EUR/USD bumped slightly higher after the Federal Reserve (Fed) released its latest rate outlook, with the US central bank citing an improvement in inflationary conditions, though targets remain unhit.

EUR/USDbumped higher after Fed acknowledged easing inflation pressures. Rate markets still see November as a likely first rate cut. US NFP Friday to provide key labor figures. EUR/USD bumped slightly higher after the Fed eral Reserve released its latest rate outlook, with the US central bank citing an improvement in inflationary conditions, though targets remain unhit and progress has slowed. The US Dollar eased broadly and risk appetite is taking a cautious step forward.

5% as forecast Markets will be awaiting key statements from the Federal Open Market Committee's press conference due to begin at 18:30 GMT, presided over by Fed Chair Jerome Powell. EUR/USD technical outlook EUR/USD found some early bidding post-Fed monetary policy report, ticking closer to 1.0700 as the pair springboards off intraday technical support from the 200-period Exponential Moving Average near 1.0675 on five-minute charts.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

– Bearish Technical Signal Halts EUR/USD Ahead of FOMC DecisionThe Euro is struggling against the a resurgent US dollar as rate cut expectations between the two continue to widen. Today’s FOMC may underpin thoughts that the Fed is comfortable with rates staying higher for longer.

– Bearish Technical Signal Halts EUR/USD Ahead of FOMC DecisionThe Euro is struggling against the a resurgent US dollar as rate cut expectations between the two continue to widen. Today’s FOMC may underpin thoughts that the Fed is comfortable with rates staying higher for longer.

Lire la suite »

EUR/USD Price Analysis: Manages to hold above 200-hour SMA ahead of Eurozone CPI, FOMCThe EUR/USD pair meets with some supply during the Asian session on Tuesday and erodes a part of the previous day's gains amid the emergence of fresh US Dollar (USD) buying.

EUR/USD Price Analysis: Manages to hold above 200-hour SMA ahead of Eurozone CPI, FOMCThe EUR/USD pair meets with some supply during the Asian session on Tuesday and erodes a part of the previous day's gains amid the emergence of fresh US Dollar (USD) buying.

Lire la suite »

EUR/USD under pressure after US CPI and FOMC minutesThe EUR/USD pair declined to 1.0739, representing a substantial decline of 1.1%.

EUR/USD under pressure after US CPI and FOMC minutesThe EUR/USD pair declined to 1.0739, representing a substantial decline of 1.1%.

Lire la suite »

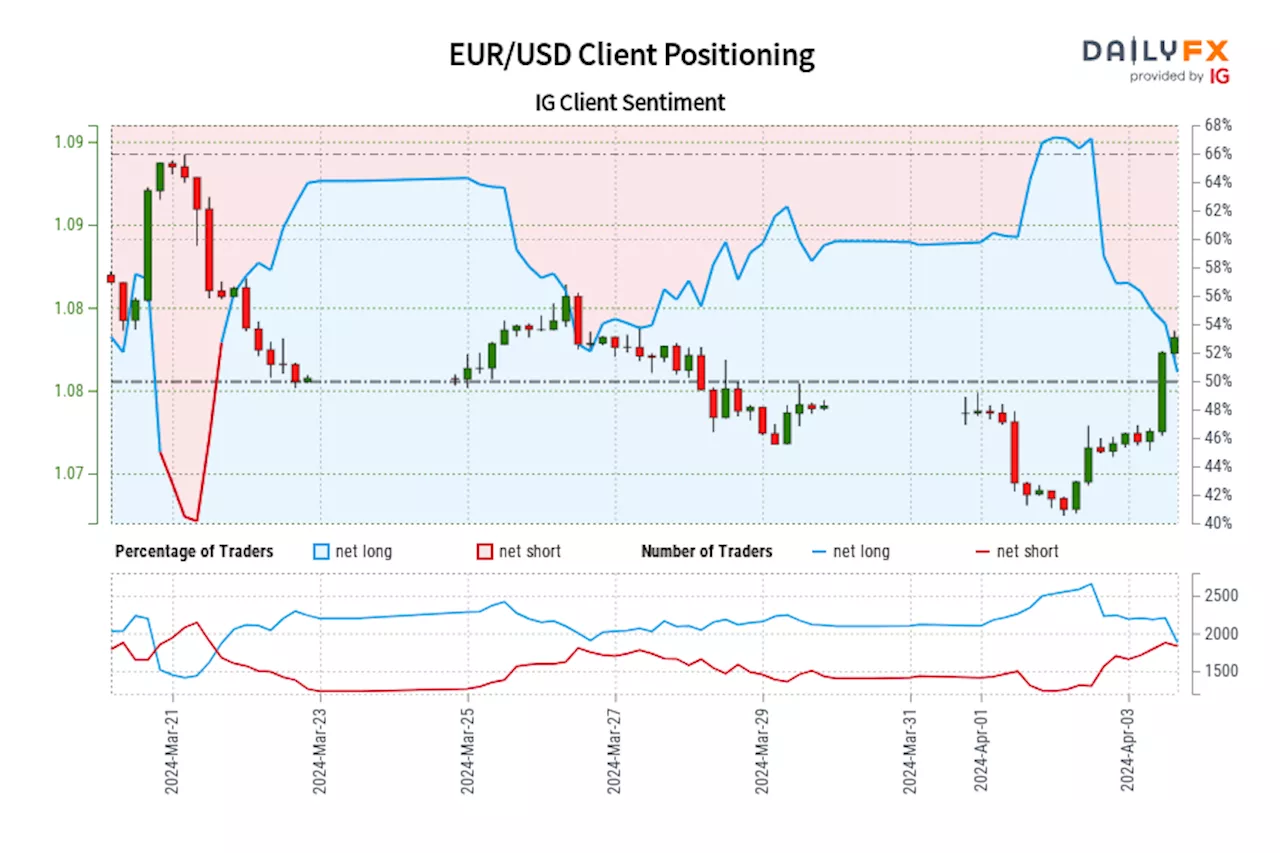

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

EUR/USD IG Client Sentiment: Our data shows traders are now net-short EUR/USD for the first time since Mar 21, 2024 when EUR/USD traded near 1.09.Traders are further net-short than yesterday and last week, and the combination of current sentiment and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias.

Lire la suite »

EUR/USD holds mildly up after US data, Fed loomsThe EUR/USD pair is trading mildly higher at 1.0682, with a daily variation of 0.12% on Wednesday’s session.

EUR/USD holds mildly up after US data, Fed loomsThe EUR/USD pair is trading mildly higher at 1.0682, with a daily variation of 0.12% on Wednesday’s session.

Lire la suite »

EUR/USD Forecast: Lifeless as the Federal Reserve's announcement loomsFinancial markets are pretty quiet this Wednesday, as most markets remain closed amid the Labor Day holiday.

EUR/USD Forecast: Lifeless as the Federal Reserve's announcement loomsFinancial markets are pretty quiet this Wednesday, as most markets remain closed amid the Labor Day holiday.

Lire la suite »