EUR/USD jumped on reaction to the Federal Reserve’s (Fed) latest rate call, which held rates at 5.5% as markets had broadly predicted.

EUR/USD bumped towards 1.0900 after Fed held steady. Fed Dot Plot still sees 75 bps in 2024. Fed expects rates to be held higher by end of 2026. EUR/USD jumped on reaction to the Federal Reserve’s latest rate call, which held rates at 5.5% as markets had broadly predicted. Investor expectations are pricing in additional easing in 2024, despite the Federal Open Market Committee seeing stronger growth through 2024 and 2025 than initially expected.

Read more:Fed leaves interest rate unchanged at 5.25%-5.5% as forecast Fed Chair Powell noted during the FOMC Press Conference that while inflation continues to ease, price growth remains a key issue the Fed can't dismiss, as a tight labor market and higher-than-expected growth continues to complicate the future of rate cuts. Powell speech:January and February inflation numbers did not add to our confidence EUR/USD 5-minute chart EUR/USD Overview Today last price 1.0894 Today Daily Change 0.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

EUR/USD drops on high US yields as markets eye FOMC decisionThe Euro drops against the US Dollar at the beginning of the week as investors brace for the Federal Open Market Committee (FOMC) monetary policy decision.

EUR/USD drops on high US yields as markets eye FOMC decisionThe Euro drops against the US Dollar at the beginning of the week as investors brace for the Federal Open Market Committee (FOMC) monetary policy decision.

Lire la suite »

– ZEW Economic Sentiment Improves, EUR/USD Hinges on FOMC DecisionEconomic sentiment in the Euro Area and Germany turned higher in March, according to the latest ZEW report, but Wednesday’s FOMC meeting will dictate the next EUR/USD move.

– ZEW Economic Sentiment Improves, EUR/USD Hinges on FOMC DecisionEconomic sentiment in the Euro Area and Germany turned higher in March, according to the latest ZEW report, but Wednesday’s FOMC meeting will dictate the next EUR/USD move.

Lire la suite »

EUR/USD under pressure as traders await FOMC decisionThe Euro remains on the defensive against the US Dollar as market participants await March’s monetary policy decision by the Federal Open Market Committee (FOMC) on Wednesday.

EUR/USD under pressure as traders await FOMC decisionThe Euro remains on the defensive against the US Dollar as market participants await March’s monetary policy decision by the Federal Open Market Committee (FOMC) on Wednesday.

Lire la suite »

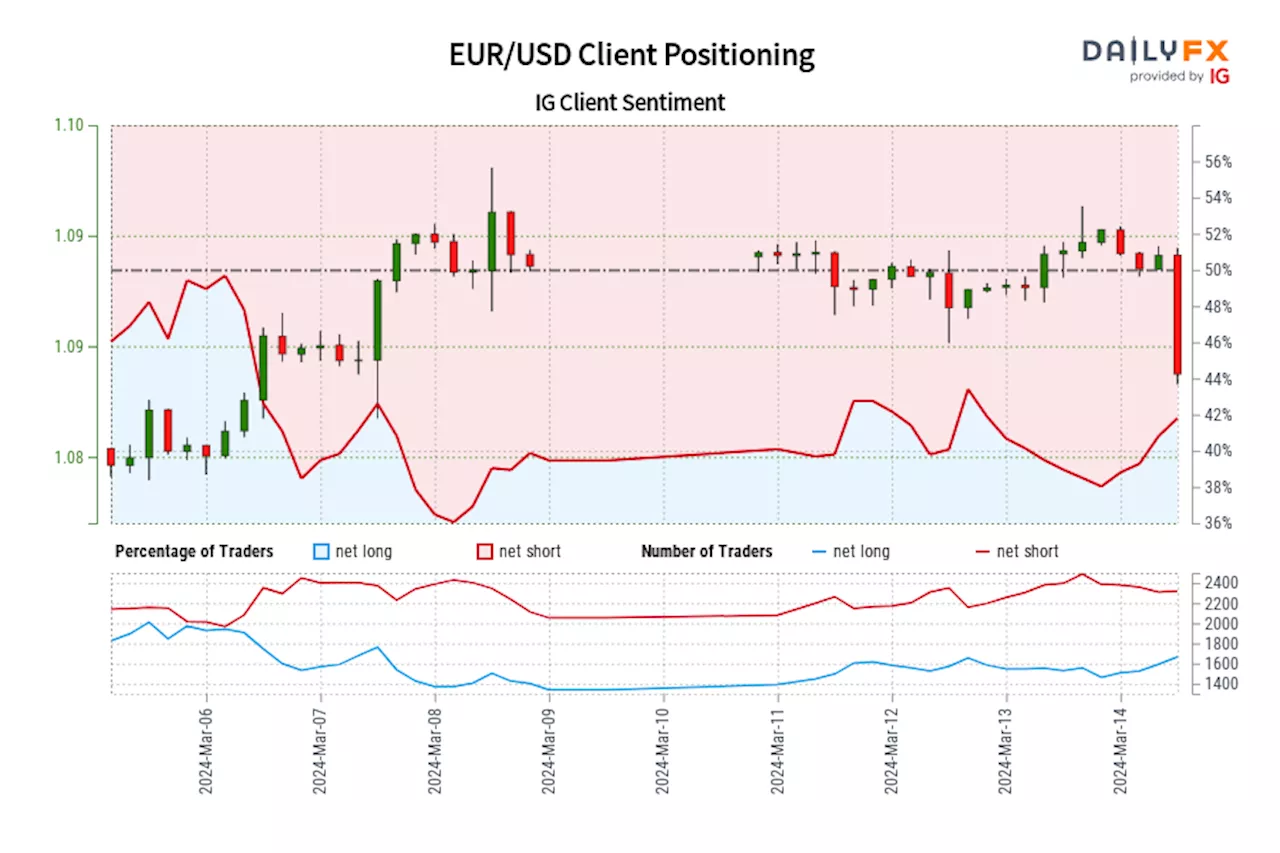

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-long EUR/USD for the first time since Mar 06, 2024 03:00 GMT when EUR/USD traded near 1.09.Traders are further net-long than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bearish contrarian trading bias.

Lire la suite »

US Dollar Soars on Inflation Risks as Fed Looms; EUR/USD, GBP/USD, USD/JPY SetupsThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY and GBP/USD, exploring various technical and fundamental scenarios that could play out in the near term.

US Dollar Soars on Inflation Risks as Fed Looms; EUR/USD, GBP/USD, USD/JPY SetupsThis article provides an in-depth analysis of the outlook for EUR/USD, USD/JPY and GBP/USD, exploring various technical and fundamental scenarios that could play out in the near term.

Lire la suite »

EUR/USD Levels Off at Support Ahead of Key Fed DecisionThis article looks at EUR/USD’s near-term outlook, examining potential technical scenarios ahead of the Fed decision next week.

EUR/USD Levels Off at Support Ahead of Key Fed DecisionThis article looks at EUR/USD’s near-term outlook, examining potential technical scenarios ahead of the Fed decision next week.

Lire la suite »