Debt consolidation loans and debt consolidation programs can help you get out of debt. But which is better?

As inflation sends the prices of consumer goods and services higher, the Federal Reserve's response to that inflation has pushed interest rates up. That's a painful reality for many who carry balances on credit cards and other debts. After all, credit card minimum payments tend to rise alongside interest rates. And, when you have to find a way to squeeze higher prices for goods and services into your budget, it can be difficult to make extra room for higher payments too.

When debt consolidation programs are betterDebt consolidation programs are typically better than debt consolidation loans when you're having a hard time making your minimum payments or you don't have a good credit score. If you're dealing with financial hardship, your service provider may use your hardship information to negotiate a better deal on your behalf.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

How much debt do you need to qualify for credit card debt forgiveness?Minimum debt requirements for credit card debt forgiveness vary. Here are those requirements for top providers.

How much debt do you need to qualify for credit card debt forgiveness?Minimum debt requirements for credit card debt forgiveness vary. Here are those requirements for top providers.

Lire la suite »

Debt consolidation vs. bankruptcy: What's the difference?Debt consolidation and bankruptcy are both debt relief options, but how exactly do they differ?

Debt consolidation vs. bankruptcy: What's the difference?Debt consolidation and bankruptcy are both debt relief options, but how exactly do they differ?

Lire la suite »

How Argentina's debt crisis changed the sovereign debt marketNew York State Senator Gustavo Rivera wants to disrupt the market.

How Argentina's debt crisis changed the sovereign debt marketNew York State Senator Gustavo Rivera wants to disrupt the market.

Lire la suite »

Debt consolidation vs. debt settlement: Which is better?Debt consolidation and debt settlement are both popular debt relief options. But which is better? Find out here.

Debt consolidation vs. debt settlement: Which is better?Debt consolidation and debt settlement are both popular debt relief options. But which is better? Find out here.

Lire la suite »

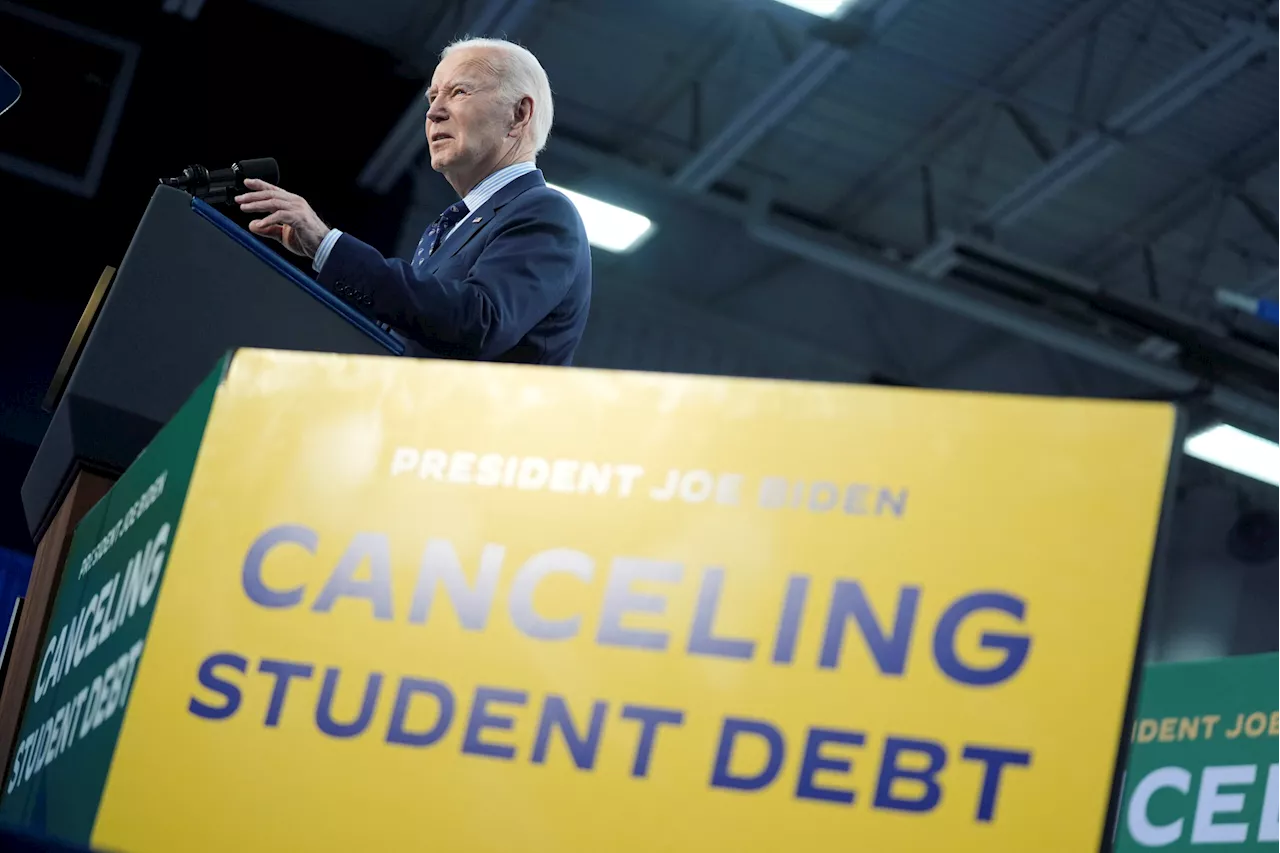

Student debt is bad, student debt bailouts are worseBailing out existing student debt only makes a bad system worse. Only real reform of our higher education system will improve the lives of young people.

Student debt is bad, student debt bailouts are worseBailing out existing student debt only makes a bad system worse. Only real reform of our higher education system will improve the lives of young people.

Lire la suite »

The Rising Cost of Credit Card DebtCredit card debt is one of the most expensive forms of debt due to high interest charges. Over the past 10 years, credit card interest rates have increased from 12.9% in 2013 to 22.8% in 2023. People tend to get into credit card debt for practical reasons, but it can be difficult to break the cycle. Here are two strategies to consider for getting out of credit card debt.

The Rising Cost of Credit Card DebtCredit card debt is one of the most expensive forms of debt due to high interest charges. Over the past 10 years, credit card interest rates have increased from 12.9% in 2013 to 22.8% in 2023. People tend to get into credit card debt for practical reasons, but it can be difficult to break the cycle. Here are two strategies to consider for getting out of credit card debt.

Lire la suite »