Emerging-market central banks are joining their developed peers in pushing back against expectations of a rapid switch to cutting interest rates, souring the outlook for developing-nation bonds.

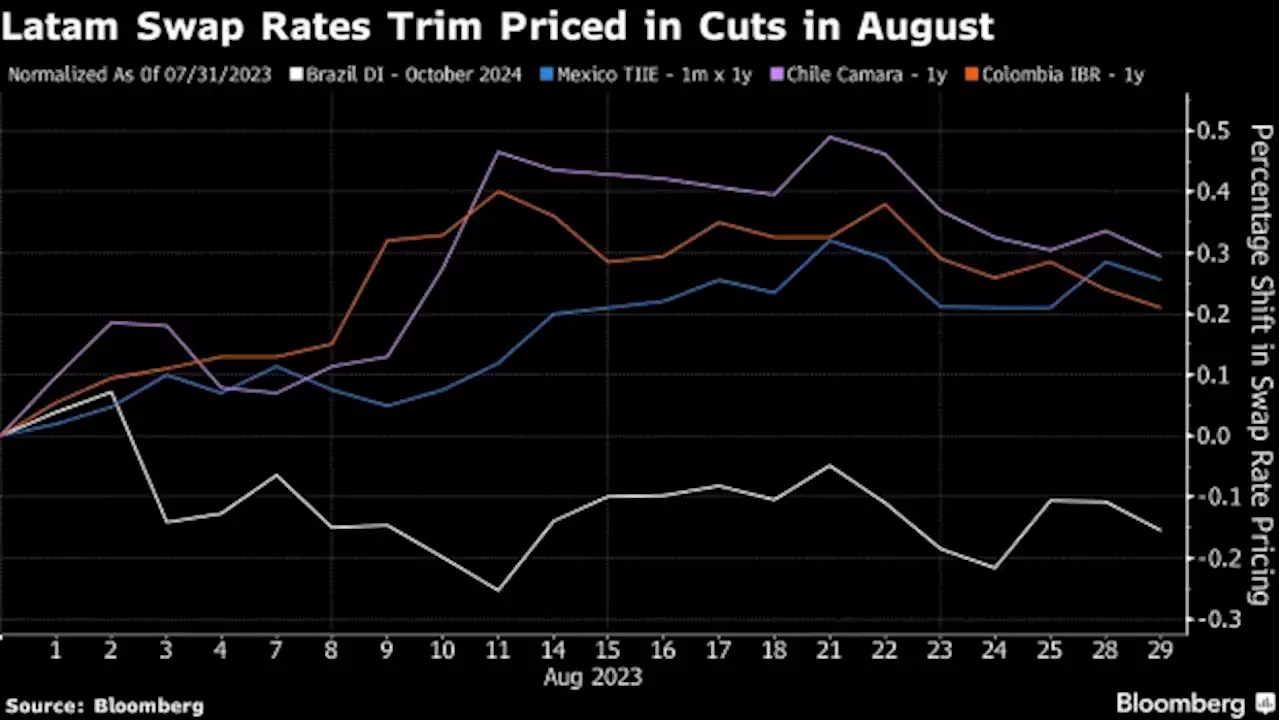

Traders have all but priced out the prospect of easier monetary policy in Asia over the next 12 months, paring expectations for lower borrowing costs in Latin America and central Europe, swaps data show. The shift has been driven by the “higher-for-longer” rhetoric from the Federal Reserve, policymakers seeking to support their currencies and the threat of El Niño stoking inflation.

“The inflation outlook for emerging markets is becoming less certain, in contrast to the broad-based disinflation of the past four-to-five months,” said Jon Harrison, managing director for emerging-market macro strategy at GlobalData TS Lombard in London. “EM local-currency bonds could also be at risk in the coming months from a further surge in the dollar or more Fed rate hikes, but we are not at that point yet.”A hawkish trend is setting in across Asia.

South Korean swaps are now pricing in 8 basis points of rate hikes over the next 12 months, compared with predictions for a tiny cut at the end of June. Indian contracts are anticipating 16 basis points of cuts, down from a chunkier 60 basis points that were priced in on June 30. “While there is probably low conviction among market participants for Asian central banks to hike again, the widening term premium suggests that participants see non-negligible risks of rate hikes starting again,” he said. Term premium is the extra compensation investors require to take on the risk of changing interest rates.Latin America is seeing a similar move toward more hawkish pricing, most noticeably in Chile, Mexico and Colombia.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

The end of an era for investorsInvestors should brace for the possibility that interest rates will stay higher for longer

The end of an era for investorsInvestors should brace for the possibility that interest rates will stay higher for longer

Lire la suite »

120 public servants no longer with the CRA following review of inappropriate CERB paymentsThe CRA provided the results of a previously-announced internal review into agency employees who may have inappropriately claimed COVID-era benefits

