Court backs CRA in rejecting Montreal couple's $54,000 moving expense claim via financialpost

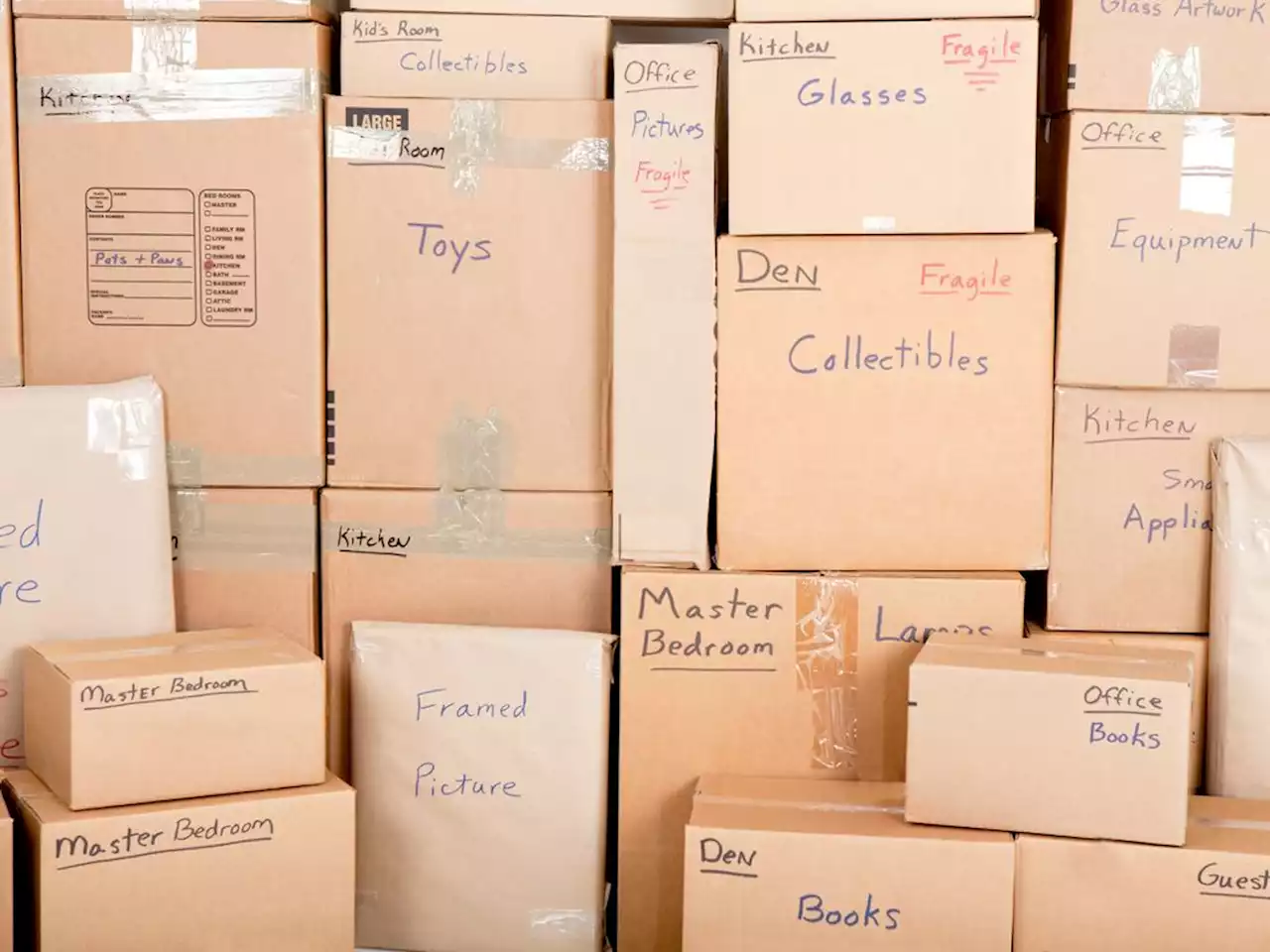

Travel expenses can include: motor vehicle expenses, meals and overnight accommodation to transport you and your family to your new home. Temporary living expenses for up to a maximum of 15 days for meals, and temporary lodging near the old, as well as the new home, are also tax deductible.

Costs associated with selling your old home are also tax deductible, including advertising, notary or legal fees, real estate commissions and any mortgage penalty associated with paying off your mortgage before maturity. Similarly, costs associated with buying your new home, including legal or notary fees, as well as any transfer taxes paid for the transfer or registration of title to your new home, are also tax deductible.

The couple worked at the same Montreal law firm. Their former residence, outside of Montreal, was close to one of the spouse’s children from a prior relationship, and both taxpayers had moved to that location in 2013 or 2014 for personal reasons, while already working at the law office. In 2019, they then moved to Montreal to reduce commuting time after the youngest of the spouse’s children completed high school.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Court backs CRA in rejecting Montreal couple's $54,000 moving expense claimMoving closer to work isn\u0027t enough to claim moving expenses on taxes, it has to be to a new work location among other requirements. Read on.

Court backs CRA in rejecting Montreal couple's $54,000 moving expense claimMoving closer to work isn\u0027t enough to claim moving expenses on taxes, it has to be to a new work location among other requirements. Read on.

Lire la suite »

Court backs CRA in rejecting Montreal couple's $54,000 moving expense claimMoving closer to work isn\u0027t enough to claim moving expenses on taxes, it has to be to a new work location among other requirements. Read on.

Court backs CRA in rejecting Montreal couple's $54,000 moving expense claimMoving closer to work isn\u0027t enough to claim moving expenses on taxes, it has to be to a new work location among other requirements. Read on.

Lire la suite »

Court backs CRA in rejecting Montreal couple's $54,000 moving expense claimMoving closer to work isn\u0027t enough to claim moving expenses on taxes, it has to be to a new work location among other requirements. Read on.

Court backs CRA in rejecting Montreal couple's $54,000 moving expense claimMoving closer to work isn\u0027t enough to claim moving expenses on taxes, it has to be to a new work location among other requirements. Read on.

Lire la suite »

More than 1,000 Canadians take CRA to court over pandemic payments—and some winIn late 2021, Tressa Mitchell was dealing with doctor's appointments for her ailing mother when she got a call from the Canada Revenue Agency seeking information to verify her eligibility for the Canada Emergency Response Benefit.

More than 1,000 Canadians take CRA to court over pandemic payments—and some winIn late 2021, Tressa Mitchell was dealing with doctor's appointments for her ailing mother when she got a call from the Canada Revenue Agency seeking information to verify her eligibility for the Canada Emergency Response Benefit.

Lire la suite »

More than 1,000 Canadians take CRA to court over pandemic payments – and some winThe rollout of the pandemic relief payments saw billions doled out to individuals and businesses on a pay-now-ask-questions-later basis. But the verification process was far from perfect

More than 1,000 Canadians take CRA to court over pandemic payments – and some winThe rollout of the pandemic relief payments saw billions doled out to individuals and businesses on a pay-now-ask-questions-later basis. But the verification process was far from perfect

Lire la suite »

More than 1,000 Canadians take CRA to court over pandemic payments — and some winOthers haven’t been so lucky: \u0027The federal government just uses this system to rip people off\u0027

More than 1,000 Canadians take CRA to court over pandemic payments — and some winOthers haven’t been so lucky: \u0027The federal government just uses this system to rip people off\u0027

Lire la suite »