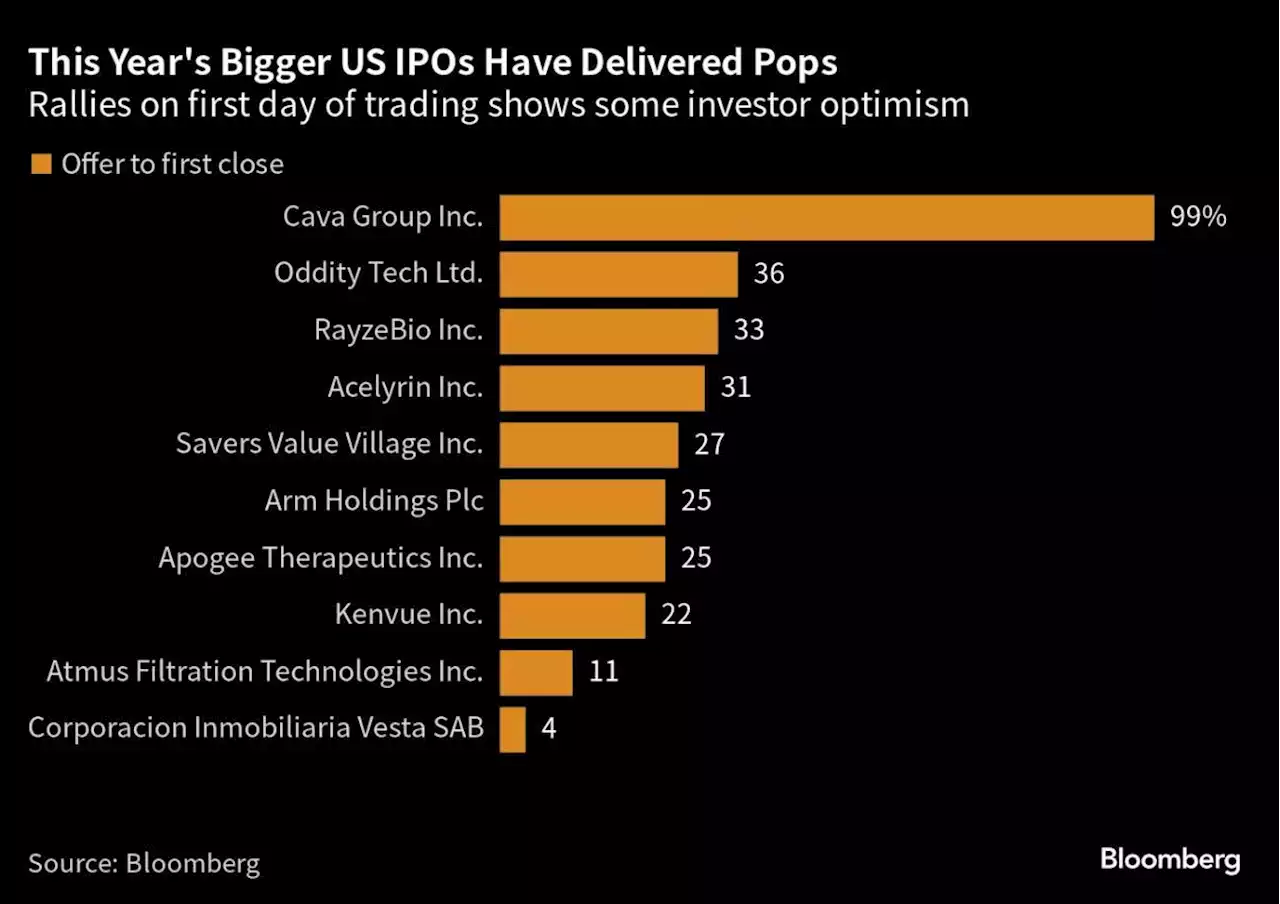

Even with Instacart and Klaviyo’s higher targets, Wall Street still sees the valuations as modest, with bankers coaxing companies to meet would-be investors at prices seen as attractive. Of the 10 companies that raised more than $300 million through IPOs on US exchanges since May, the median stock generated a 26% climb on the first day, data compiled by Bloomberg show. That’s serving as a signal that investors are getting the action they want, while companies can get much-needed deals done.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Instacart’s Higher IPO Target Aims at Trading Pop, Cash InfusionInstacart and Klaviyo Inc., reacting to the strong reception of this year’s biggest IPO, have increased the amount of money they want to raise, with the goal of bolstering their cash positions while driving an opening day pop.

