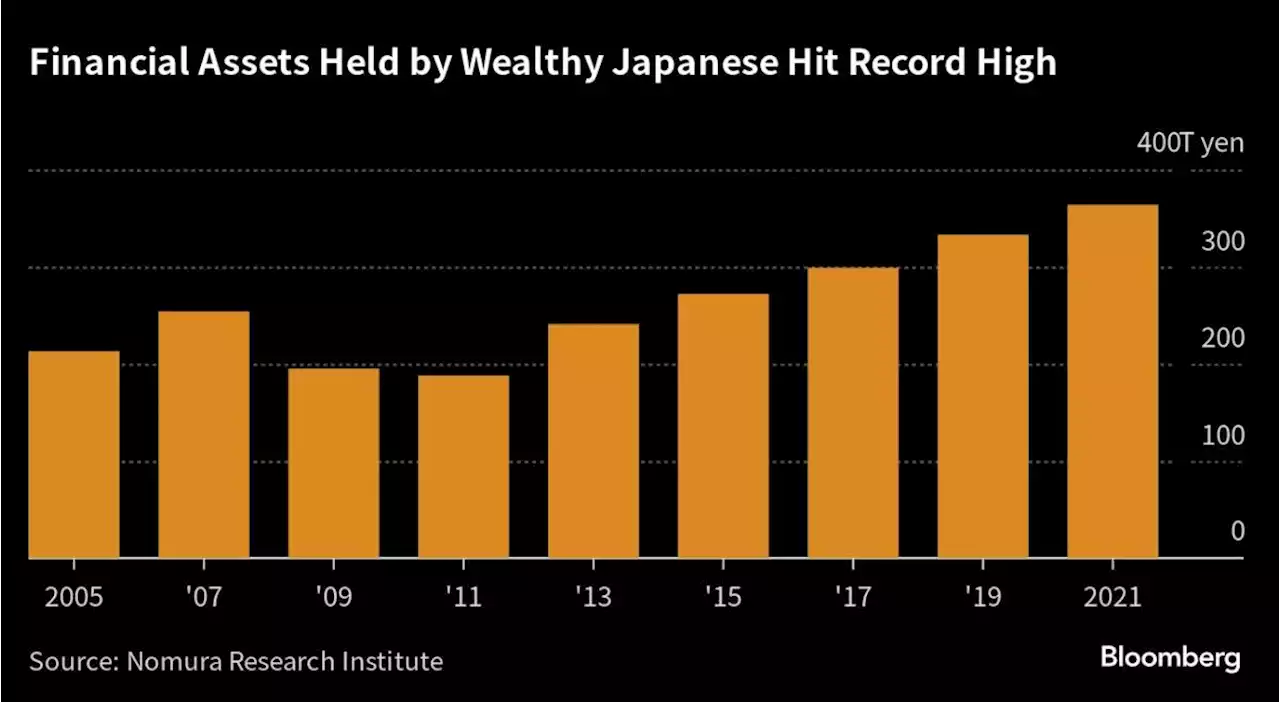

(Bloomberg) -- Japanese brokerages are gearing up to offer more alternative assets to the nation’s wealthy, who are increasing in numbers even as the overall population falls.Most Read from BloombergVegas’ Newest Resort Is a $3.7 Billion Palace, 23 Years in the MakingF-35 Debris Found After a $100 Million Fighter Jet Went MissingTrudeau’s Murder Claim Risks Upending US Courtship of IndiaIndia, Canada Trade Diplomatic Blows Over Murder AllegationsMizuho Securities Co. expects more sales this fisc

Mizuho Securities Co. expects more sales this fiscal year after selling about 15 billion yen of funds focused on private assets in the year ended March 31, in its first 12-month period of making those offerings to wealthy individuals, according to Miho Migita, head of private placement fund development division.

UBS SuMi Trust Wealth Management Co., meanwhile, said it has seen private assets that it oversees more than double over the past three years in Japan, without specifying the amount. It started selling private credit products targeting its high-net-worth clients last year. “As listed securities face market volatility, it’s getting difficult to effectively diversify portfolios with listed assets, and more and more customers are looking for something different,” said Kaoru Fujita, managing director of private wealth solutions at Blackstone Inc. in Japan.

