(Kitco commentary) - After continued U.S. economic strength announced this week, the likelihood of another Fed rate hike by November moving closer to 50% has taken Gold Futures closer to key technical support at $1900.

After continued U.S. economic strength announced this week, the likelihood of another Fed rate hike by November moving closer to 50% has taken Gold Futures closer to key technical support at $1900. Traders assign a 45% chance of a November rate hike, after an expected pause in September. One week ago, those odds of a November hike were less than 30%.

If USD momentum can stay overbought, while price breaks above the 200-dma and this down trendline becomes support, a move to 105.5 becomes the probability with Gold Futures possibly moving towards longer-term support at $1850. The main risk to be aware of next week is a continuation of the ‘higher rates for longer’ interest rate narrative from Federal Reserve Chairman Jerome Powell speaking from the FOMC Jackson Hole Symposium on Friday morning. Each year, FOMC officials gather at their summer retreat in Jackson Hole, Wyoming for a symposium in late August to exchange views on monetary policy and economic trends.

Inflation has moderated, although much of the improvement has been attributed to declines in energy prices. Core inflation is still burning hot and since the labor market remains extremely tight, there are concerns inflation might not return to its 2% target anytime soon. Although this is what we need to see to attract generalist investors back into the mining space as a safe-haven, we cannot rule out further risk to the downside in the form of a panic selloff in equities during "crash season." A Fall market crash could be precipitated by a worsening banking crisis as a result of persistent relatively high interest rates. If so, the move could set up a test of the September 2022 lows in both GDX & GDXJ.

We will probably experience a bit more pain in gold stocks during the last few weeks of summer doldrums, but are likely close to a significant bottom in the mining space. Fed Chairman Jerome Powell's Jackson Hole speech next Friday could either accelerate the decline for a near-term upside reversal, or set the final low.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Gold prices oscillating around $1900 as Philly Fed survey beats expectations to turn positive in August(Kitco News) - The gold market is trading on both sides of the key $1,900 level with neither bulls nor bears able to establish a clear direction after the Philadelphia Federal Reserve said its manufacturing sector survey surged dramatically into positive territory.

Gold prices oscillating around $1900 as Philly Fed survey beats expectations to turn positive in August(Kitco News) - The gold market is trading on both sides of the key $1,900 level with neither bulls nor bears able to establish a clear direction after the Philadelphia Federal Reserve said its manufacturing sector survey surged dramatically into positive territory.

Lire la suite »

Gold Market Analysis for August 18 - Key Intra-day Price Entry Levels for Active Traders(Kitco News) - This 5-minute bar chart for Comex gold futures can be a valuable analytical and trading tool for the active intra-day gold futures trader/market watcher.

Lire la suite »

New gold mine north of Sudbury to pour first gold bar soonCôté Gold project construction is moving ahead quickly with ‘approximately 85.7 per cent complete at the end of June’

New gold mine north of Sudbury to pour first gold bar soonCôté Gold project construction is moving ahead quickly with ‘approximately 85.7 per cent complete at the end of June’

Lire la suite »

Klondike Gold digs deep in historic gold territory for new discoveriesKlondike Gold Corp. is advancing its 100%-owned Klondike District Gold Project located at Dawson City, Yukon Territory, one of the top mining jurisdictions in the world.

Klondike Gold digs deep in historic gold territory for new discoveriesKlondike Gold Corp. is advancing its 100%-owned Klondike District Gold Project located at Dawson City, Yukon Territory, one of the top mining jurisdictions in the world.

Lire la suite »

