With EthereumMerge just around the corner, derivatives traders are finding that staking $ETH is more rewarding than ever. In fact, ether's price has surged recently in anticipation of the Merge.

through Voltz. At press time, most traders on those two pools were what's known as variable takers , meaning they're swapping a fixed interest rate for a variable rate, believing staking yields will double to 8%. About 82% of the just over $12 million in those pools, which went live July 1 and will expire at the end of December, are VT investments.

The emergence of the decentralized finance interest rate swap market may help accelerate market maturity by allowing borrowers and lenders to hedge risks and facilitate price discovery of interest rates. It's yet one more way cryptocurrencies are looking more like traditional financial markets. Voltz's swap market is analogous to the traditional interest rate market, where two counterparties agree to exchange one stream of future interest payments for another. A common TradFi strategy is exchanging a fixed interest rate for a floating rate, often traded against an industry benchmark interest rate, such as the London Interbank Offered Rate .

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

CME Group Plans to Launch Options for Ether Futures Ahead of MergeCME's new product is expected to launch just before the long-awaited Merge.

CME Group Plans to Launch Options for Ether Futures Ahead of MergeCME's new product is expected to launch just before the long-awaited Merge.

Lire la suite »

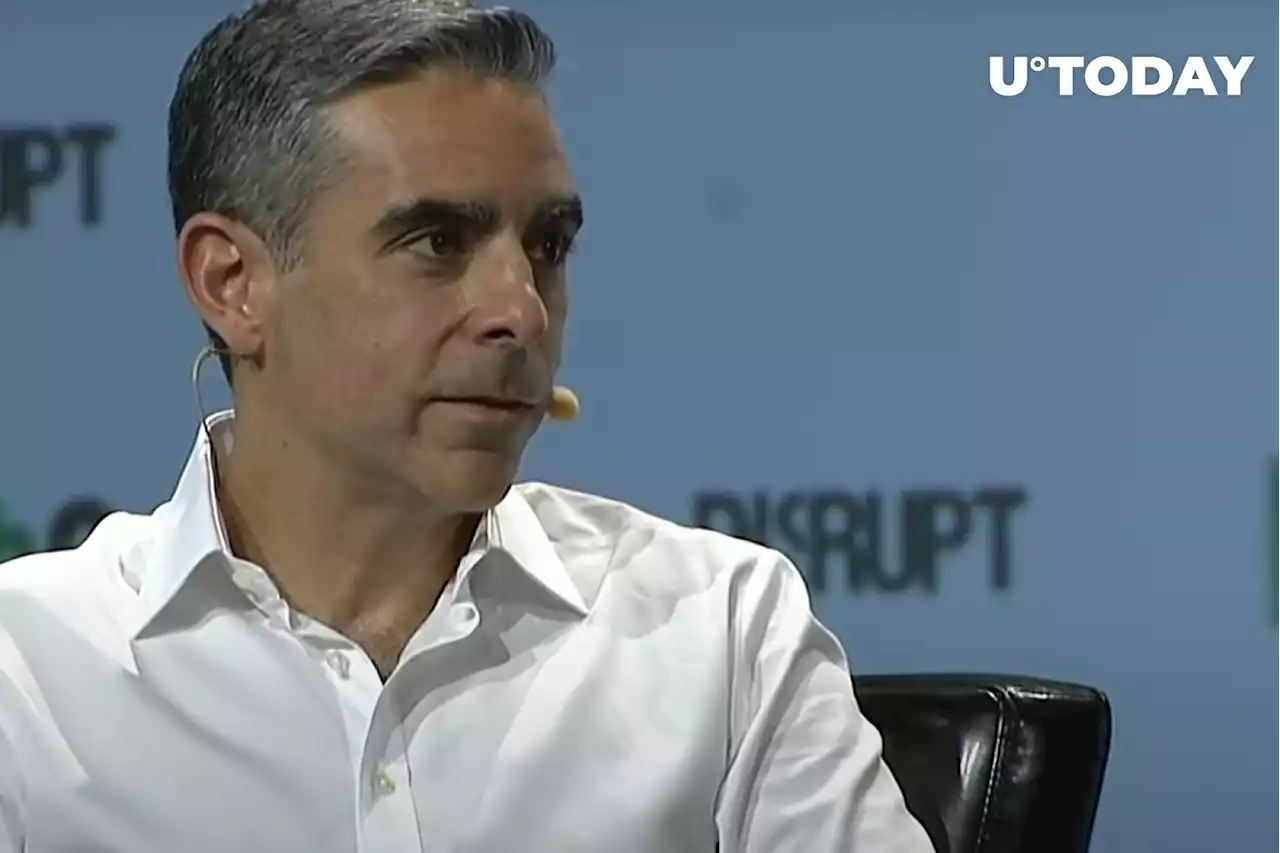

Former Meta Exec Praises Bitcoin Ahead of Ethereum MergeThe creator of Meta’s failed Libra stablecoin took a not-so-veiled swipe at Ethereum in a recent tweet

Former Meta Exec Praises Bitcoin Ahead of Ethereum MergeThe creator of Meta’s failed Libra stablecoin took a not-so-veiled swipe at Ethereum in a recent tweet

Lire la suite »

Staked ETH at New All-Time Highs in Anticipation of September's MergeWith the long-anticipated Merge right behind the corner, the number of ETH locked for staking has tapped a new ATH.

Staked ETH at New All-Time Highs in Anticipation of September's MergeWith the long-anticipated Merge right behind the corner, the number of ETH locked for staking has tapped a new ATH.

Lire la suite »

Ethereum's 'Merge' Is a Big Deal for Crypto—and the PlanetOne of the most influential cryptocurrency projects is set to finally ditch proof-of-work mining.

Ethereum's 'Merge' Is a Big Deal for Crypto—and the PlanetOne of the most influential cryptocurrency projects is set to finally ditch proof-of-work mining.

Lire la suite »

JPMorgan Claims Bigger Revenue Opportunity for Coinbase With Ethereum StakingCoinbase, FTX, Gemini, and Binance are all likely to benefit from Ethereum's Merge.

JPMorgan Claims Bigger Revenue Opportunity for Coinbase With Ethereum StakingCoinbase, FTX, Gemini, and Binance are all likely to benefit from Ethereum's Merge.

Lire la suite »