Uncertainty caused by the collapse of Silicon Valley Bank this month triggered outflows and plunging share prices at peers including First Republic and PacWest.

"Things have calmed down for sure," Dubugras told CNBC in a phone interview. "There's been a lot of ins and outs, but people are still putting money into the big banks."

The post-SVB playbook, he said, is for startups to keep three to six months of cash at regional banks or new entrants like Brex, while parking the rest at one of the four biggest players. That approach combines the service and features of smaller lenders with the perceived safety of too-big-to-fail banks for the bulk of their money, he said.

"A lot of founders opened an account at a Big Four bank, moved a lot of money there, and now they're remembering why they didn't do that in the first place," he said. The biggest banks haven't historically catered to risky startups, which was the domain of specialty lenders like SVB. Dubugras said that JPMorgan, the biggest U.S. bank by assets, was the largest single gainer of deposits among lenders this month, in part because VCs have flocked to the bank. That belief has been supported by anecdotalFor now, attention has turned to First Republic, which has teetered in recent weeks and whose shares have lost 90% this month. The bank is known for its success in catering to wealthy customers on the East and West coasts.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

A couple is accusing JPMorgan of drilling open safe deposit boxesA couple is accusing JPMorgan of drilling open their safe deposit boxes and selling $10 million of their jewelry after they failed to pay rent for the boxes

Lire la suite »

State financial officers call on JPMorgan Chase to address politically motivated de-bankingA group of state financial officers is writing to JPMorgan Chase CEO Jamie Dimon to call for transparency and an end to political or religious bias in decisions to de-bank clients.

State financial officers call on JPMorgan Chase to address politically motivated de-bankingA group of state financial officers is writing to JPMorgan Chase CEO Jamie Dimon to call for transparency and an end to political or religious bias in decisions to de-bank clients.

Lire la suite »

Citi analyst sees ‘ample’ liquidity in banks to cover deposit withdrawalsRegions Financial Corp. KeyCorp and Fifth Third Bancorp top a list of nine regional banks as measured by total available liquidity to cover potential deposit...

Citi analyst sees ‘ample’ liquidity in banks to cover deposit withdrawalsRegions Financial Corp. KeyCorp and Fifth Third Bancorp top a list of nine regional banks as measured by total available liquidity to cover potential deposit...

Lire la suite »

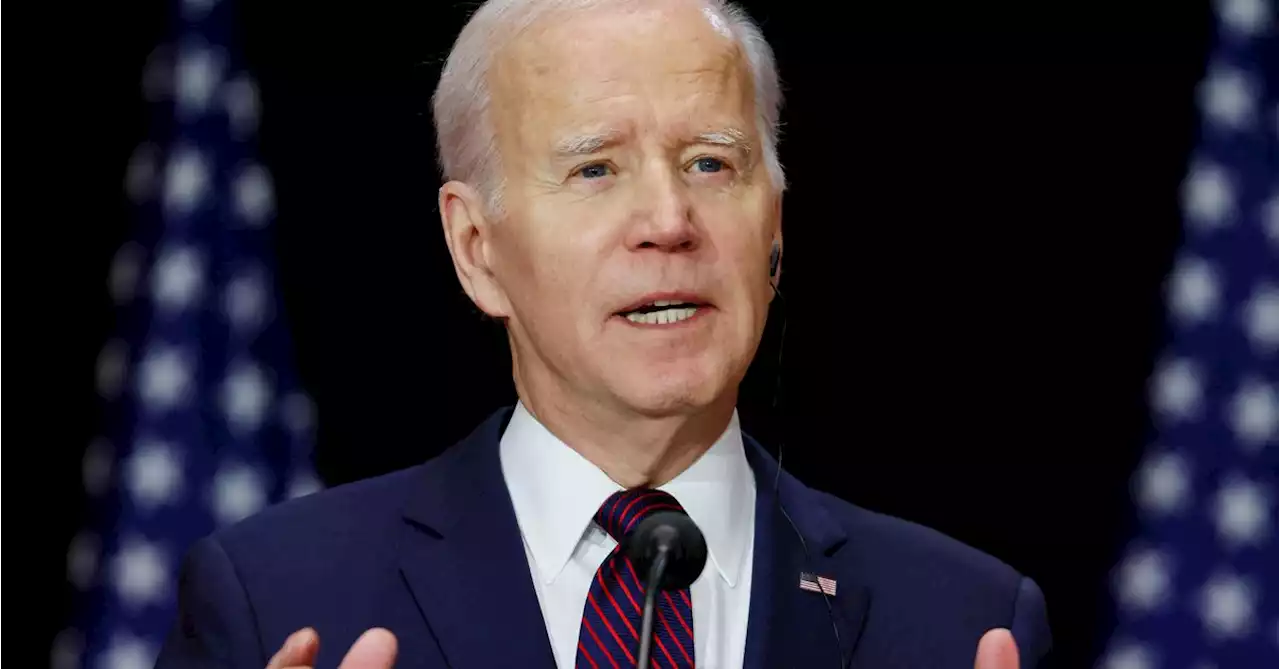

Biden said federal deposit insurance could be tapped further if banks failPresident Joe Biden said on Friday that federal deposit insurance could be tapped for deposits above $250,000 if other U.S. banks fail.

Biden said federal deposit insurance could be tapped further if banks failPresident Joe Biden said on Friday that federal deposit insurance could be tapped for deposits above $250,000 if other U.S. banks fail.

Lire la suite »

US Tsr Sec. Yellen: Prepared for additional deposit actions `if warranted'Treasury Secretary Janet Yellen, Council of Economic Advisers Chair Cecila Rouse, and Office of Management and Budget Director Shalanda Young are deli

US Tsr Sec. Yellen: Prepared for additional deposit actions `if warranted'Treasury Secretary Janet Yellen, Council of Economic Advisers Chair Cecila Rouse, and Office of Management and Budget Director Shalanda Young are deli

Lire la suite »

Exclusive: JPMorgan, Citi, BofA tell staff not to poach clients from stressed banks -memo, sourcesAs a series of U.S. lenders were besieged by customers yanking out their money this month, banking behemoths JPMorgan Chase & Co , Citigroup Inc and Bank of America Corp. , warned employees: Do not make it worse.

Exclusive: JPMorgan, Citi, BofA tell staff not to poach clients from stressed banks -memo, sourcesAs a series of U.S. lenders were besieged by customers yanking out their money this month, banking behemoths JPMorgan Chase & Co , Citigroup Inc and Bank of America Corp. , warned employees: Do not make it worse.

Lire la suite »