(Bloomberg) -- The European Central Bank is more likely to lower borrowing costs as a next move, rather than raise them further, Governing Council member Yannis Stournaras said in the clearest remarks yet on rates likely having reached their peak.

The Greek official was joined on Thursday by Croatia’s Boris Vujcic in saying this month’s ECB hike was probably the last in an unprecedented bout of monetary tightening — assuming inflation moderates back toward 2% as envisaged.

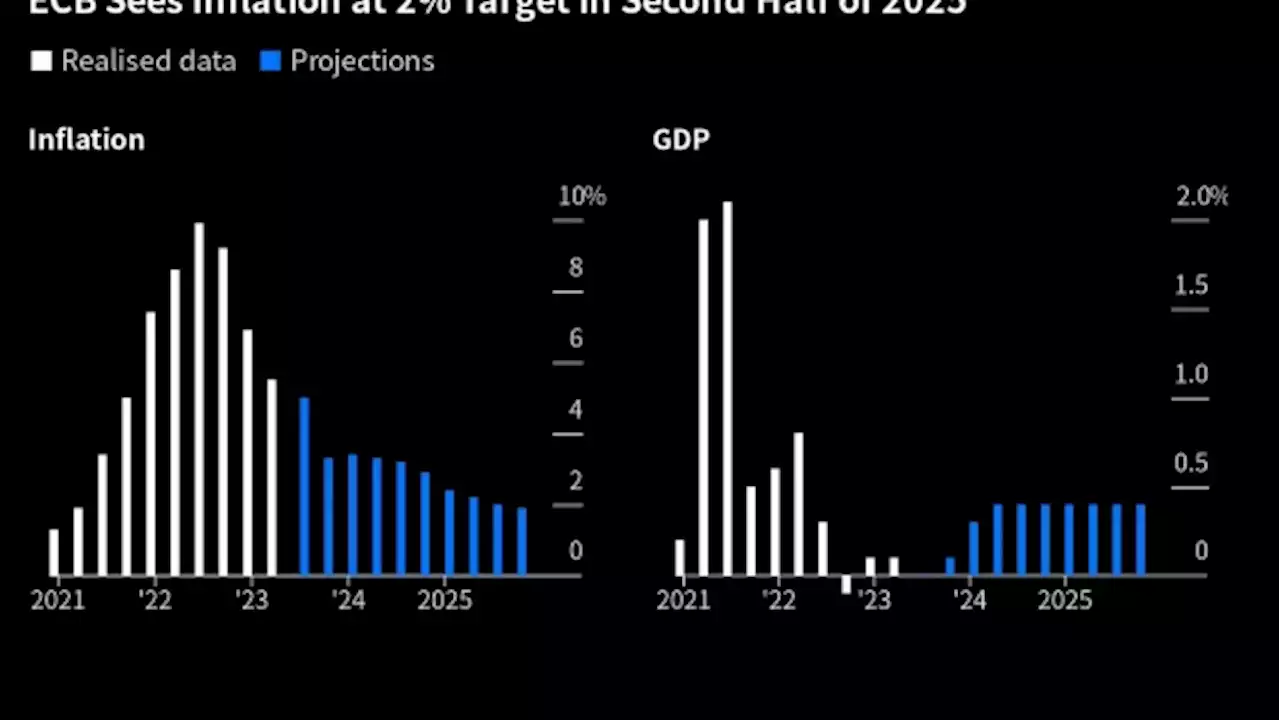

ECB officials took the deposit rate to 4% last week, saying that this level will make a “substantial contribution” to returning inflation to their target. But in the days that followed, several — including Vice President Luis de Guindos — have expressed hope that additional tightening won’t be needed.

How long borrowing costs will remain where they are is now the key question, with investors penciling in cuts for the spring as the 20-nation euro-zone economy shows increasing signs of weakness, even if a recession isn’t being forecast yet. “Have we reached the plateau?” he said in a speech in Frankfurt. “This cannot yet be clearly predicted. The inflation rate is still too high. And the forecasts still only show a slow decline toward the target level of 2%.”

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Pup punted from flight after airline deems carrier is too smallWatch Pup punted from flight after airline deems carrier is too small Video Online, on GlobalNews.ca

Pup punted from flight after airline deems carrier is too smallWatch Pup punted from flight after airline deems carrier is too small Video Online, on GlobalNews.ca

Lire la suite »

IRS plans to cut back on its audits of lower-income taxpayersThe agency this week said it plans to reduce audits for taxpayers who claim the earned income tax credit, or EITC.

IRS plans to cut back on its audits of lower-income taxpayersThe agency this week said it plans to reduce audits for taxpayers who claim the earned income tax credit, or EITC.

Lire la suite »

Private Carrier JSX to Cut Austin Flights in Blow to CommutersJSX Inc., a small carrier that offers private-jet service at close to commercial-jet prices, will cut nearly all of its flights out of Austin after losing access to one of its original operating facilities.

Private Carrier JSX to Cut Austin Flights in Blow to CommutersJSX Inc., a small carrier that offers private-jet service at close to commercial-jet prices, will cut nearly all of its flights out of Austin after losing access to one of its original operating facilities.

Lire la suite »

HILL: Smith government should cut corporate welfare to generate tax reliefTEGAN HILL: Smith government should cut corporate welfare to generate tax relief

HILL: Smith government should cut corporate welfare to generate tax reliefTEGAN HILL: Smith government should cut corporate welfare to generate tax relief

Lire la suite »

Bank of Canada watching its words to avoid rate cut speculation, summary revealsThe Bank of Canada was watching its words at its last interest rate announcement as it sought to avoid spurring speculation that rate cuts are on the table any time soon.

Bank of Canada watching its words to avoid rate cut speculation, summary revealsThe Bank of Canada was watching its words at its last interest rate announcement as it sought to avoid spurring speculation that rate cuts are on the table any time soon.

Lire la suite »

Bank of Canada watching its words to avoid spur rate cut speculation, summary revealsOTTAWA — The Bank of Canada was watching its words at its last interest rate announcement as it sought to avoid spurring speculation that rate cuts are on the table any time soon.

Bank of Canada watching its words to avoid spur rate cut speculation, summary revealsOTTAWA — The Bank of Canada was watching its words at its last interest rate announcement as it sought to avoid spurring speculation that rate cuts are on the table any time soon.

Lire la suite »