Fiera Capital Corp.’s founder and chief executive officer bought about $3.7 million in shares, a move that ensures he keeps control of the board of the Canadian asset manager, for now.

Jean-Guy Desjardins’ share purchase means that a limited partnership he controls will have slightly more than 20% of Fiera’s stock, according to a company statement. That number is important because it gives that partnership special voting rights to choose two-thirds of the board, insulating the firm from activist investors.

If the partnership’s stake were to fall below 20% for 90 days, those rights would end and the company would change to a structure in which all shares have equal weight in choosing directors.“Given the current ownership is just above 20%, we will closely monitor Fiera LP ownership going forward ,” Gary Ho, an analyst with Desjardins Securities, said in a note to clients.

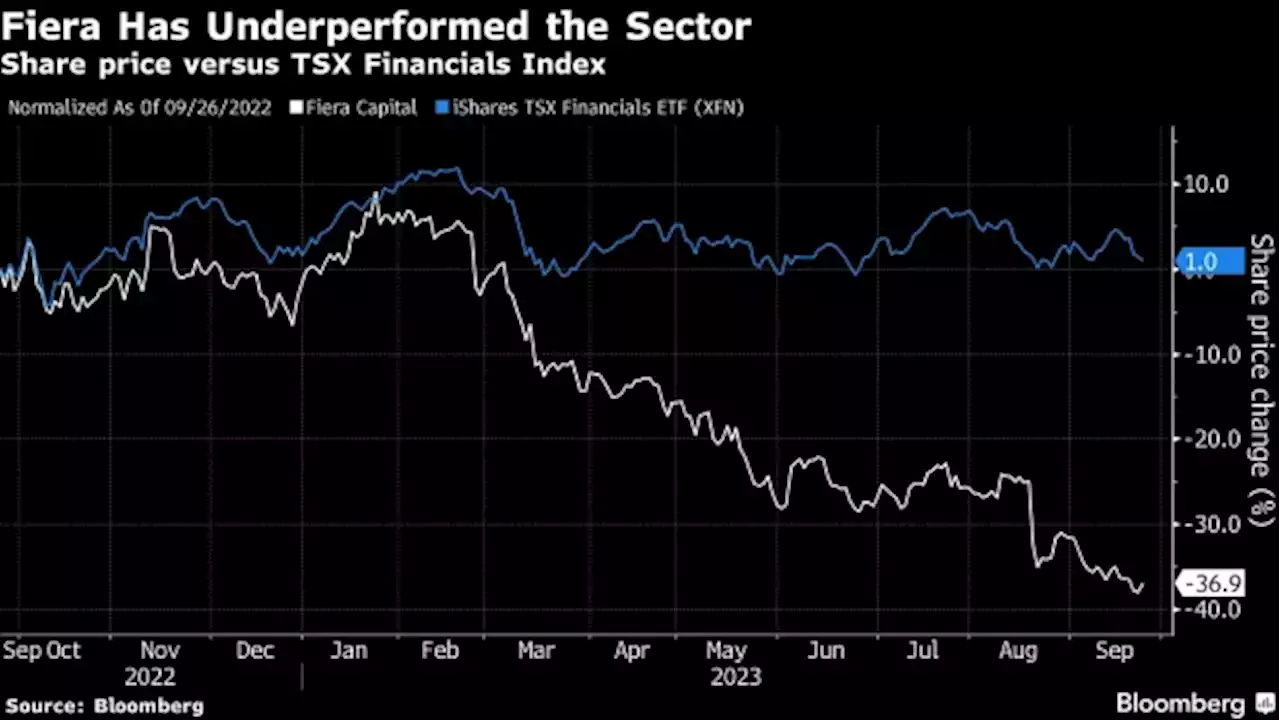

Desjardins surprised the market in January by returning as CEO at the age of 78, a little more than a year after he’d stepped down. But equity investors have not given him much credit so far. Fiera shares have fallen 36% this year on concerns about the long-term health of its business and the sustainability of its rich dividend. The stock currently yields more than 15%. Fiera has about C$164 billion under management, most of it in stocks and fixed income.“I remain committed to Fiera Capital and find the opportunity to purchase shares at the current price particularly attractive,” the CEO said in a news release.

The controlling partnership’s ownership stake in Fiera has been shrinking over time. In 2019, it was nearly 26%, according to corporate filings at the time. In April, it was 22%. The percentage is falling because of shares being transferred out of the partnership by current and former employees of Fiera. It now stands at 20.04%.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Stock losses accelerate amid Fed fallout, shutdown worries: Stock market news todayStocks pulled back as Wall Street continued to face up to the prospect of a long period of high interest rates.

Stock losses accelerate amid Fed fallout, shutdown worries: Stock market news todayStocks pulled back as Wall Street continued to face up to the prospect of a long period of high interest rates.

Lire la suite »

Stocks look to shake off Fed rate worries: Stock market news todayWall Street stocks struggled to advance on Monday, as the Federal Reserve's 'higher for longer' interest rate strategy continued to pile on pressure as a US government shutdown loomed.

Stocks look to shake off Fed rate worries: Stock market news todayWall Street stocks struggled to advance on Monday, as the Federal Reserve's 'higher for longer' interest rate strategy continued to pile on pressure as a US government shutdown loomed.

Lire la suite »

Energy stocks help lift S&P/TSX composite, U.S. stock markets mixedTORONTO — Strength in energy stocks helped Canada's main stock index move higher in late-morning trading, while U.S. stock markets were mixed to start the trading week. The S&P/TSX composite index was up 30.53 points at 19,810.50.

Energy stocks help lift S&P/TSX composite, U.S. stock markets mixedTORONTO — Strength in energy stocks helped Canada's main stock index move higher in late-morning trading, while U.S. stock markets were mixed to start the trading week. The S&P/TSX composite index was up 30.53 points at 19,810.50.

Lire la suite »

Corporate America brings its new skinny look to stock marketWall Street is preparing for a wave of spinoffs as a slew of household\u002Dname companies moves to streamline operations. Read more.

Corporate America brings its new skinny look to stock marketWall Street is preparing for a wave of spinoffs as a slew of household\u002Dname companies moves to streamline operations. Read more.

Lire la suite »

Energy stocks help lift S&P/TSX composite, U.S. stock markets mixedTORONTO — Strength in energy stocks helped Canada's main stock index move higher in late-morning trading, while U.S. stock markets were mixed to start the trading week. The S&P/TSX composite index was up 30.53 points at 19,810.50. In New York, the Dow Jones industrial average was down 18.23 points at 33,945.61. The S&P 500 index was up 9.00 points at 4,329.06, while the Nasdaq composite was up 40.50 points at 13,252.31. The Canadian dollar traded for 74.24 cents US compared with 74.27 cents US o

Energy stocks help lift S&P/TSX composite, U.S. stock markets mixedTORONTO — Strength in energy stocks helped Canada's main stock index move higher in late-morning trading, while U.S. stock markets were mixed to start the trading week. The S&P/TSX composite index was up 30.53 points at 19,810.50. In New York, the Dow Jones industrial average was down 18.23 points at 33,945.61. The S&P 500 index was up 9.00 points at 4,329.06, while the Nasdaq composite was up 40.50 points at 13,252.31. The Canadian dollar traded for 74.24 cents US compared with 74.27 cents US o

Lire la suite »