The EU faces a tough period as the energy crisis bites and debt troubles return. But the bloc could have the world’s cheapest and cleanest energy by the mid-2030s, and it will probably emerge stronger geopolitically, writes Hugodixon

In some ways, the current difficulties are harder for the EU to manage than the euro crisis of a decade ago. Then the European Central Bank was able to keep interest rates low and buy government debt. That’s not an option now. Indeed the ECB has justWhat’s more, the EU is facing a structural shock from high energy prices. Highly industrialised countries like Germany will have to restructure their economic models. Tensions between governments are rising.

Solidarity is fraying. France has blocked a gas pipeline across the Pyrenees from Spain. And Germany is spending 200 billion euros to bail out its consumers and businesses, prompting other countries to complain that Berlin is distorting the EU’s single market by giving its companies an unfair advantage.

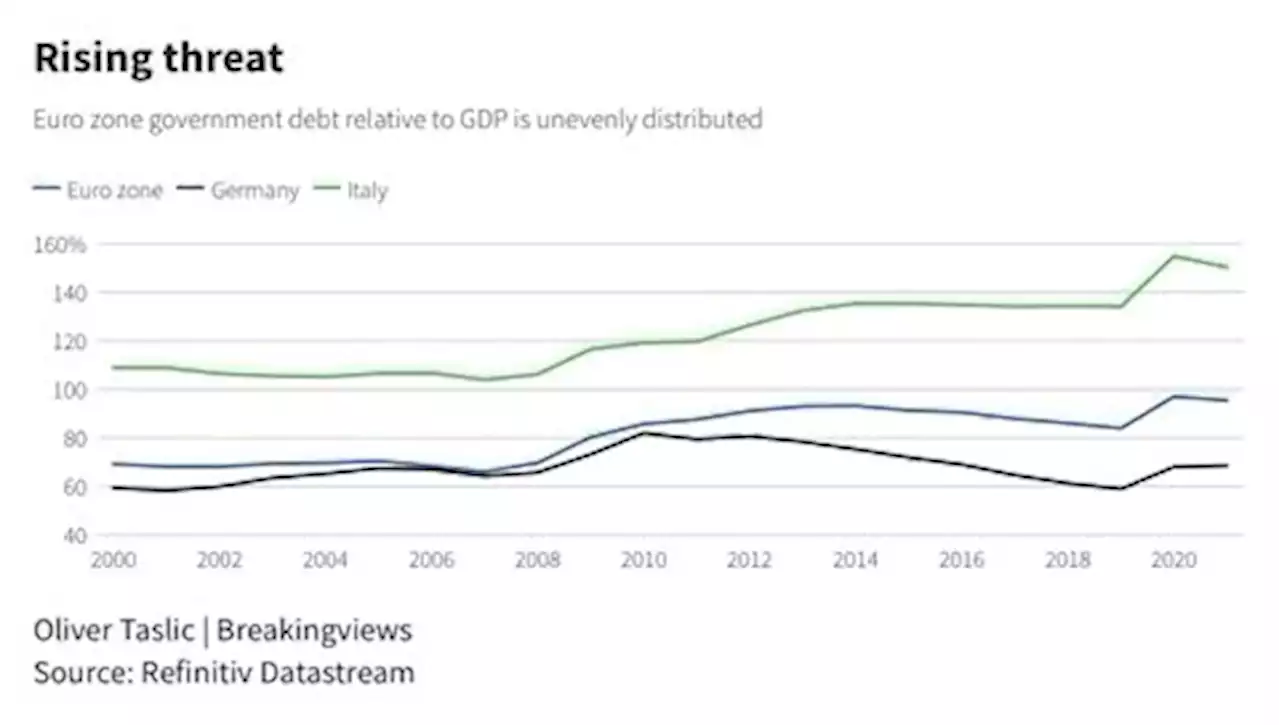

EU leaders are already complaining about high interest rates, with Giorgia Meloni, the new Italian prime minister, criticising the ECB last week. But the central bank cannot avoid raising interest rates even if it wanted to. Inflation in the euro zone wasHigh inflation has had the side benefit of lowering government debt as a proportion of GDP. But if inflation expectations become entrenched, investors will demand higher yields to hold government bonds, pushing up the cost of borrowing further.

