The ECB left the rate it pays on deposits at a record-high 4.0%, reaffirming that the current level of borrowing costs may just be enough to tame inflation if kept there ‘sufficiently long’

The European Central Bank broke the longest streak of interest rate hikes in its 25-year history on Thursday, saying the latest data continued to point to inflation slowly coming down to its 2 per cent target.

“The Governing Council’s past interest rate increases continue to be transmitted forcefully into financing conditions,” the ECB said. “This is increasingly dampening demand and thereby helps push down inflation.” This sharp policy tightening is leaving a mark on the economy, with data earlier this week showing weak credit creation and economic activity.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

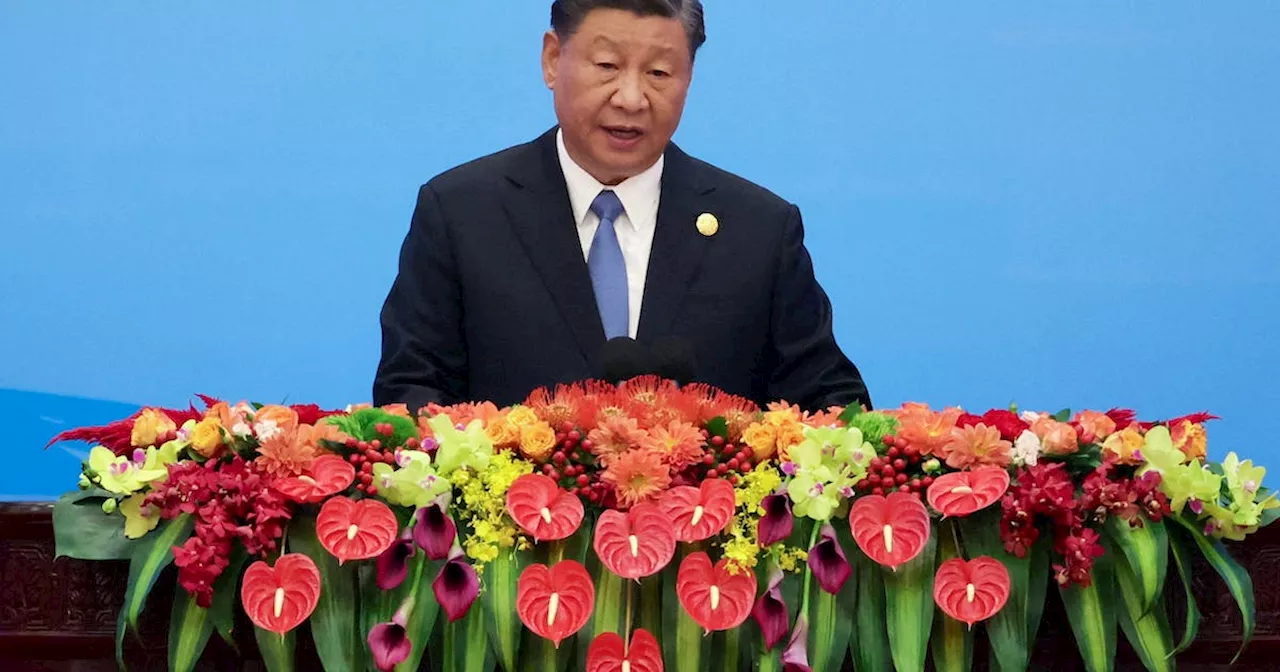

China's Xi makes first known visit to central bank -sourcesExplore stories from Atlantic Canada.

China's Xi makes first known visit to central bank -sourcesExplore stories from Atlantic Canada.

Lire la suite »

Singapore central bank consults on regulatory structure for fund managersMarket News

Singapore central bank consults on regulatory structure for fund managersMarket News

Lire la suite »

China's Xi makes first known visit to central bank -sourcesExplore stories from Atlantic Canada.

China's Xi makes first known visit to central bank -sourcesExplore stories from Atlantic Canada.

Lire la suite »

Mexico’s Inflation Slows More Than Expected With Central Bank on HoldMexico’s annual inflation slowed past all forecasts in early October as the central bank pledges to hold interest rates at a record high in Latin America’s second-largest economy.

Mexico’s Inflation Slows More Than Expected With Central Bank on HoldMexico’s annual inflation slowed past all forecasts in early October as the central bank pledges to hold interest rates at a record high in Latin America’s second-largest economy.

Lire la suite »

Turkish central bank expected to raise rates to 35% on Oct. 26: Reuters pollMarket News

Turkish central bank expected to raise rates to 35% on Oct. 26: Reuters pollMarket News

Lire la suite »

South African Central Bank Sees Too Many Risks to Say Rate Hikes Are DoneSouth African Reserve Bank Deputy Governor Fundi Tshazibana said there are too many risks to the inflation outlook to declare that the cycle of interest-rate increases is over.

South African Central Bank Sees Too Many Risks to Say Rate Hikes Are DoneSouth African Reserve Bank Deputy Governor Fundi Tshazibana said there are too many risks to the inflation outlook to declare that the cycle of interest-rate increases is over.

Lire la suite »