Fed's Bullard: Not much progress on inflation means rates need to continue to rise – by eren_fxstreet Fed CentralBanks

"US recession predictions ignore strength of labor market, pandemic savings still to be used."

"Risk of bank stress causing broad problems seems to have diminished, though policymakers monitoring situation closely."recovered modestly on these hawkish remarks and was last seen losing 0.25% on the day at 101.84.Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

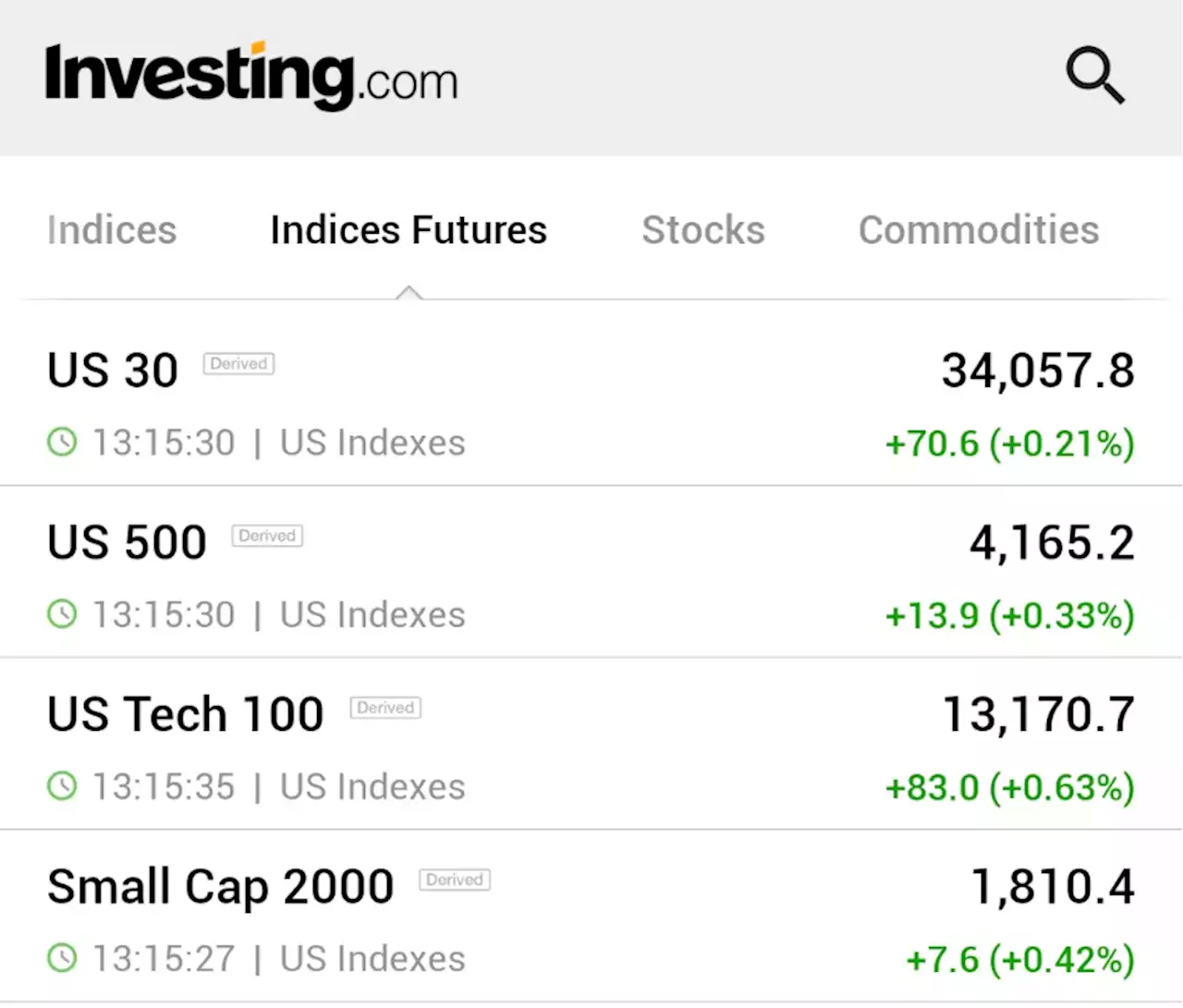

Wall St ends higher; investors await earnings, Fed cues By Reuters⚠️BREAKING: *DOW JUMPS 100 POINTS AS U.S. STOCKS END HIGHER TO START BUSY EARNINGS WEEK *VIX FALLS TO LOWEST LEVEL SINCE JANUARY 2022 $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Wall St ends higher; investors await earnings, Fed cues By Reuters⚠️BREAKING: *DOW JUMPS 100 POINTS AS U.S. STOCKS END HIGHER TO START BUSY EARNINGS WEEK *VIX FALLS TO LOWEST LEVEL SINCE JANUARY 2022 $DIA $SPY $QQQ $IWM $VIX 🇺🇸🇺🇸

Lire la suite »

BoE to raise rates once more in May but decision a close call: Reuters pollThe Bank of England likely has one more hike in its tightening cycle but it was a close call for a final quarter-point rate lift in May, according to a Reuters poll of economists who said the bigger risk was inflation being higher than they expect.

BoE to raise rates once more in May but decision a close call: Reuters pollThe Bank of England likely has one more hike in its tightening cycle but it was a close call for a final quarter-point rate lift in May, according to a Reuters poll of economists who said the bigger risk was inflation being higher than they expect.

Lire la suite »

Marketmind: Global pulse picks up, rates creep higher again By Reuters*U.S. STOCK FUTURES RISE AHEAD OF MORE BANK EARNINGS AS CHINA GROWTH DATA BOOSTS SENTIMENT $DIA $SPY $QQQ $IWM 🇺🇸🇺🇸

Marketmind: Global pulse picks up, rates creep higher again By Reuters*U.S. STOCK FUTURES RISE AHEAD OF MORE BANK EARNINGS AS CHINA GROWTH DATA BOOSTS SENTIMENT $DIA $SPY $QQQ $IWM 🇺🇸🇺🇸

Lire la suite »

USD/JPY Price Analysis: Likely flex muscles above 134.00 as Fed to hike rates furtherUSD/JPY Price Analysis: Likely flex muscles above 134.00 as Fed to hike rates further USDJPY DollarIndex ChartPatterns SupportResistance Inflation

USD/JPY Price Analysis: Likely flex muscles above 134.00 as Fed to hike rates furtherUSD/JPY Price Analysis: Likely flex muscles above 134.00 as Fed to hike rates further USDJPY DollarIndex ChartPatterns SupportResistance Inflation

Lire la suite »

Wall St slips as Fed seen hiking rates in May; State Street sinksU.S. stocks slipped on Monday after strong data on manufacturing activity in New York state supported the case for another interest rate increase in May, while investors awaited more quarterly reports to gauge the health of corporate America.

Wall St slips as Fed seen hiking rates in May; State Street sinksU.S. stocks slipped on Monday after strong data on manufacturing activity in New York state supported the case for another interest rate increase in May, while investors awaited more quarterly reports to gauge the health of corporate America.

Lire la suite »