Highly indebted countries such as Italy fear that borrowing more would add to their debt problems. That’s why they want the EU to issue debt collectively as they did during the pandemic. But Germany and some less indebted countries are resisting this.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

History As It Happens: Flirting with ArmageddonSixty Octobers ago the world narrowly avoided nuclear conflict. After 13 tense days, the Cuban Missile Crisis ended with a compromise deal rather than war. President Joseph R. Biden’s remark that the war in Ukraine represents humanity’s closest brush with nuclear Armageddon since the 1962 crisis may at first seem overwrought, but there’s nothing like an anniversary to focus our minds on such a dreadful possibility. The war in Eastern Europe is escalating, and there is no sign it will come to a decisive conclusion before the onset of winter. Hanging over all of this is Vladimir Putin’s threat to use tactical nuclear weapons inside Ukraine. In this episode, military historian Max Hastings, author of “The Abyss: Nuclear Crisis Cuba 1962”, discusses the critical parallels between the two conflicts.

History As It Happens: Flirting with ArmageddonSixty Octobers ago the world narrowly avoided nuclear conflict. After 13 tense days, the Cuban Missile Crisis ended with a compromise deal rather than war. President Joseph R. Biden’s remark that the war in Ukraine represents humanity’s closest brush with nuclear Armageddon since the 1962 crisis may at first seem overwrought, but there’s nothing like an anniversary to focus our minds on such a dreadful possibility. The war in Eastern Europe is escalating, and there is no sign it will come to a decisive conclusion before the onset of winter. Hanging over all of this is Vladimir Putin’s threat to use tactical nuclear weapons inside Ukraine. In this episode, military historian Max Hastings, author of “The Abyss: Nuclear Crisis Cuba 1962”, discusses the critical parallels between the two conflicts.

Lire la suite »

History As It Happens: Flirting with ArmageddonSixty Octobers ago the world narrowly avoided nuclear conflict. After 13 tense days, the Cuban Missile Crisis ended with a compromise deal rather than war. President Joseph R. Biden’s remark that the war in Ukraine represents humanity’s closest brush with nuclear Armageddon since the 1962 crisis may at first seem overwrought, but there’s nothing like an anniversary to focus our minds on such a dreadful possibility. The war in Eastern Europe is escalating, and there is no sign it will come to a decisive conclusion before the onset of winter. Hanging over all of this is Vladimir Putin’s threat to use tactical nuclear weapons inside Ukraine. In this episode, military historian Max Hastings, author of “The Abyss: Nuclear Crisis Cuba 1962”, discusses the critical parallels between the two conflicts.

History As It Happens: Flirting with ArmageddonSixty Octobers ago the world narrowly avoided nuclear conflict. After 13 tense days, the Cuban Missile Crisis ended with a compromise deal rather than war. President Joseph R. Biden’s remark that the war in Ukraine represents humanity’s closest brush with nuclear Armageddon since the 1962 crisis may at first seem overwrought, but there’s nothing like an anniversary to focus our minds on such a dreadful possibility. The war in Eastern Europe is escalating, and there is no sign it will come to a decisive conclusion before the onset of winter. Hanging over all of this is Vladimir Putin’s threat to use tactical nuclear weapons inside Ukraine. In this episode, military historian Max Hastings, author of “The Abyss: Nuclear Crisis Cuba 1962”, discusses the critical parallels between the two conflicts.

Lire la suite »

Europe’s pain will be ultimately worth itThe European Union faces a tough period as the energy crisis bites and debt troubles return. But the bloc could have the world’s cheapest and cleanest energy by the mid-2030s and it will probably emerge stronger geopolitically, says Hugo Dixon.

Europe’s pain will be ultimately worth itThe European Union faces a tough period as the energy crisis bites and debt troubles return. But the bloc could have the world’s cheapest and cleanest energy by the mid-2030s and it will probably emerge stronger geopolitically, says Hugo Dixon.

Lire la suite »

I cried ‘almost daily’ for 6 months regretting the name I gave my sonIt’s not exactly a name worth sobbing over — in fact, it’s a pretty common name — but the TikTok mom insists she cried daily over it.

I cried ‘almost daily’ for 6 months regretting the name I gave my sonIt’s not exactly a name worth sobbing over — in fact, it’s a pretty common name — but the TikTok mom insists she cried daily over it.

Lire la suite »

Breakingviews - Breakingviews: Bank of Japan fiddles while bond market burnsBank of Japan Governor Haruhiko Kuroda is playing with forex fire. The yield-curve control policy in which the central bank attempts to hold down interest rates by buying – or threatening to buy - unlimited amounts of sovereign bonds, is breaking down and risks freezing the market over, a bad look for an international reserve currency.

Breakingviews - Breakingviews: Bank of Japan fiddles while bond market burnsBank of Japan Governor Haruhiko Kuroda is playing with forex fire. The yield-curve control policy in which the central bank attempts to hold down interest rates by buying – or threatening to buy - unlimited amounts of sovereign bonds, is breaking down and risks freezing the market over, a bad look for an international reserve currency.

Lire la suite »