China's Contemporary Amperex Technology (CATL), the world's leading electric vehicle battery producer, has applied for a listing on the Hong Kong Stock Exchange. The initial public offering (IPO) is projected to raise at least $5 billion, potentially becoming Hong Kong's largest IPO in five years. This move aims to diversify the sector mix of Hong Kong-listed shares, currently dominated by Chinese internet companies and banks. The listing is also expected to attract global long-term institutional investors, some of whom may be restricted from investing in mainland China-based companies.

China's Contemporary Amperex Technology , the largest electric vehicle battery producer in the world, has filed for listing on Hong Kong's stock exchange.

The listing will help diversify the sector mix of Hong Kong-listed shares, which largely comprise Chinese internet companies and banks, said GROW Investment's William Ma.Philadelphia news 24/7: Watch NBC10 free wherever you arereported that the deal is expected to raise at least $5 billion, citing sources familiar with the matter.

"The timing is ideal as global investors are starting to find China's markets trading at attractive valuations," Ma told CNBC.The listing will also help diversify the sector mix of Hong Kong-listed shares, which largely comprise Chinese internet companies and banks, he added.after three consecutive years of declines in terms of deal values, according to data from Dealogic. The city's bourse raised $10.65 billion across 63 deals last year, a jump of more than 80% from the $5.