120 public servants no longer with the CRA following review of inappropriate CERB paymentsThe CRA provided the results of a previously-announced internal review into agency employees who may have inappropriately claimed COVID-era benefits

Lire la suite »

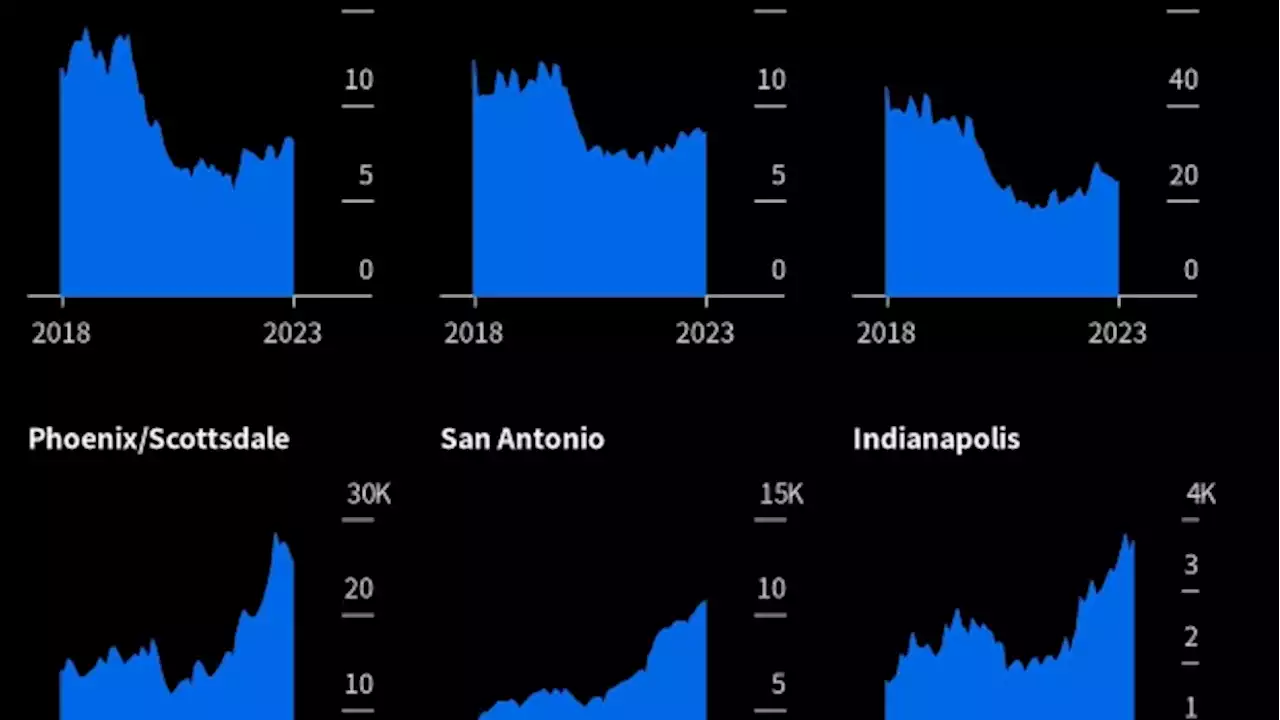

Crackdown on Airbnb Hosts Spurs Lawsuits, Losses, Longer StaysLegal and regulatory hurdles for people offering their homes for short-term rental on sites like Airbnb Inc. and Vrbo are upending the market for vacation properties.

Crackdown on Airbnb Hosts Spurs Lawsuits, Losses, Longer StaysLegal and regulatory hurdles for people offering their homes for short-term rental on sites like Airbnb Inc. and Vrbo are upending the market for vacation properties.

Lire la suite »

Network outage at Toronto Pearson Airport causing longer waitsA network outage at Toronto Pearson International Airport is causing longer waits on Friday ahead of the long weekend.

Network outage at Toronto Pearson Airport causing longer waitsA network outage at Toronto Pearson International Airport is causing longer waits on Friday ahead of the long weekend.

Lire la suite »

120 employees no longer with CRA after inappropriately claiming CERB, agency saysThe Canada Revenue Agency has gotten rid of 120 employees who took advantage of the Canada emergency response benefit during the first months of the COVID-19 pandemic.

120 employees no longer with CRA after inappropriately claiming CERB, agency saysThe Canada Revenue Agency has gotten rid of 120 employees who took advantage of the Canada emergency response benefit during the first months of the COVID-19 pandemic.

Lire la suite »

120 public servants no longer with the CRA following review of inappropriate CERB paymentsThe CRA provided the results of a previously-announced internal review into agency employees who may have inappropriately claimed COVID-era benefits.

120 public servants no longer with the CRA following review of inappropriate CERB paymentsThe CRA provided the results of a previously-announced internal review into agency employees who may have inappropriately claimed COVID-era benefits.

Lire la suite »