Finance Minister Christian Lindner has rejected talk that Germany plans to resort to tax measures last used after World War II to consolidate the budget.

Speaking at the government’s open day in Berlin, the pro-market Free Democrat said suggestions of reviving a policy which forced property owners and others with substantial assets to pay a levy of 50% on their assets into a so-called equalization fund over 30 years, was “absolutely fake news.”

Germany can reach its pre-crisis level of public debt of about 60% of gross domestic product “in a few years” without such measures, he added, on the back of good budgetary management and policies to promote faster growth. The episode highlights the challenges facing a government coalition that’s losing public support, while the AfD, which considers the euro a failed currency and wants to dismantle the European Union in its current form, has become the second most popular party in Germany.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Wall Street Banks Rush to Reclaim Edge in Market for Buyout DebtWall Street’s top banks are rushing back into the lucrative market for leveraged buyouts to reclaim business from private creditors.

Wall Street Banks Rush to Reclaim Edge in Market for Buyout DebtWall Street’s top banks are rushing back into the lucrative market for leveraged buyouts to reclaim business from private creditors.

Lire la suite »

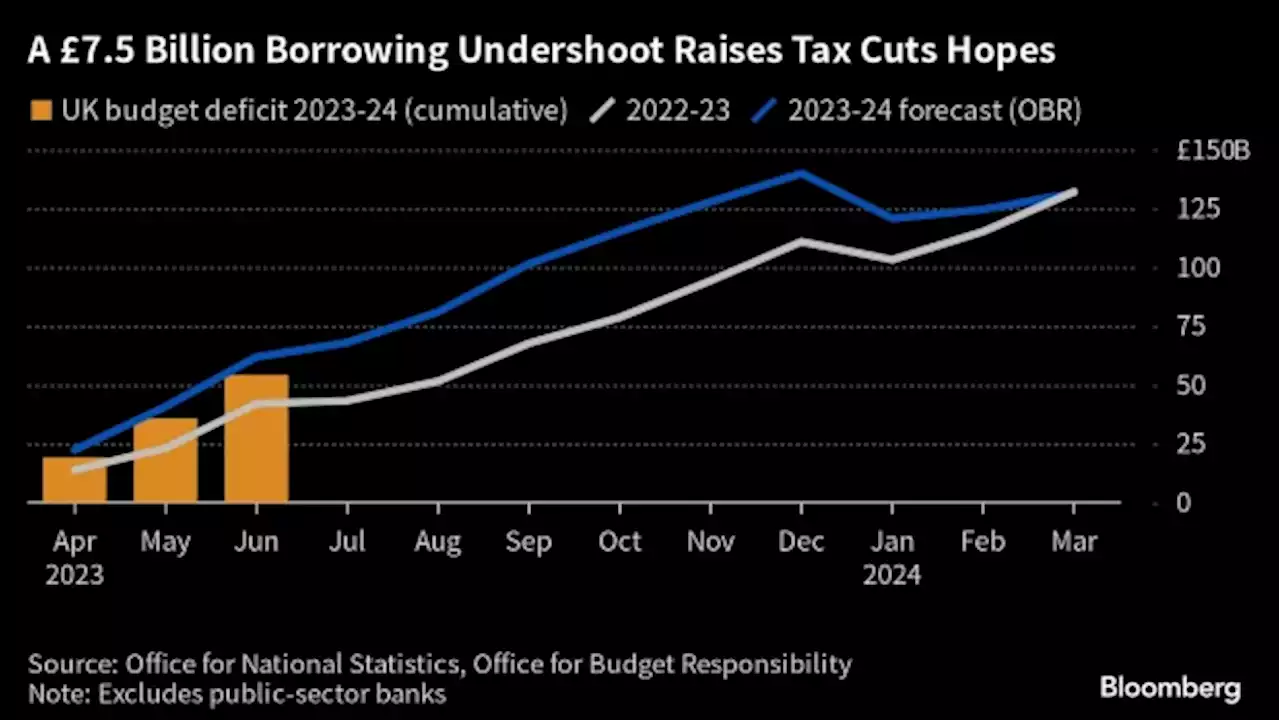

Slow-Growing UK Faces Reckoning Over £2.6 Trillion Debt Pile(Bloomberg) -- From the financial crisis to Russia’s invasion of Ukraine, Britain has borrowed and spent its way out of every jam. The bill for that is becoming a worry all its own.

Slow-Growing UK Faces Reckoning Over £2.6 Trillion Debt Pile(Bloomberg) -- From the financial crisis to Russia’s invasion of Ukraine, Britain has borrowed and spent its way out of every jam. The bill for that is becoming a worry all its own.

Lire la suite »

China’s PBOC, Regulators Urge Boosting Loans, Cutting Debt RiskChina’s central bank and the country’s financial and securities regulators urged a boosting of loans to support the economy and the cutting of local government bond risks.

China’s PBOC, Regulators Urge Boosting Loans, Cutting Debt RiskChina’s central bank and the country’s financial and securities regulators urged a boosting of loans to support the economy and the cutting of local government bond risks.

Lire la suite »

China vows to coordinate support to resolve local government debt risksBEIJING (Reuters) - China will coordinate financial support to resolve local government debt problems, the central bank said in a statement on Sunday, ...

China vows to coordinate support to resolve local government debt risksBEIJING (Reuters) - China will coordinate financial support to resolve local government debt problems, the central bank said in a statement on Sunday, ...

Lire la suite »

China Local Governments to Sell $206 Billion of Financing DebtChina plans to allow local governments to sell 1.5 trillion yuan ($205.9 billion) of special financing bonds to help 12 regions repay debt, Caixin reported.

China Local Governments to Sell $206 Billion of Financing DebtChina plans to allow local governments to sell 1.5 trillion yuan ($205.9 billion) of special financing bonds to help 12 regions repay debt, Caixin reported.

Lire la suite »

The $1 trillion of high yield debt that's piled up in the last 5 years is about to have a 'day of reckoning,' Bank of America saysAround $400 billion of debt assets are considered to be in 'pre-distress,' while $150 billion are 'deeply distressed,' Bank of America said.

The $1 trillion of high yield debt that's piled up in the last 5 years is about to have a 'day of reckoning,' Bank of America saysAround $400 billion of debt assets are considered to be in 'pre-distress,' while $150 billion are 'deeply distressed,' Bank of America said.

Lire la suite »