EUR/USD: Risks skewed to downside from ECB and Fed policy updates – MUFG EURUSD ECB Fed

We continue to believe that EUR/USD has moved into a new higher trading range between 1.1000 and 1.1500.

On balance, we believe that risks for the pair are skewed to the downside in the week ahead from the ECB and Fed’s policy updates. Assuming that the Fed does not signal that next week’s hike is the last in the cycle and the ECB does not strongly commit to one more hike later this year. However, support at 1.1000 should hold and provide an opportunity to build long positioning in anticipation of a move toward the top of the range in the coming months.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

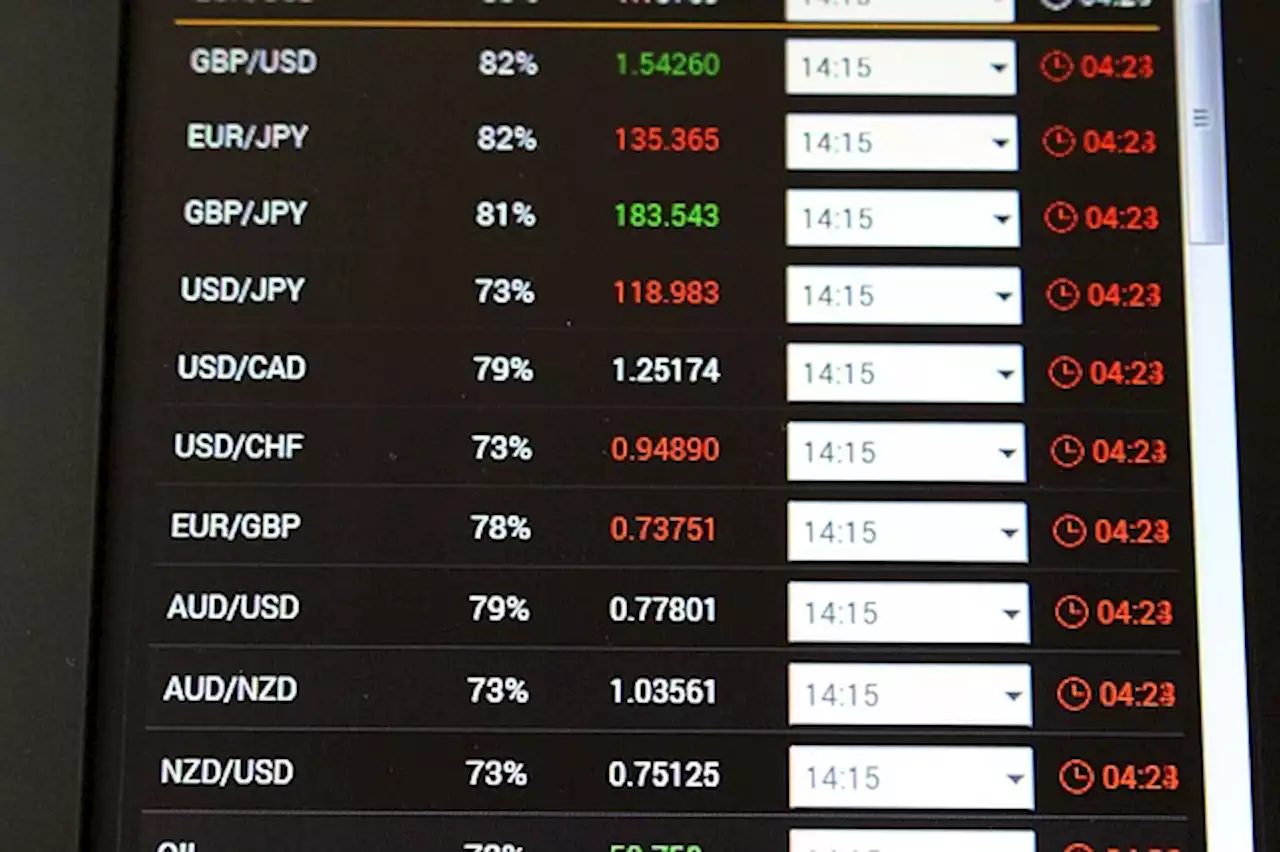

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Silver, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 23rd, 2022 here.

Pairs in Focus This Week \u2013 GBP/USD, EUR/USD, Silver, USD/CADGet the Forex Forecast using fundamentals, sentiment, and technical position analyses for major pairs for the week of July 23rd, 2022 here.

Lire la suite »

EUR/USD: Weekly Forecast 23rd July - 29th JulyThe ability of the EUR/USD to reach a high of nearly 1.12760 last Tuesday touched a value not seen since late February of 2022.

EUR/USD: Weekly Forecast 23rd July - 29th JulyThe ability of the EUR/USD to reach a high of nearly 1.12760 last Tuesday touched a value not seen since late February of 2022.

Lire la suite »

Trading Support and Resistance \u2013 EUR/USD, USD/CADThis week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

Trading Support and Resistance \u2013 EUR/USD, USD/CADThis week I will begin with my monthly and weekly Forex forecast of the currency pairs worth watching.

Lire la suite »

Weekly Forex Forecast \u2013 NASDAQ 100 Index, EUR/USD, USD/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Weekly Forex Forecast \u2013 NASDAQ 100 Index, EUR/USD, USD/JPYThe difference between success and failure in Forex / CFD trading is highly likely to depend mostly upon which assets you choose to trade each week and in which

Lire la suite »

EUR/USD holds steady above 1.1100 mark, eyes flash Euro Zone/US PMIs for some impetusThe EUR/USD pair kicks off the new week on subdued note and oscillates in a narrow trading band around the 1.1125-1.1130 area through the Asian sessio

EUR/USD holds steady above 1.1100 mark, eyes flash Euro Zone/US PMIs for some impetusThe EUR/USD pair kicks off the new week on subdued note and oscillates in a narrow trading band around the 1.1125-1.1130 area through the Asian sessio

Lire la suite »

EUR/USD Price Analysis: Edges higher past 1.1100-1090 support zone ahead of Eurozone, US PMIEUR/USD Price Analysis: Edges higher past 1.1100-1090 support zone ahead of Eurozone, US PMI – by anilpanchal7 EURUSD Technical Analysis ChartPatterns SwingTrading PMI

EUR/USD Price Analysis: Edges higher past 1.1100-1090 support zone ahead of Eurozone, US PMIEUR/USD Price Analysis: Edges higher past 1.1100-1090 support zone ahead of Eurozone, US PMI – by anilpanchal7 EURUSD Technical Analysis ChartPatterns SwingTrading PMI

Lire la suite »