(Reuters) - European shares fell on Thursday, tracking overnight losses on Wall Street after the U.S. Federal Reserve signalled higher-for-longer ...

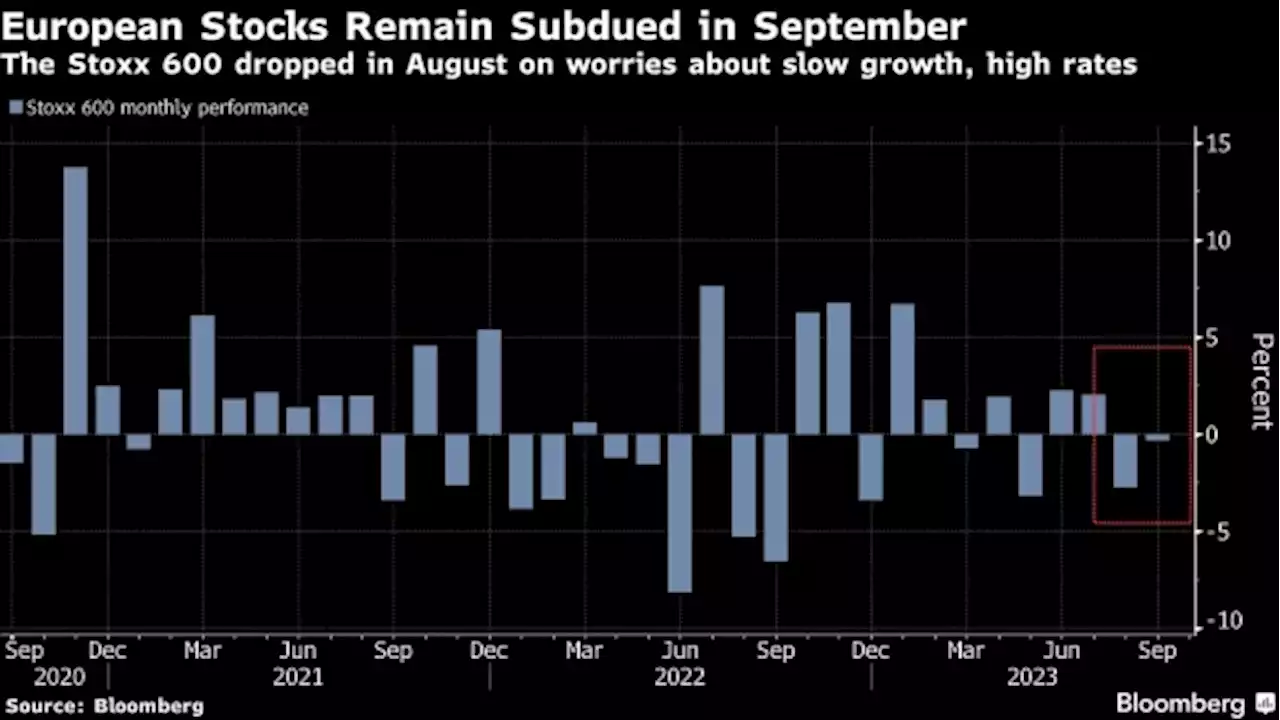

- European shares fell on Thursday, tracking overnight losses on Wall Street after the U.S. Federal Reserve signalled higher-for-longer interest rates and ahead of rate decisions from the Swiss National Bank, Riksbank, Norges Bank and Bank of England.Commodity-linked sectors like mining and energy fell over 1% each, leading early losses as metal and crude prices weakened against a stronger dollar.

The Fed held key interest rates steady on Wednesday, as widely expected, and revised economic projections higher with warnings that the battle against inflation was far from over.The focus is now also on the monetary policy decisions in Switzerland, Sweden, Norway and the UK later in the day after the European Central Bank raised its key interest rate last week to a record high of 4%.

UK's FTSE 100 eased 0.5% ahead of the BoE's decision on whether it will halt a run of rate hikes that stretches back to December 2021 after data on Wednesday showed an unexpected drop in inflation.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

European shares edge higher with Fed decision in focus(Reuters) - European shares edged higher on Wednesday ahead of the U.S. Federal Reserve's rate decision later in the day, while UK data showing ...

European shares edge higher with Fed decision in focus(Reuters) - European shares edged higher on Wednesday ahead of the U.S. Federal Reserve's rate decision later in the day, while UK data showing ...

Lire la suite »

European Stocks Rise on Cooling UK Inflation Before Fed DecisionEuropean stocks rose on Wednesday as an unexpected slowdown in UK inflation lifted risk appetite ahead of the Federal Reserve’s policy decision later in the day.

European Stocks Rise on Cooling UK Inflation Before Fed DecisionEuropean stocks rose on Wednesday as an unexpected slowdown in UK inflation lifted risk appetite ahead of the Federal Reserve’s policy decision later in the day.

Lire la suite »

European shares advance as bond yields ease ahead of U.S. Fed's interest rate decisionKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

European shares advance as bond yields ease ahead of U.S. Fed's interest rate decisionKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Lire la suite »

Yellen says U.S. 'soft landing' can weather strike, govt shutdown, student loan risksBy David Lawder NEW YORK (Reuters) - U.S. Treasury Secretary Janet Yellen told Reuters that a

Yellen says U.S. 'soft landing' can weather strike, govt shutdown, student loan risksBy David Lawder NEW YORK (Reuters) - U.S. Treasury Secretary Janet Yellen told Reuters that a

Lire la suite »

Fed's 'big message' will be restrictive policy for longer: EconomistMarkets and investors are waiting and wondering how much the Fed's September interest rate decision will line up with expectations, with many anticipating a rate pause this month. SEI Chief Investment Officer Jim Smigiel and Dreyfus and Mellon Chief Economist Vincent Reinhart join Yahoo Finance Live to share their predictions on Fed Chair Jerome Powell's ultimate decision. 'The Fed does not like to disappoint when the market is kind of all lined up with an expectation like they are for this week, where there will be a pause — the Fed will deliver on that,' Smigiel comments on the market's hawkish sentiment. 'However, we do think there is, at the least, one more hike baked in the cake. So that will probably come in November.' 'The big message the Fed's going to want to convey is they're going to keep policy restrictive for as long as it takes,' Reinhart outlines. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.

Fed's 'big message' will be restrictive policy for longer: EconomistMarkets and investors are waiting and wondering how much the Fed's September interest rate decision will line up with expectations, with many anticipating a rate pause this month. SEI Chief Investment Officer Jim Smigiel and Dreyfus and Mellon Chief Economist Vincent Reinhart join Yahoo Finance Live to share their predictions on Fed Chair Jerome Powell's ultimate decision. 'The Fed does not like to disappoint when the market is kind of all lined up with an expectation like they are for this week, where there will be a pause — the Fed will deliver on that,' Smigiel comments on the market's hawkish sentiment. 'However, we do think there is, at the least, one more hike baked in the cake. So that will probably come in November.' 'The big message the Fed's going to want to convey is they're going to keep policy restrictive for as long as it takes,' Reinhart outlines. For more expert insight and the latest market action, click here to watch this full episode of Yahoo Finance Live.

Lire la suite »

Stocks slide ahead of Fed meeting, Instacart IPO: Stock market news todayStocks fell on Tuesday as the Federal Reserve was set to begin its latest policy meeting.

Stocks slide ahead of Fed meeting, Instacart IPO: Stock market news todayStocks fell on Tuesday as the Federal Reserve was set to begin its latest policy meeting.

Lire la suite »