EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls (NFP) Friday.

EUR/USD rebounds into high side of near-term range. US NFP labor figures to be pivotal data point this week. Investors looking for easing labor and slowing wages to bolster rate cut chances. EUR/USD drove back to the top end of recent consolidation on Thursday, recovering chart territory north of the 1.0700 handle as market risk appetite regains balance heading into another US Nonfarm Payrolls Friday.

US Average Hourly Earnings in April are also forecast to hold steady at 0.3% MoM, with wage growth a key fear point for inflationary pressures. At current cut, the rate markets are expecting a first quarter-point trim from the Fed in September, with 62% odds of at least a 25 basis point reduction according to the CME’s FedWatch Tool. EUR/USD technical outlook EUR/USD is back into the top side of recent consolidation, testing into the bottom end of a supply zone between 1.0750 and 1.0720.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

US Dollar Tanks Ahead of Fed Verdict, NFP Data - EUR/USD, GBP/USD, USD/CADThis article explores the fundamental and the technical outlook for the U.S. dollar, zeroing in on three popular and very liquid pairs: EUR/USD, GBP/USD and USD/CAD.

US Dollar Tanks Ahead of Fed Verdict, NFP Data - EUR/USD, GBP/USD, USD/CADThis article explores the fundamental and the technical outlook for the U.S. dollar, zeroing in on three popular and very liquid pairs: EUR/USD, GBP/USD and USD/CAD.

Lire la suite »

EUR/USD jitters post-Fed with NFP Friday over the horizonEUR/USD cycled familiar territory on Wednesday after the US Federal Reserve (Fed) held rates as many investors had expected.

EUR/USD jitters post-Fed with NFP Friday over the horizonEUR/USD cycled familiar territory on Wednesday after the US Federal Reserve (Fed) held rates as many investors had expected.

Lire la suite »

EUR/USD mired near 1.0730 after choppy Thursday market sessionEUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

EUR/USD mired near 1.0730 after choppy Thursday market sessionEUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Lire la suite »

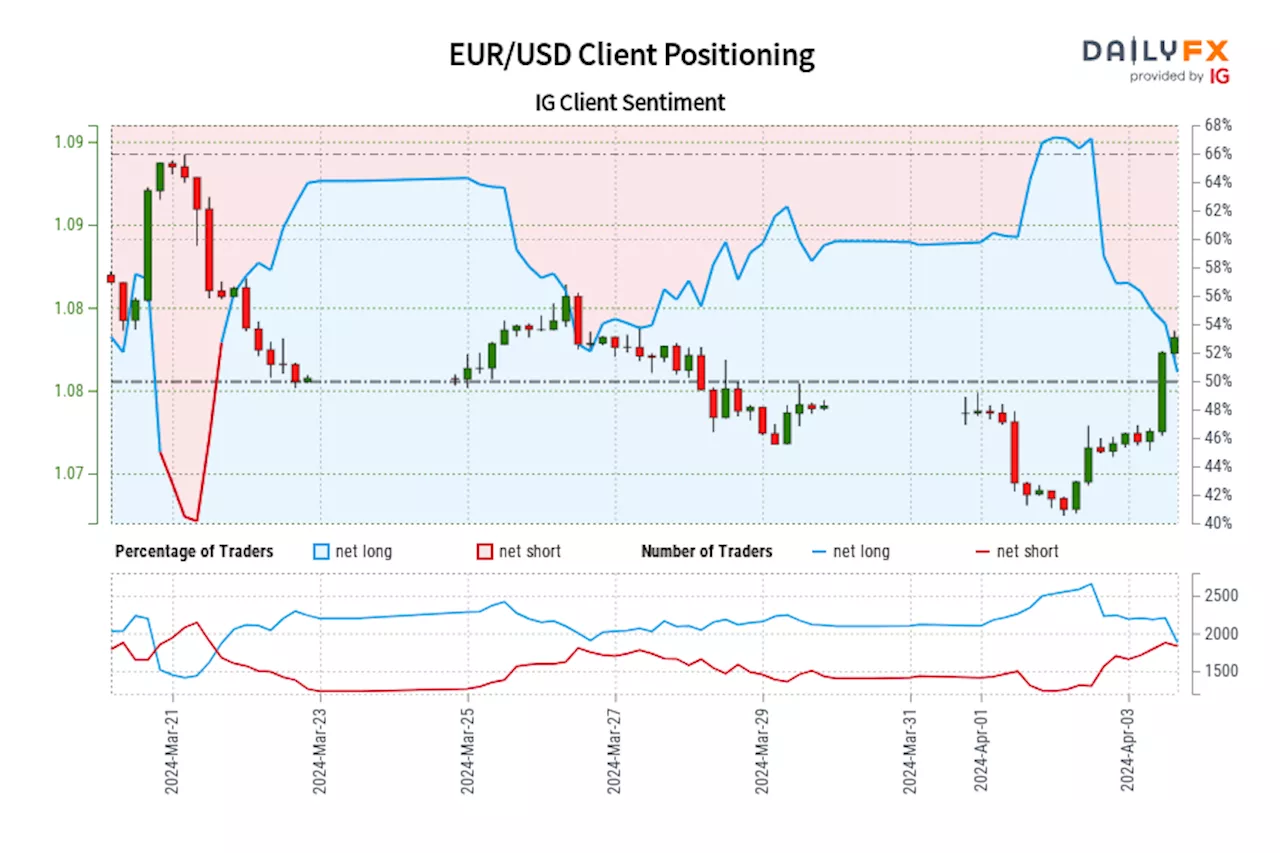

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Lire la suite »

EUR/USD holds above 1.0650 amid renewed selling pressure in US DollarThe EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session.

EUR/USD holds above 1.0650 amid renewed selling pressure in US DollarThe EUR/USD pair edges higher to 1.0672 on Thursday during the early Asian session.

Lire la suite »

EUR/USD Price Analysis: The key support level is seen around 1.0730, oversold RSI condition eyedThe EUR/USD pair loses traction around 1.0745 on Thursday during the early European session.

EUR/USD Price Analysis: The key support level is seen around 1.0730, oversold RSI condition eyedThe EUR/USD pair loses traction around 1.0745 on Thursday during the early European session.

Lire la suite »