If they shift to riskier investments, that may result in a jump in flows from Japan. Investors there have tended to be more financially conservative than their global peers, holding more than 50% of their assets in cash or bank deposits, according to Bank of Japan data. That’s a much higher ratio than in the US or Europe.Private assets carry the risk that because they are less liquid than publicly traded securities, they will likely be harder to unload if market sentiment takes a dive.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Brokers Woo Rich Japanese Worth $2 Trillion With Private AssetsJapanese brokerages are gearing up to offer more alternative assets to the nation’s wealthy, who are increasing in numbers even as the overall population falls.

Brokers Woo Rich Japanese Worth $2 Trillion With Private AssetsJapanese brokerages are gearing up to offer more alternative assets to the nation’s wealthy, who are increasing in numbers even as the overall population falls.

Lire la suite »

DeSantis Heads to Texas to Woo Donors as Campaign Faces Cash CrunchFlorida Governor Ron DeSantis has reeled in wealthy Texas donors once loyal to former President Donald Trump, and he’s heading to the state this week to make another pitch for his struggling presidential campaign.

DeSantis Heads to Texas to Woo Donors as Campaign Faces Cash CrunchFlorida Governor Ron DeSantis has reeled in wealthy Texas donors once loyal to former President Donald Trump, and he’s heading to the state this week to make another pitch for his struggling presidential campaign.

Lire la suite »

Bryan Woo wins homecoming as Seattle Mariners blank Oakland AthleticsMariners rookie Bryan Woo had six strikeouts over five sharp innings in a successful homecoming, and Seattle pulled even for the third AL wild card by beating the last-place Oakland Athletics 5-0 on Monday night.

Bryan Woo wins homecoming as Seattle Mariners blank Oakland AthleticsMariners rookie Bryan Woo had six strikeouts over five sharp innings in a successful homecoming, and Seattle pulled even for the third AL wild card by beating the last-place Oakland Athletics 5-0 on Monday night.

Lire la suite »

Goldman Strategists Raise Forecasts for Japanese Shares on Stable Yen ViewGoldman Sachs Group Inc. strategists raised their forecasts for Japanese shares to reflect updated assumptions that the yen likely won’t strengthen much in coming months.

Goldman Strategists Raise Forecasts for Japanese Shares on Stable Yen ViewGoldman Sachs Group Inc. strategists raised their forecasts for Japanese shares to reflect updated assumptions that the yen likely won’t strengthen much in coming months.

Lire la suite »

Japanese companies warm up to employee stock incentivesAirline operator ANA Holdings plans to offer around $60 million worth of shares to thousands of employees, the latest Japanese company to use employee share incentives as a tool to retain talent and comply with a request by the regulator to pay more attention to share price performance. ANA will offer 100 shares worth about $20 each to about 70% of nearly 45,000 employees in November, following in the footsteps of other major Japanese firms such as Omron and Sony Group. The employee share incentive plans coincide with one of the most severe labour shortages Japan has seen in years, and as the Tokyo Stock Exchange urges listed firms to become 'more conscious' of their share prices due to concerns that far too many companies are trading below their book value.

Japanese companies warm up to employee stock incentivesAirline operator ANA Holdings plans to offer around $60 million worth of shares to thousands of employees, the latest Japanese company to use employee share incentives as a tool to retain talent and comply with a request by the regulator to pay more attention to share price performance. ANA will offer 100 shares worth about $20 each to about 70% of nearly 45,000 employees in November, following in the footsteps of other major Japanese firms such as Omron and Sony Group. The employee share incentive plans coincide with one of the most severe labour shortages Japan has seen in years, and as the Tokyo Stock Exchange urges listed firms to become 'more conscious' of their share prices due to concerns that far too many companies are trading below their book value.

Lire la suite »

Japanese companies warm up to employee stock incentivesBy Makiko Yamazaki and Ritsuko Shimizu TOKYO (Reuters) - Airline operator ANA Holdings plans to offer around $60 million worth of shares to thousands ...

Japanese companies warm up to employee stock incentivesBy Makiko Yamazaki and Ritsuko Shimizu TOKYO (Reuters) - Airline operator ANA Holdings plans to offer around $60 million worth of shares to thousands ...

Lire la suite »