How Tesla Became Debt-Free In Just Two Decades

company was able to keep its debts low has created a new precedent for auto manufacturers, simultaneously putting pressure on some of the industry’s biggest names.demonstrates how the automaker’s example could set a new precedent for the auto industry, even as other companies still have huge debts to their lendors.

Currently, Ford has a total long-term debt of $140 billion, while GM is right behind with $115 billion in the same category. Tesla, on the other hand, has just $5 billion in long-term debt, and plenty of cash to show for. In fact, the company has $22 billion in free cash flow, meaning that its cash minus debt gives it a $17 billion surplus.

To be sure, the auto industry requires high capital expenditures to some extent, largely due to the expensive materials involved, as well as labor and equipment for production. Automakers also need top-of-the-line research and development, which can be costly from an investment standpoint. Cobb attributes Tesla’s low debts to a few different things, with the first being its sleek lineup of cars, innovative technology, and its overall dedication to renewable energy and sustainability. Through this and CEO Elon Musk’s ability to create investor buzz on social media, Cobb points out how Tesla was able to go from a startup to a large corporation and soaring stock with newly high valuation around 2020.

With a market capitalization of $548 billion , Tesla has demonstrated its strength in financial management over the last 20 years. And with the emerging EV sector gaining more ground than ever before, it will be interesting to see how legacy automakers attempt to catch back up to Tesla’s dominance in the next 20.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

French researchers got $350K and a new Tesla after hacking a Tesla Model 3During a hackathon this week, researchers at Synacktiv hacked into a Tesla Model 3's energy management and infotainment system.

French researchers got $350K and a new Tesla after hacking a Tesla Model 3During a hackathon this week, researchers at Synacktiv hacked into a Tesla Model 3's energy management and infotainment system.

Lire la suite »

Doctor suing Gwyneth Paltrow became ‘angry person’ after ski crash: witnessPolly Sanderson Grasham, 49, said her dad Terry Sanderson was permanently changed by the incident at Deer Valley Resort in Utah.

Doctor suing Gwyneth Paltrow became ‘angry person’ after ski crash: witnessPolly Sanderson Grasham, 49, said her dad Terry Sanderson was permanently changed by the incident at Deer Valley Resort in Utah.

Lire la suite »

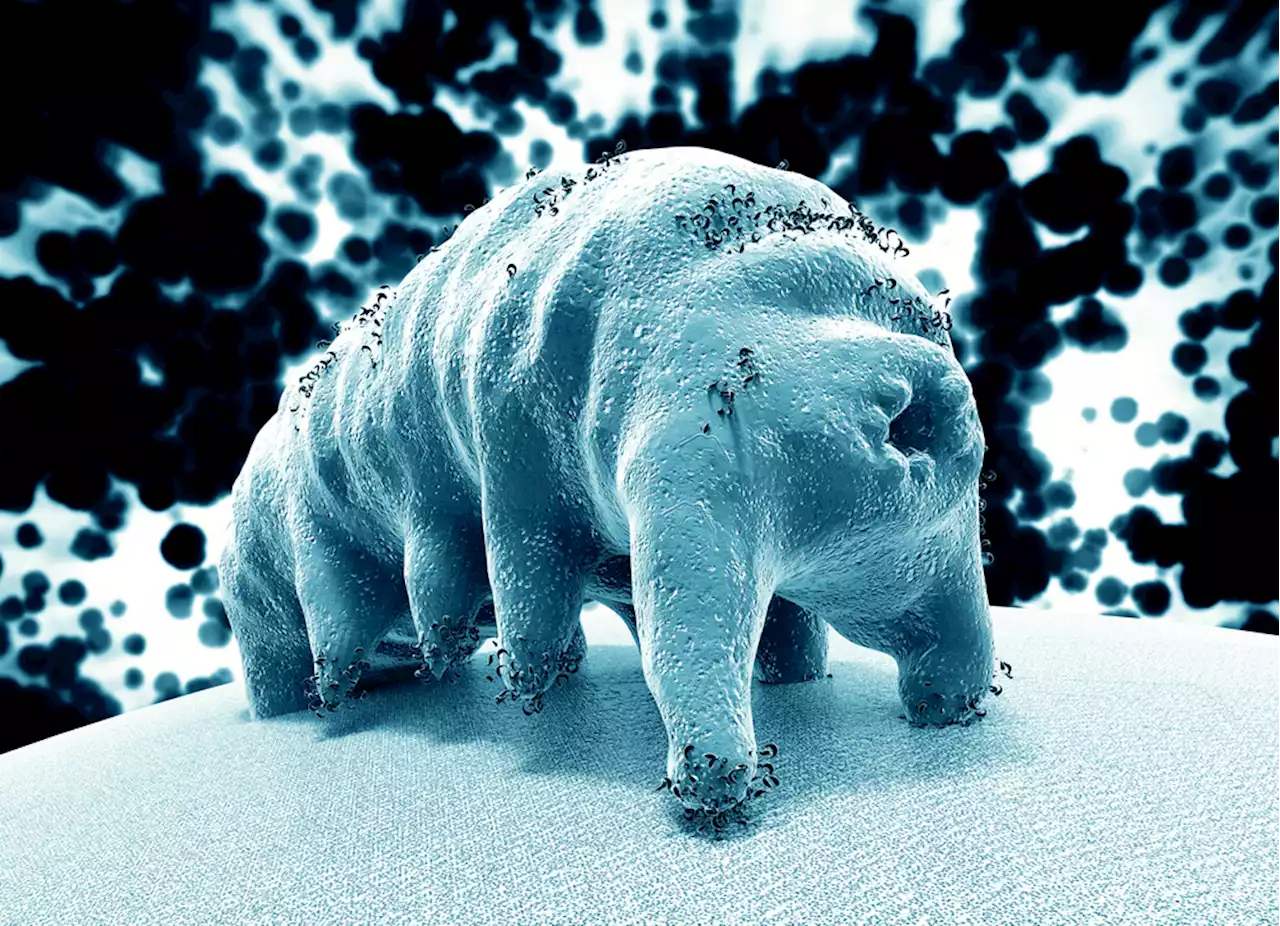

How a Tardigrade 'Micro Animal' Became Quantum Entangled with Superconducting Qubit🔄FROM THE ARCHIVE: Physicists have extended the conditions in which life can exist further than ever before.