IPO ELECTRIC VEHICLES BATTERY CATL HONG KONG STOCK EXCHANGE

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

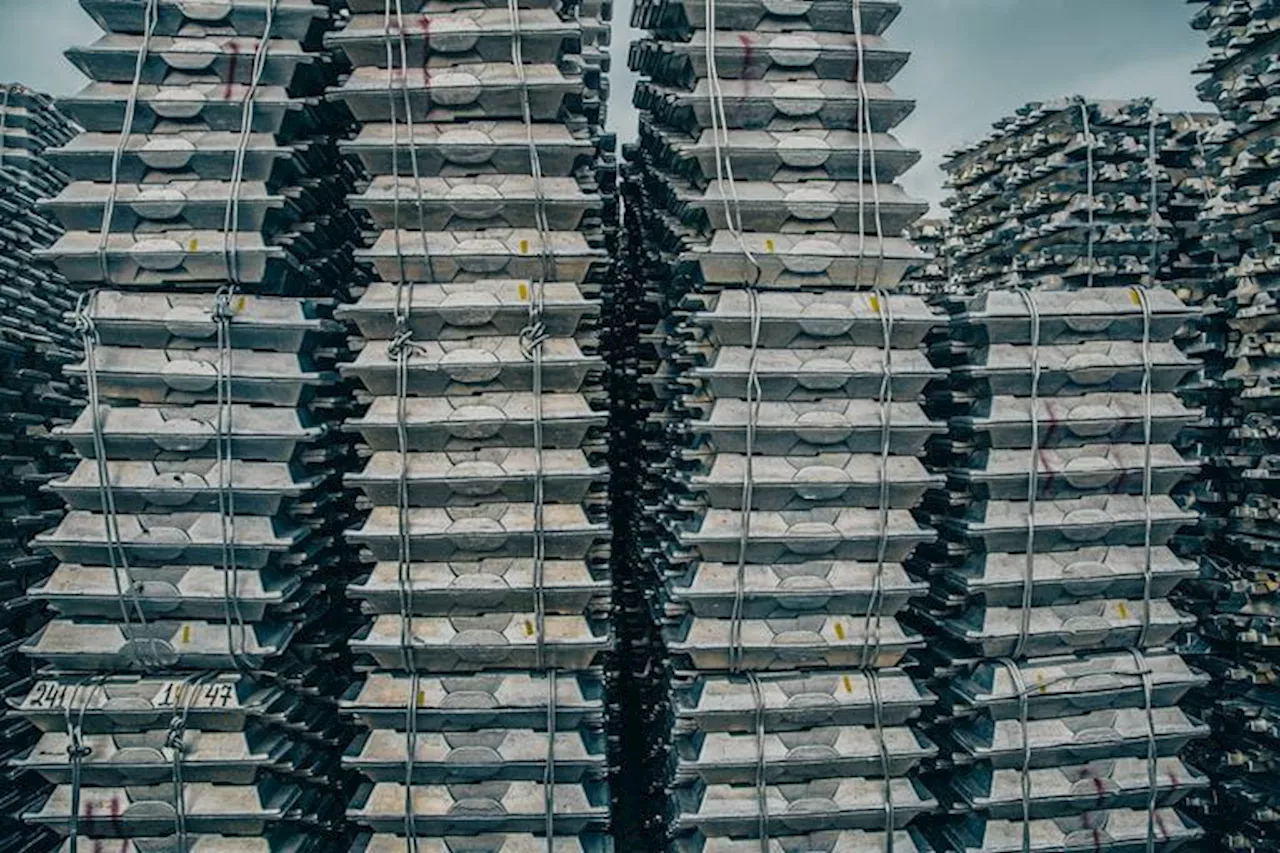

LME Approves Hong Kong as Warehouse Delivery Point to Boost China AccessThe London Metal Exchange (LME) has approved Hong Kong as a warehouse delivery point, aiming to enhance access to mainland China, the world's largest metals consumer. This move, a strategic goal since 2012, will allow Hong Kong warehouses to store all six primary metals traded on the LME. Despite higher costs in Hong Kong, investors are drawn to its proximity to China. While no financial incentives have been agreed upon with Hong Kong authorities, LME CEO Matthew Chamberlain believes the warehousing structure will remain economically attractive.

LME Approves Hong Kong as Warehouse Delivery Point to Boost China AccessThe London Metal Exchange (LME) has approved Hong Kong as a warehouse delivery point, aiming to enhance access to mainland China, the world's largest metals consumer. This move, a strategic goal since 2012, will allow Hong Kong warehouses to store all six primary metals traded on the LME. Despite higher costs in Hong Kong, investors are drawn to its proximity to China. While no financial incentives have been agreed upon with Hong Kong authorities, LME CEO Matthew Chamberlain believes the warehousing structure will remain economically attractive.

Lire la suite »

Battery giant CATL files for Hong Kong listing in what could be city's largest IPO since 2021CATL is also listed on the Shenzhen stock exchange, boasting a market cap of $150.5 billion. The battery giant supplies big automakers like Tesla.

Battery giant CATL files for Hong Kong listing in what could be city's largest IPO since 2021CATL is also listed on the Shenzhen stock exchange, boasting a market cap of $150.5 billion. The battery giant supplies big automakers like Tesla.

Lire la suite »

China Bolsters Yuan with Hong Kong Investments and Relaxed Borrowing RulesChina is taking steps to stabilize its weakening yuan by increasing reserves held in Hong Kong and allowing companies to borrow more overseas. The People's Bank of China aims to counter the effects of a strong dollar, falling bond yields, and potential trade barriers under the new Trump administration.

China Bolsters Yuan with Hong Kong Investments and Relaxed Borrowing RulesChina is taking steps to stabilize its weakening yuan by increasing reserves held in Hong Kong and allowing companies to borrow more overseas. The People's Bank of China aims to counter the effects of a strong dollar, falling bond yields, and potential trade barriers under the new Trump administration.

Lire la suite »

Lai Chi Wo: A Hong Kong Village Rediscovering Its RootsThis article tells the story of Lai Chi Wo, a 300-year-old village in Hong Kong that was nearly abandoned due to industrialization. A revitalization project, combining traditional Hakka philosophies with modern sustainability, has brought back residents and restored the village's biodiversity.

Lai Chi Wo: A Hong Kong Village Rediscovering Its RootsThis article tells the story of Lai Chi Wo, a 300-year-old village in Hong Kong that was nearly abandoned due to industrialization. A revitalization project, combining traditional Hakka philosophies with modern sustainability, has brought back residents and restored the village's biodiversity.

Lire la suite »

US allies' undersea cables are cut, world looks to Russia and ChinaMithil Aggarwal is a Hong Kong-based reporter/producer for NBC News.

US allies' undersea cables are cut, world looks to Russia and ChinaMithil Aggarwal is a Hong Kong-based reporter/producer for NBC News.

Lire la suite »

AI Investment Theme to Continue Growing Through 2025: Hong Kong Tech Fund ManagerPando CMS Innovation ETF's CIO Beck Lee believes AI will be a long-term investment theme, citing Nvidia's CEO Jensen Huang's perspective on AI's evolution. The fund has seen significant gains in 2024, largely driven by its investments in AI companies like Nvidia and Spotify. Lee expects Nvidia to continue outperforming but cautions about its ability to maintain current profit margins. The fund's strategy combines top-down macroeconomic analysis with bottom-up company fundamental research.

AI Investment Theme to Continue Growing Through 2025: Hong Kong Tech Fund ManagerPando CMS Innovation ETF's CIO Beck Lee believes AI will be a long-term investment theme, citing Nvidia's CEO Jensen Huang's perspective on AI's evolution. The fund has seen significant gains in 2024, largely driven by its investments in AI companies like Nvidia and Spotify. Lee expects Nvidia to continue outperforming but cautions about its ability to maintain current profit margins. The fund's strategy combines top-down macroeconomic analysis with bottom-up company fundamental research.

Lire la suite »