Rising inflation is giving Big Tobacco a big leg-up. High cigarette taxes mean the price of smokes is less sensitive to rising input costs. Having customers who struggle to say “no” also makes it easier to charge more. Couple that with inflation-wary investors prioritising dividends, and companies like $102 billion British American Tobacco and $164 billion Philip Morris International are on a tear. Cementing those gains requires a post-smoking transition plan.

of the price of a packet of cigarettes in Britain goes to the taxman, a major lever in the battle against smoking. But such thinking also gives tobacco giants a shield when input costs soar – a 10% leap in raw materials prices translates into an overall rise of 2% or less. Nicotine-craving customers will happily inhale that.

The stock market’s inflation-phobia helps. Tobacco stocks have been insulated from the recent selloff because they pay high dividends. When inflation’s taking root, profits received today are more attractive than a windfall five years hence. BAT is up 30% since the start of December. PMI has gained 24%.However, the biggest factor determining valuations is whether investors believe that tobacco companies will exist in the 2030s.

The jury is still out on PMI’s focus on tobacco-heating, rather than vaping or pouches. BAT’s strategy based on alternative means of nicotine delivery is arguably better suited to varied regulatory regimes. More certain is that both are far ahead of Imperial Brands . The $23 billion London-listed purveyor of Gauloises hasn’t set revenue targets, aiming only for a “distinctive presence” in non-smoking products. After a 17% jump since December, its shares are now trading on 7 times EBITDA. Investors should not take that as a sign of long-term good health.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Inflation gives Big Tobacco a handy dragHigh cigarette taxes shield their makers from the pain of soaring input costs. Customers who can’t say no also make hiking prices easier. But long-term survival relies on solid smoke-free plans. In that race, $102 bln BAT is playing catch-up to $164 bln rival Philip Morris.

Inflation gives Big Tobacco a handy dragHigh cigarette taxes shield their makers from the pain of soaring input costs. Customers who can’t say no also make hiking prices easier. But long-term survival relies on solid smoke-free plans. In that race, $102 bln BAT is playing catch-up to $164 bln rival Philip Morris.

Lire la suite »

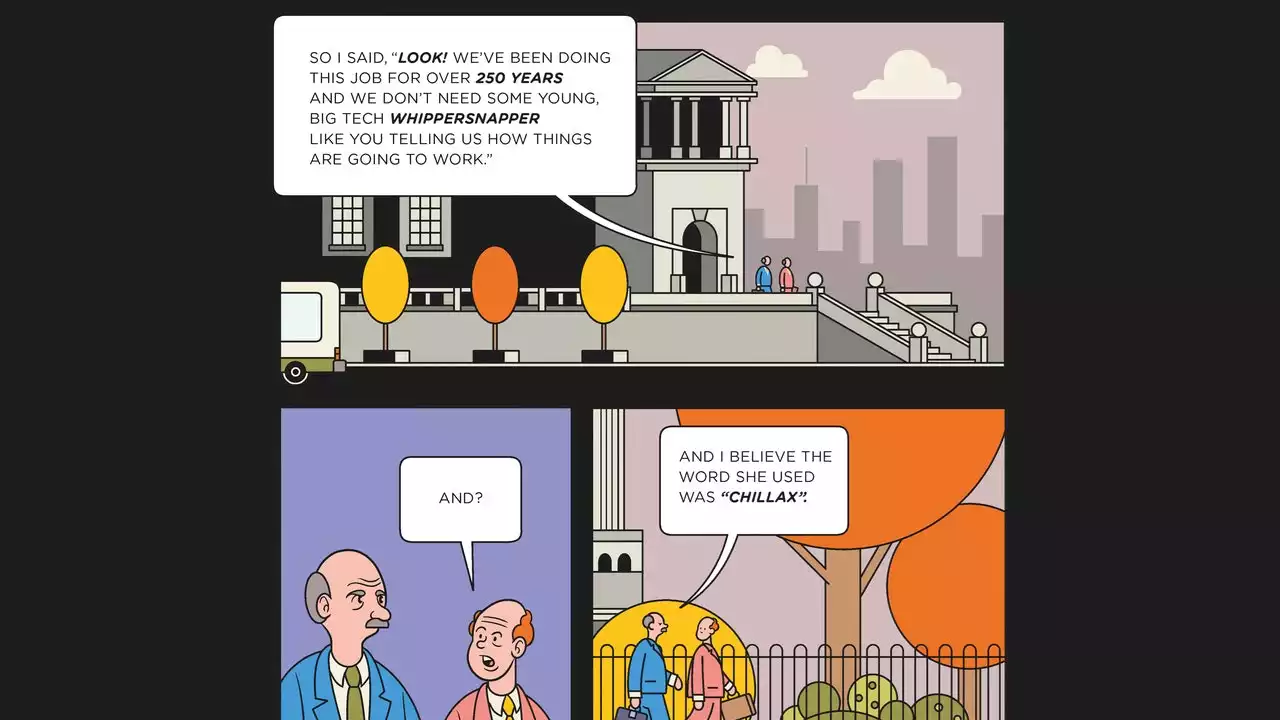

Big Tech’s Next Move? Taking on Big Banks“In 2022, the traditional banking industry will be watching anxiously for technology companies to make their next move. The banks’ choice will be stark: whether to ignore the threat – or to partner with it.” Via WIREDUK WIREDWorld2022

Big Tech’s Next Move? Taking on Big Banks“In 2022, the traditional banking industry will be watching anxiously for technology companies to make their next move. The banks’ choice will be stark: whether to ignore the threat – or to partner with it.” Via WIREDUK WIREDWorld2022

Lire la suite »

Polestar Super Bowl commercial previewed ahead of the big gamePolestar released a 15-second preview of its first Super Bowl ad, which highlights minimalism. The 30-second ad will air during the game's first quarter.

Polestar Super Bowl commercial previewed ahead of the big gamePolestar released a 15-second preview of its first Super Bowl ad, which highlights minimalism. The 30-second ad will air during the game's first quarter.

Lire la suite »

Morning Bid: Ready for a big bang U.S. rate hike?A look at the day ahead in markets from Dhara Ranasinghe.

Morning Bid: Ready for a big bang U.S. rate hike?A look at the day ahead in markets from Dhara Ranasinghe.

Lire la suite »

Big Pharma In Psychedelics: Inside Mindset Pharma’s Deal With OtsukaA deal inked last month validates the path of at least one company developing next-generation psychedelics.

Big Pharma In Psychedelics: Inside Mindset Pharma’s Deal With OtsukaA deal inked last month validates the path of at least one company developing next-generation psychedelics.

Lire la suite »

‘Same old guy’: Highland Park upbringing set Matthew Stafford up for big stage without changing himPerhaps the first hint that Matthew Stafford wasn’t like other kids was when he learned to properly dribble a basketball, using his fingertips, not his...

‘Same old guy’: Highland Park upbringing set Matthew Stafford up for big stage without changing himPerhaps the first hint that Matthew Stafford wasn’t like other kids was when he learned to properly dribble a basketball, using his fingertips, not his...

Lire la suite »