The trajectory of crude oil markets encountered a subtle roadblock on Thursday- Forex Forecast

In the context of potential downward movements, a silver lining emerges in the form of substantial buyer support extending downwards to the $80 level. This hints at the underlying market sentiment that views such pullbacks as opportunities for strategic acquisitions. Amidst these dynamics, the 200-Day Exponential Moving Average emerges as a crucial reference point. Positioned around the $77.89 mark, it serves as a metaphorical floor for the ongoing uptrend.

The Brent crude market, known for its historical correlation with WTI crude, mirrored the latter's performance during the Thursday session. The $87.50 level posed resistance, consistent with its past behavior. This recurring pattern of resistance isn't surprising, and its manifestation on Thursday only reinforces this characteristic.

Consequently, the scenario suggests that buyers are likely to triumph, perpetuating crude oil's upward momentum. In the broader context, as market participants navigate potential fluctuations, it's important to factor in the inherent noise associated with such markets. While short-term volatility can obscure the landscape, the overarching trend underscores the market's propensity to advance. With a forecast pointing towards higher prices, Brent crude's march towards the $90 level could potentially intersect with various options barriers.

In the end, the recent episode of resistance in crude oil markets aligns with expectations of temporary exhaustion. While short-term fluctuations are natural, the prevailing sentiment leans towards a continued upward trajectory. Investors should be prepared for fluctuations while recognizing the underlying upward bias.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Saudi Arabia to send more oil to China despite crude supply cutSaudi Arabia is about to send more oil to China, even though it's slashed crude supply levels

Lire la suite »

'Digital euro might be dead on arrival,' experts forecastThe EU's commitment to develop a digital euro is doomed to fail, academics claim.

'Digital euro might be dead on arrival,' experts forecastThe EU's commitment to develop a digital euro is doomed to fail, academics claim.

Lire la suite »

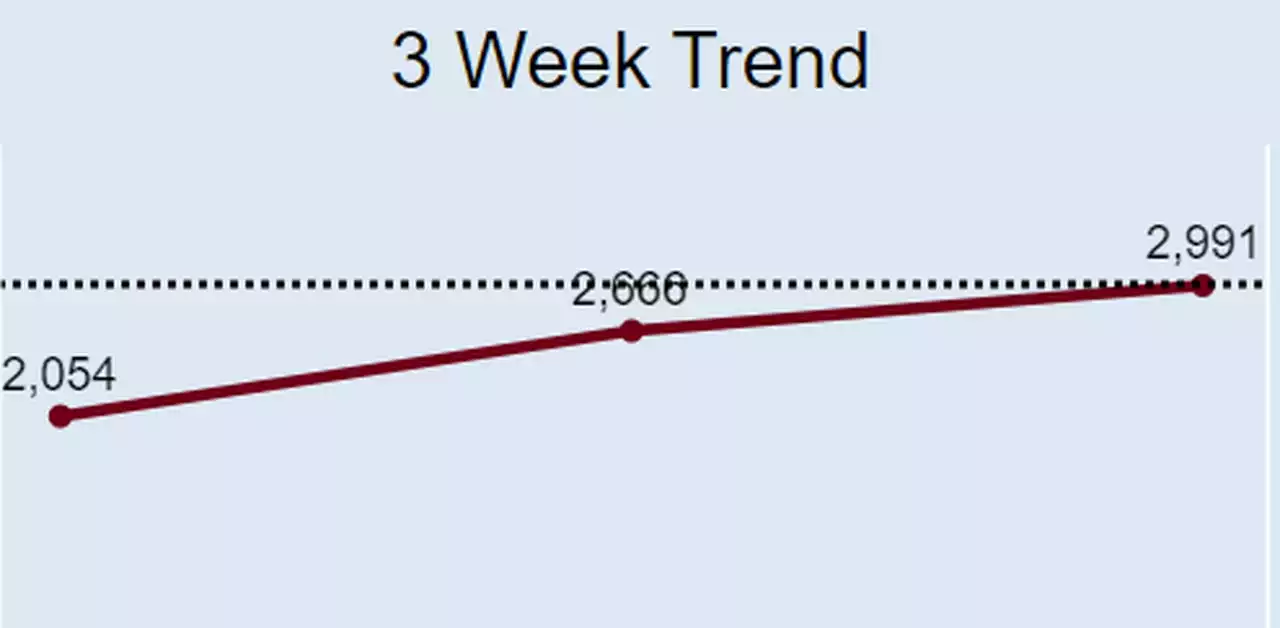

Ohio COVID-19 cases up for 5th straight week; Coronavirus update for Thursday, Aug. 10Case numbers had been falling since March. Ohio’s weekly case numbers were as low as 1,228 on June 15. The reported case number this week is 2,991.

Ohio COVID-19 cases up for 5th straight week; Coronavirus update for Thursday, Aug. 10Case numbers had been falling since March. Ohio’s weekly case numbers were as low as 1,228 on June 15. The reported case number this week is 2,991.

Lire la suite »

Gold Price Forecast: XAU/USD not profiting from moderate US inflation figures – CommerzbankFollowing the publication of the US inflation figures, Gold price briefly climbed to $1,930 but then dropped back to $1,915. Economists at Commerzbank

Gold Price Forecast: XAU/USD not profiting from moderate US inflation figures – CommerzbankFollowing the publication of the US inflation figures, Gold price briefly climbed to $1,930 but then dropped back to $1,915. Economists at Commerzbank

Lire la suite »

S\u0026P 500 Forecast: Continues to Move to Inflation and EarningThe S\u0026P 500 displayed a marginal upward movement during Thursday\u0027s trading session, finding support near the 50-Day Exponential Moving Average.

Lire la suite »

GBP/USD Forecast: Reacts to US CPI and Unemployment ClaimsThe GBPUSD displayed a swift upward movement in response to the latest Consumer Price Index (CPI) readings from the United States- Forex Forecast

Lire la suite »