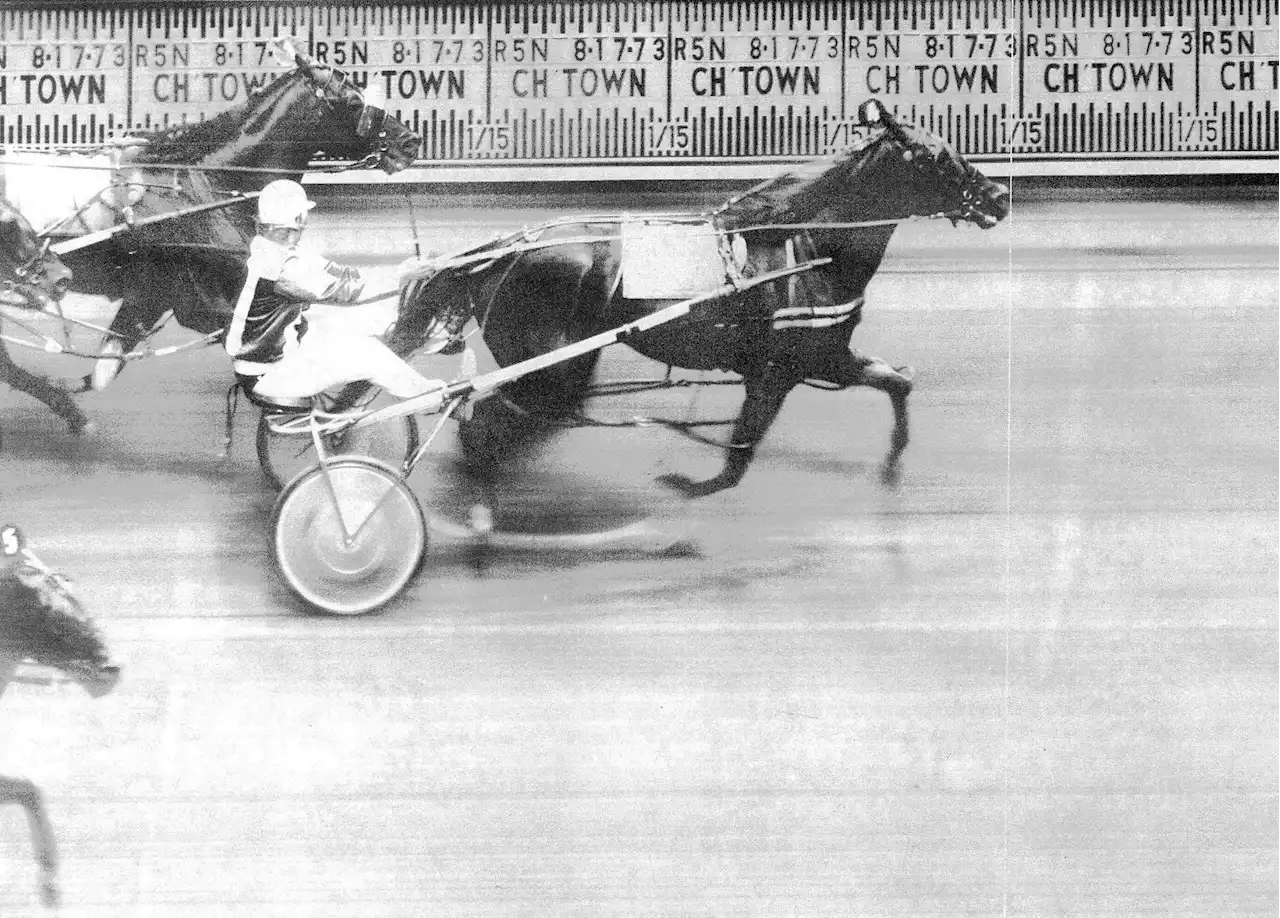

GOLD CUP AND SAUCER: Waite remains youngest winner of Gold Cup and SaucerKatie Ingram Special to SaltWire Fifty years ago, Leslie Waite and his horse Dr. Walter C made history. Waite, then 20 years old, remains the youngest ...

GOLD CUP AND SAUCER: Waite remains youngest winner of Gold Cup and SaucerKatie Ingram Special to SaltWire Fifty years ago, Leslie Waite and his horse Dr. Walter C made history. Waite, then 20 years old, remains the youngest ...

Lire la suite »

Coinbase gets regulatory approval to offer crypto futures in the U.S.Cryptocurrency exchange Coinbase has secured the approval from a CFTC-designated body to offer crypto futures.

Coinbase gets regulatory approval to offer crypto futures in the U.S.Cryptocurrency exchange Coinbase has secured the approval from a CFTC-designated body to offer crypto futures.

Lire la suite »