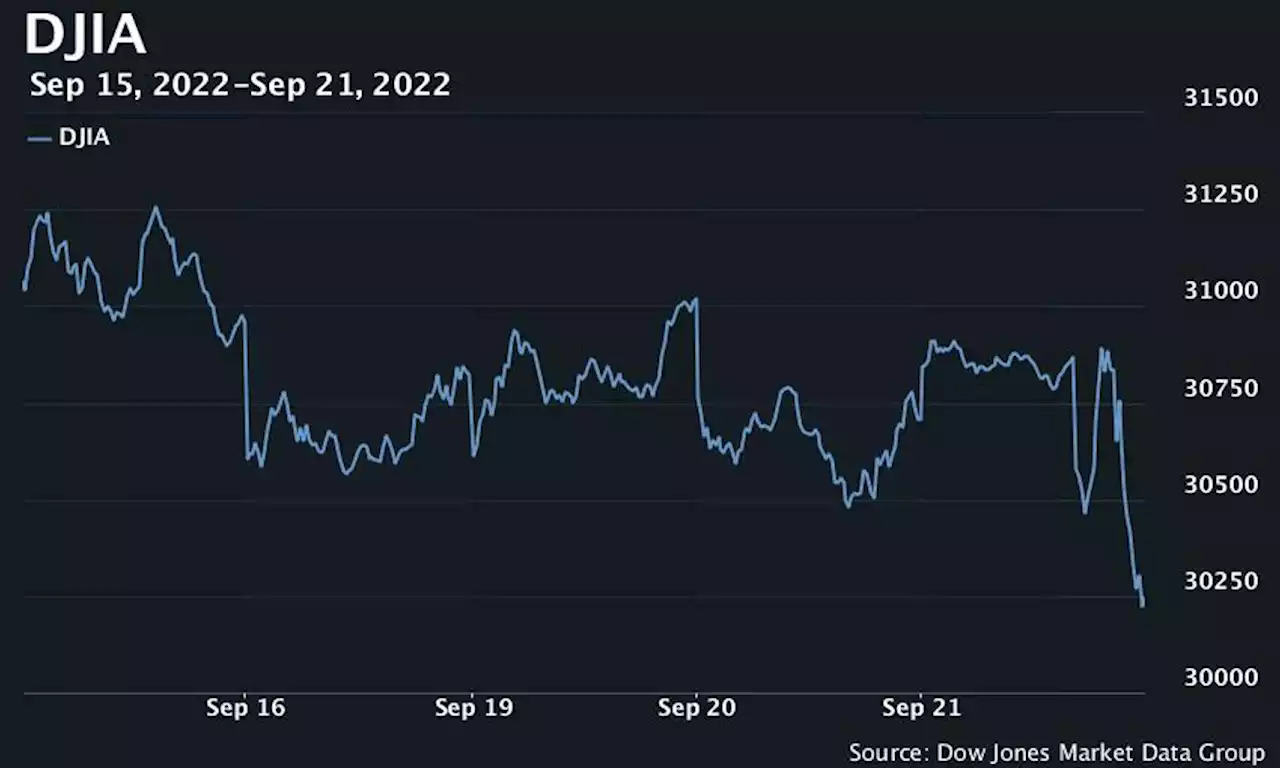

Stocks fell Friday morning as investors continued responding to the Fed's decision.

Loading chart...

Bear in mind, the Dow first closed above 30,000 on Nov. 24, 2020 , and went on to reach an all-time intraday high that very nearly touched 37,000 back in the first week of January this year.

The wholesale retailer said it's seeing higher freight and labor costs and reported operating margins slightly below consensus expectations.The dollar index hit its highest level since 2002. The Dow Jones Industrial Average fell by 340 points, or 1.1%, touching below its June closing low and the 30,000 level. The S&P 500 slid 1.3% and the Nasdaq Composite lost 1.2%.Oil hit a trading low of $79.64 per barrel Friday, marking the first time since early January it has traded below $80 per barrel.

"A lot of people can't get done what they want to get done, so they're getting done what they can get done.

Citi suggests investors take a defensive stance to play this uncertain market. The bank maintains a long position in healthcare, replacing its previous position in communication with utilities and staying short on financials and industrials.All the major averages are slated to end the week with losses ahead of Friday's trading session, with the Dow on track to break below its June closing low.Down 17.2% this year, 2.4% for the weekDown about 3% for the week, 21.1% this yearDown 3.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Dollar towering, stocks cowering as Fed hikes higherThe dollar surged to a fresh two-decade high against major peers and stocks fell on Thursday after the Federal Reserve raised U.S. interest rates and forecast more hikes ahead than investors had expected.

Dollar towering, stocks cowering as Fed hikes higherThe dollar surged to a fresh two-decade high against major peers and stocks fell on Thursday after the Federal Reserve raised U.S. interest rates and forecast more hikes ahead than investors had expected.

Lire la suite »

Stocks slump on Wall Street as Fed steps up inflation fightStocks closed sharply lower Wednesday after the Federal Reserve made another big interest rate hike and sharply increased its outlook for how high it expects to raise rates in coming months.

Stocks slump on Wall Street as Fed steps up inflation fightStocks closed sharply lower Wednesday after the Federal Reserve made another big interest rate hike and sharply increased its outlook for how high it expects to raise rates in coming months.

Lire la suite »

Stocks end lower as global central banks follow Fed in hiking ratesU.S. stocks ended lower Thursday, adding to sharp declines after the Fed on Wednesday delivered a 75 basis point rate hike and signaled significant further tightening ahead. The Dow Jones Industrial Average fell around 108 points, or 0.4%:

Stocks end lower as global central banks follow Fed in hiking ratesU.S. stocks ended lower Thursday, adding to sharp declines after the Fed on Wednesday delivered a 75 basis point rate hike and signaled significant further tightening ahead. The Dow Jones Industrial Average fell around 108 points, or 0.4%:

Lire la suite »

Stocks swing lower after Fed hikes, raises outlook for ratesU.S. stocks gave up gains to turn lower Wednesday afternoon after the Federal Reserve, as expected, raised its fed funds rate by 75 basis points, while also...

Stocks swing lower after Fed hikes, raises outlook for ratesU.S. stocks gave up gains to turn lower Wednesday afternoon after the Federal Reserve, as expected, raised its fed funds rate by 75 basis points, while also...

Lire la suite »

Crypto-Linked Stocks Rally After Fed Rate HikeCryptocurrency-exposed stocks rose along with bitcoin and ether following the Federal Reserve's announcement Wednesday to boost the interest rate 75 basis points.

Crypto-Linked Stocks Rally After Fed Rate HikeCryptocurrency-exposed stocks rose along with bitcoin and ether following the Federal Reserve's announcement Wednesday to boost the interest rate 75 basis points.

Lire la suite »

Dow drops over 500 points as stocks end sharply lower after Fed rate hikeStocks took a sharp turn lower to end a choppy session Wednesday, sinking after the Federal Reserve delivered a widely expected 75 basis point rate hike. The Dow Jones Industrial Average dropped around 522 points, or 1.7%, to end near 30,184:

Dow drops over 500 points as stocks end sharply lower after Fed rate hikeStocks took a sharp turn lower to end a choppy session Wednesday, sinking after the Federal Reserve delivered a widely expected 75 basis point rate hike. The Dow Jones Industrial Average dropped around 522 points, or 1.7%, to end near 30,184:

Lire la suite »