Instacart’s Higher IPO Target Aims at Trading Pop, Cash InfusionInstacart and Klaviyo Inc., reacting to the strong reception of this year’s biggest IPO, have increased the amount of money they want to raise, with the goal of bolstering their cash positions while driving an opening day pop.

Lire la suite »

Klaviyo Is Said to Boost Target for Tuesday IPO to $557 MillionMarketing and data automation provider Klaviyo Inc. is elevating its target to $557 million for what is expected to be a third major US initial public offering in a week, according to people familiar with the matter.

Klaviyo Is Said to Boost Target for Tuesday IPO to $557 MillionMarketing and data automation provider Klaviyo Inc. is elevating its target to $557 million for what is expected to be a third major US initial public offering in a week, according to people familiar with the matter.

Lire la suite »

Klaviyo, Instacart raise IPO price rangesAfter Arm Holdings' (ARM) strong IPO debut, Klaviyo (KVYO) raised its IPO price range to between $27 and $29 per share. This comes after Instacart (CART) raised its own IPO price range as well, to between $28 and $30 per share. Yahoo Finance Live discusses what these debuts could mean for the IPO market.

Klaviyo, Instacart raise IPO price rangesAfter Arm Holdings' (ARM) strong IPO debut, Klaviyo (KVYO) raised its IPO price range to between $27 and $29 per share. This comes after Instacart (CART) raised its own IPO price range as well, to between $28 and $30 per share. Yahoo Finance Live discusses what these debuts could mean for the IPO market.

Lire la suite »

Chinese AI firm Fourth Paradigm leads Hong Kong IPO surge to raise $280 millionThree Chinese firms, led by AI software company Beijing Fourth Paradigm, are aiming to raise up to $280 million in Hong Kong initial public offerings launched on Monday. Beijing Fourth Paradigm, an AI startup, is aiming to raise up to $144 million by selling 18.4 million shares in a price range of HK$55.60 to HK$61.16 each, according to its regulatory filings. Three cornerstone investors, headed by New China Capital Management, have subscribed for about $96.8 million worth of stock, which equates to 70.6% of the IPO, the filings showed.

Chinese AI firm Fourth Paradigm leads Hong Kong IPO surge to raise $280 millionThree Chinese firms, led by AI software company Beijing Fourth Paradigm, are aiming to raise up to $280 million in Hong Kong initial public offerings launched on Monday. Beijing Fourth Paradigm, an AI startup, is aiming to raise up to $144 million by selling 18.4 million shares in a price range of HK$55.60 to HK$61.16 each, according to its regulatory filings. Three cornerstone investors, headed by New China Capital Management, have subscribed for about $96.8 million worth of stock, which equates to 70.6% of the IPO, the filings showed.

Lire la suite »

Chinese AI firm Fourth Paradigm leads Hong Kong IPO surge to raise $280 millionBy Scott Murdoch SYDNEY (Reuters) - Three Chinese firms, led by AI software company Beijing Fourth Paradigm, are aiming to raise up to $280 million in ...

Chinese AI firm Fourth Paradigm leads Hong Kong IPO surge to raise $280 millionBy Scott Murdoch SYDNEY (Reuters) - Three Chinese firms, led by AI software company Beijing Fourth Paradigm, are aiming to raise up to $280 million in ...

Lire la suite »

Germany’s Schott Seeks €859 Million in IPO of Medical-Glass UnitSchott AG is looking to raise as much as €859 million ($917 million) from an initial public offering of its specialty medical-glassware division, in what is likely to be one of the biggest German stock listings this year.

Germany’s Schott Seeks €859 Million in IPO of Medical-Glass UnitSchott AG is looking to raise as much as €859 million ($917 million) from an initial public offering of its specialty medical-glassware division, in what is likely to be one of the biggest German stock listings this year.

Lire la suite »