How a Tardigrade 'Micro Animal' Became Quantum Entangled with Superconducting Qubit🔄FROM THE ARCHIVE: Physicists have extended the conditions in which life can exist further than ever before.

Lire la suite »

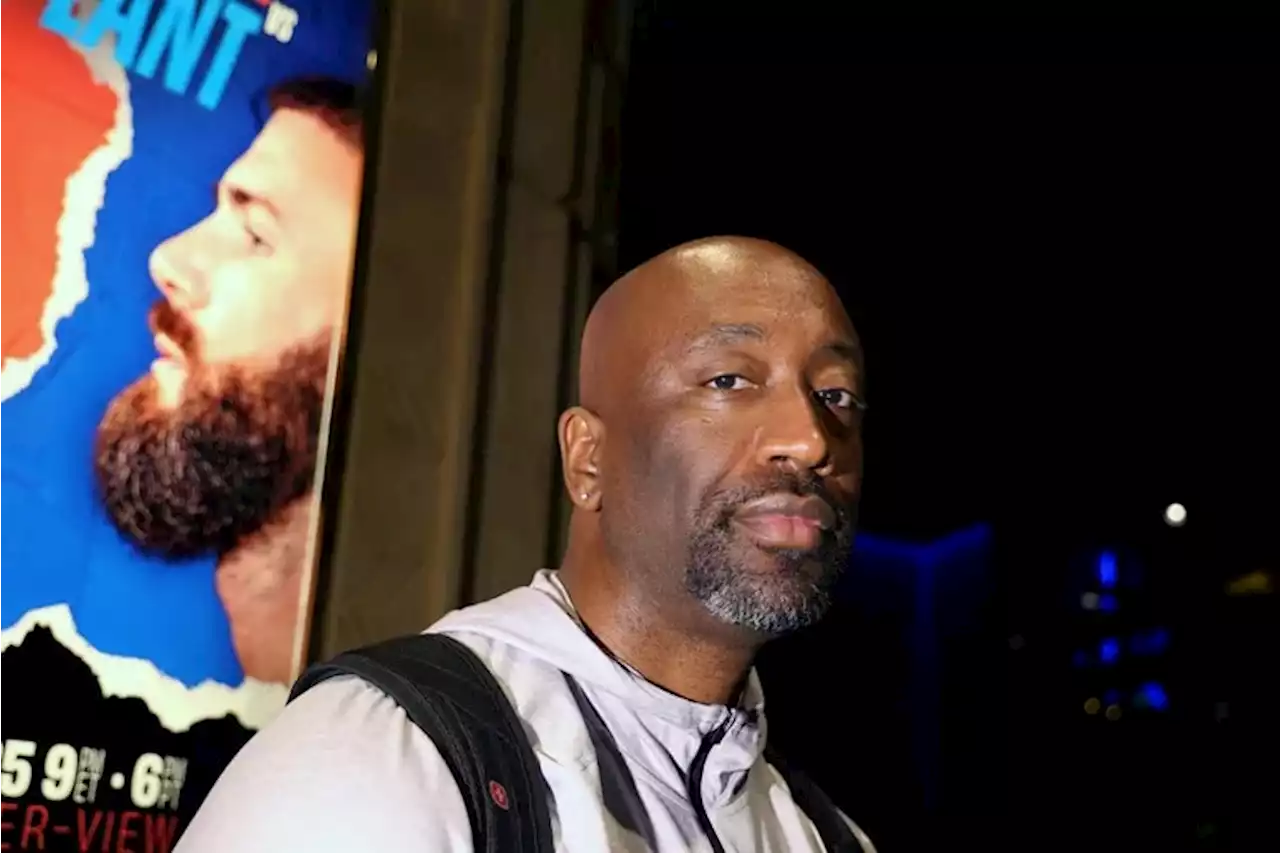

How former SEPTA bus driver Stephen Edwards became a world-champion boxing trainerNearly 20 years ago, Edwards swapped his CDL license for a boxing trainer’s license. He's navigated the boxing world since, helping guide Caleb Plant and Julian Williams through successful careers.

How former SEPTA bus driver Stephen Edwards became a world-champion boxing trainerNearly 20 years ago, Edwards swapped his CDL license for a boxing trainer’s license. He's navigated the boxing world since, helping guide Caleb Plant and Julian Williams through successful careers.

Lire la suite »

Watch how defense became a family affair for Villanova guard Bella RunyanThe junior guard hails from a family that has plied much of its trade in the defense of others

Watch how defense became a family affair for Villanova guard Bella RunyanThe junior guard hails from a family that has plied much of its trade in the defense of others

Lire la suite »

How 'too big to fail' banks became a symbol of safetyOnce upon a time, 'too big to fail' was shorthand to villainize big banks. These days, it's a way to say 'your money is safe.'

How 'too big to fail' banks became a symbol of safetyOnce upon a time, 'too big to fail' was shorthand to villainize big banks. These days, it's a way to say 'your money is safe.'

Lire la suite »