The surging euro may be the European Central Bank's best friend for a change.

Unlike much of the past 15 years, euro strength is on the ECB's side as it meets on Thursday. And it is unlikely to restrain the central bank from tightening further.

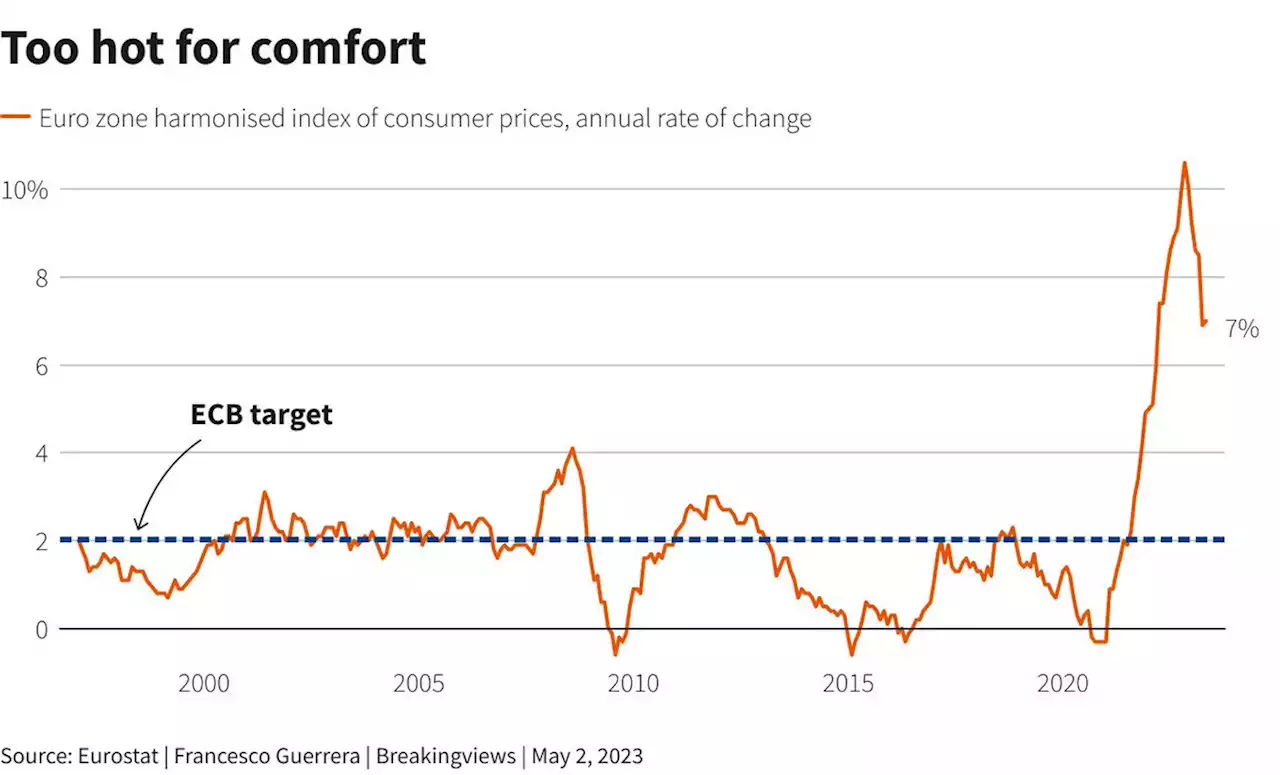

The scale of that rise matches the trade-weighted euro's surge as the pandemic unfolded in 2020 and in less time than the 300 days it took back then. For the past decade, that sort of euro strength would have drawn howls of ECB protest against a deflationary impact via import, energy and commodity prices - aggravating the central bank's struggle to get inflation up to its 2% target, even with negative interest rates and persistent asset purchase schemes.

Euro strength has built on belated ECB interest rate hikes since July - up some 350 basis points to 3.0% so far and expected to go up at least another 25 bps this week. What's more, a preference of global investors for relatively cheap euro zone equities and a greater exposure of the bloc to China's post-COVID reopening helped the currency. Murmurs of a reshuffling of reserve holdings away from dollars due to geopolitics and the U.S. debt ceiling standoff added something at the margins.It is unlikely to stand in its way anymore at least.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

EUR/USD eyes more weakness below 1.0960 as focus shifts to Fed/ECB policyThe EUR/USD pair is hovering near the eight-day-old support of 1.0960 in the early Asian session. The major currency pair is expected to display a she

EUR/USD eyes more weakness below 1.0960 as focus shifts to Fed/ECB policyThe EUR/USD pair is hovering near the eight-day-old support of 1.0960 in the early Asian session. The major currency pair is expected to display a she

Lire la suite »

EUR/JPY continues to rally on ECB and BoJ central bank divergenceThe EUR/JPY remains rallying sharply to multi-year highs at 150.94, sponsored by central bank divergence, with the European Central Bank (ECB) expecte

EUR/JPY continues to rally on ECB and BoJ central bank divergenceThe EUR/JPY remains rallying sharply to multi-year highs at 150.94, sponsored by central bank divergence, with the European Central Bank (ECB) expecte

Lire la suite »

EUR/GBP approaches 0.8800 ahead of Eurozone Inflation, ECB policy to remain a key eventThe EUR/GBP pair is oscillating in a narrow range below 0.8890 in the Asian session. The cross is expected to recapture the round-level resistance of

EUR/GBP approaches 0.8800 ahead of Eurozone Inflation, ECB policy to remain a key eventThe EUR/GBP pair is oscillating in a narrow range below 0.8890 in the Asian session. The cross is expected to recapture the round-level resistance of

Lire la suite »

Yen sinks to 15-year low vs euro as dovish BOJ contrasts with ECBThe yen continued its steep descent on Tuesday, reaching a 15-year low to the euro, as a dovish BOJ kept foreign exchange markets engaging in 'carry-trades.'

Yen sinks to 15-year low vs euro as dovish BOJ contrasts with ECBThe yen continued its steep descent on Tuesday, reaching a 15-year low to the euro, as a dovish BOJ kept foreign exchange markets engaging in 'carry-trades.'

Lire la suite »

ECB risks interest-rate blunder after messy dataThe European Central Bank is none the wiser following a raft of new numbers. Lenders may be reining in credit, but headline inflation is rising. Hardliners will still push for a 50 basis point hike on Thursday. The uncertain conditions call for an increase half that size.

ECB risks interest-rate blunder after messy dataThe European Central Bank is none the wiser following a raft of new numbers. Lenders may be reining in credit, but headline inflation is rising. Hardliners will still push for a 50 basis point hike on Thursday. The uncertain conditions call for an increase half that size.

Lire la suite »

EUR/USD aims stability above 1.1000 as mixed Eurozone CPI supports mega rate hike from ECBEUR/USD aims stability above 1.1000 as mixed Eurozone CPI supports mega rate hike from ECB – by Sagar_Dua24 EURUSD ECB Fed Inflation RiskAversion

EUR/USD aims stability above 1.1000 as mixed Eurozone CPI supports mega rate hike from ECBEUR/USD aims stability above 1.1000 as mixed Eurozone CPI supports mega rate hike from ECB – by Sagar_Dua24 EURUSD ECB Fed Inflation RiskAversion

Lire la suite »