Qantas is bringing employees along for the bumpy ride. Alongside an optimistic outlook following its A$1.1 billion ($813 million) half-year underlying operating loss, the Australian airline on Thursday detailed plans to make some 20,000 staff, or about 90% of its significantly shrunken workforce, eligible for 1,000 shares each if the company hits certain financial targets. It’s a sensible, if belated, retention effort.

Qantas aircraft are seen on the tarmac at Melbourne International Airport in Melbourne, Australia, November 6, 2018. REUTERS/Phil Noble//File Photo - RC2YPS901YHIis bringing employees along for the bumpy ride. Alongside an optimistic outlook following its A$1.

There can be myriad benefits, including loyalty and job satisfaction, from turning workers into owners. Keeping them happy will be especially tough for Qantas boss Alan Joyce, who has laid off some 10,000 people since the onset of Covid-19 and is defending against union grievances. Existing owners will be diluted by about 1%, a worthwhile price to help combat an increasingly cutthroat job market. Cabin crew and others will now be vested in the carrier achieving profitability by June 2023, slashing net debt below A$5.5 billion and finding another A$100 million of cost savings, the conditions governing the grants. With Qantas shares trading 30% below their pre-pandemic peak in December 2019, there’s even room for an additional upgrade.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

McLaren has a battery upgrade for the P1 hypercarMcLaren's P1 hypercar is now even quicker thanks to a new battery upgrade.

McLaren has a battery upgrade for the P1 hypercarMcLaren's P1 hypercar is now even quicker thanks to a new battery upgrade.

Lire la suite »

Shell a lone bright spot as European stocks tumble, energy prices soar on Russia-Ukraine tensionsRattled by fresh tensions on the Russia-Ukraine front, European stocks tracked global equity losses.

Shell a lone bright spot as European stocks tumble, energy prices soar on Russia-Ukraine tensionsRattled by fresh tensions on the Russia-Ukraine front, European stocks tracked global equity losses.

Lire la suite »

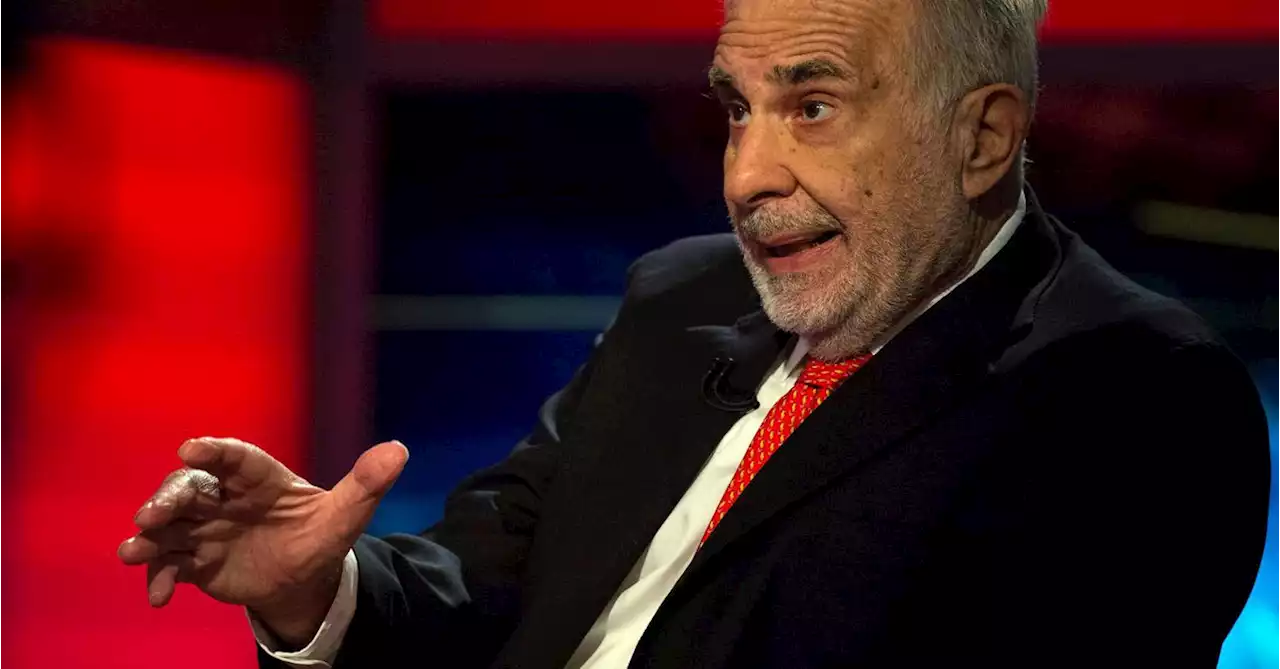

Breakingviews - Icahn's pork fight at McDonald's is in bad tasteCarl Icahn thinks suppliers of pork to McDonald’s are treating their pigs badly, and the 86-year-old investor wants two board seats to push for more humane treatment. The $190 billion fast-food chain may deserve an activist. But Icahn is reading the wrong menu.

Breakingviews - Icahn's pork fight at McDonald's is in bad tasteCarl Icahn thinks suppliers of pork to McDonald’s are treating their pigs badly, and the 86-year-old investor wants two board seats to push for more humane treatment. The $190 billion fast-food chain may deserve an activist. But Icahn is reading the wrong menu.

Lire la suite »

Breakingviews - Rio’s black marks obscure its dividend dazzleJakob Stausholm will need more than record shareholder payouts to catch up with rival Mike Henry. The new Rio Tinto , chief executive announced a bumper $17 billion dividend for 2021 on Wednesday thanks to soaring iron ore prices. However, at 4.4 times this year’s expected EBITDA, the $128 billion group’s valuation lags Henry’s BHP , which is currently trading on nearly 5 times. Rio’s cultural problems may explain some of the lag.

Breakingviews - Rio’s black marks obscure its dividend dazzleJakob Stausholm will need more than record shareholder payouts to catch up with rival Mike Henry. The new Rio Tinto , chief executive announced a bumper $17 billion dividend for 2021 on Wednesday thanks to soaring iron ore prices. However, at 4.4 times this year’s expected EBITDA, the $128 billion group’s valuation lags Henry’s BHP , which is currently trading on nearly 5 times. Rio’s cultural problems may explain some of the lag.

Lire la suite »

Breakingviews - Vladimir Putin muscles onto central banker agendasIf he didn’t already have the full attention of U.S. Federal Reserve Chair Jerome Powell, Vladimir Putin sure has it now. An escalation in Ukraine by Russia’s president jeopardises the global economic recovery from Covid-19. Any retaliation also would pour more fuel onto inflationary fires.

Breakingviews - Vladimir Putin muscles onto central banker agendasIf he didn’t already have the full attention of U.S. Federal Reserve Chair Jerome Powell, Vladimir Putin sure has it now. An escalation in Ukraine by Russia’s president jeopardises the global economic recovery from Covid-19. Any retaliation also would pour more fuel onto inflationary fires.

Lire la suite »