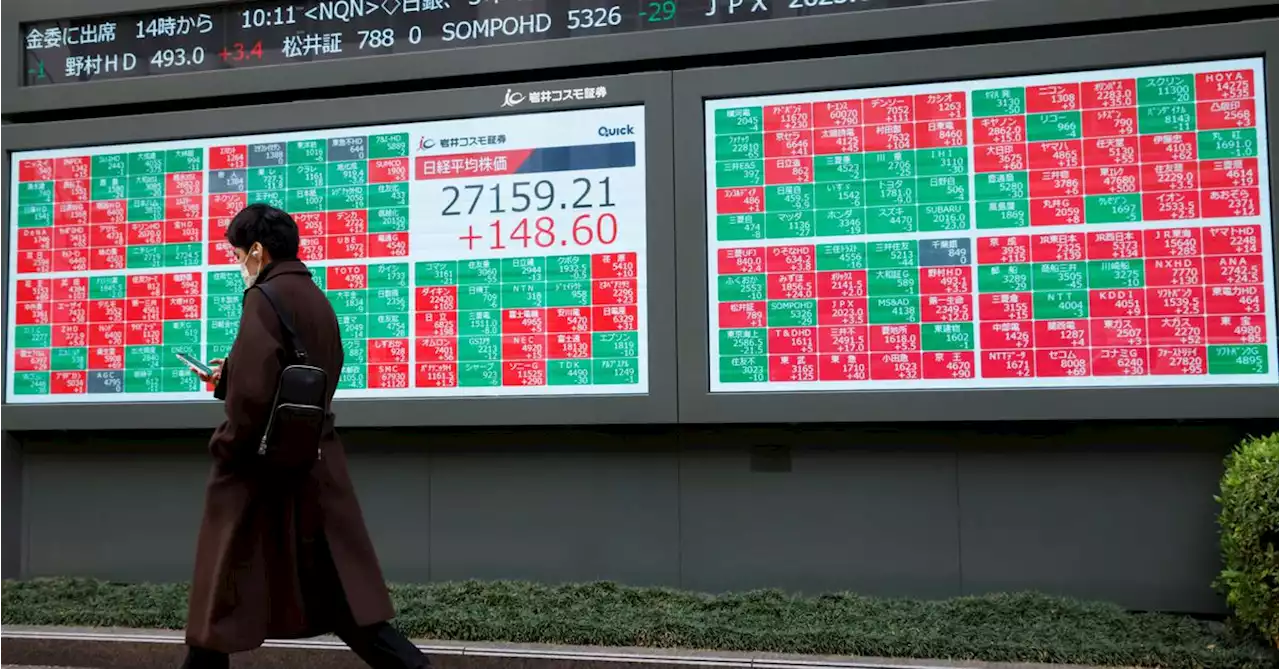

On Breakingviews: The Credit Suisse crisis has traders wondering who’s next. Japanese lenders, with staid depositor bases, look like unlikely targets for bank runs. Yet their collective overseas bond portfolio is in focus. So it should be: petesweeneypro

For years the country’s ultra-low interest rates encouraged deposit-taking institutions, lenders and other investors to borrow yen and buy higher-yielding but relatively safe assets. This helped Japan overtake China as the top foreign owner of U.S. Treasuries in 2019; they owned an estimated $2 trillion of foreign bonds as of last year. On paper the sequence of rate hikes in Western economies make such positions even more profitable.

, the inversion of the American yield curve makes it unprofitable to borrow short-term dollars and buy long-term Treasuries. Japan Inc was reducing positions well before Silicon Valley Bank imploded.in concert, should domestic sovereign bond prices suddenly fall. Nomura puts that value of that larger bucket, including equities, at $6 trillion, with half of that hedged.

, a $32 billion institution whose parent is partly owned by the Ministry of Finance. Foreign bonds make up 34% of its assets and overseas securities generated two thirds of its gross interest income in the nine months ending in December. Its net interest margin was a parlous 0.4% during that period.incoming Governor Kazuo Ueda to normalise rates, which is bad news for lenders but also reduces the risk they will be forced to sell to cover losses on their domestic holdings.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Musk responds to $100B credit line in $2B UBS-Credit Suisse deal: 'Wow'Twitter CEO Elon Musk responded to the news that UBS would get a $100 billion credit line in the buyout of Credit Suisse for $2 billion, with one word: wow.

Musk responds to $100B credit line in $2B UBS-Credit Suisse deal: 'Wow'Twitter CEO Elon Musk responded to the news that UBS would get a $100 billion credit line in the buyout of Credit Suisse for $2 billion, with one word: wow.

Lire la suite »

Credit Suisse rescue relief runs dry in skittish tradeEquity futures and Asian stocks struggled to stabilise on Monday as a weekend deal to rescue Credit Suisse and promises of liquidity from central banks offered little lasting respite from fears that a bigger banking crisis is brewing.

Credit Suisse rescue relief runs dry in skittish tradeEquity futures and Asian stocks struggled to stabilise on Monday as a weekend deal to rescue Credit Suisse and promises of liquidity from central banks offered little lasting respite from fears that a bigger banking crisis is brewing.

Lire la suite »

Credit Suisse shares slump 72% in opening trade after UBS dealCredit Suisse shares dropped 72% in opening trade, after agreeing to be bought by rival UBS in a deal underwritten by Swiss authorities. The steep share...

Credit Suisse shares slump 72% in opening trade after UBS dealCredit Suisse shares dropped 72% in opening trade, after agreeing to be bought by rival UBS in a deal underwritten by Swiss authorities. The steep share...

Lire la suite »

Breakingviews - Credit Suisse bump trade looks over-optimisticInvestors in Credit Suisse’s bombed-out stock are getting a little ahead of themselves. Despite losing more than 60% of their value on Monday morning, following a government-backed deal with UBS announced the previous evening, the bank’s shares closed at just over 0.82 Swiss francs($0.9). At that level, they’re 7% above the implied value of UBS’s offer, and a wider 13% using the lenders’ U.S.-listed shares, which trade until later in the day.

Breakingviews - Credit Suisse bump trade looks over-optimisticInvestors in Credit Suisse’s bombed-out stock are getting a little ahead of themselves. Despite losing more than 60% of their value on Monday morning, following a government-backed deal with UBS announced the previous evening, the bank’s shares closed at just over 0.82 Swiss francs($0.9). At that level, they’re 7% above the implied value of UBS’s offer, and a wider 13% using the lenders’ U.S.-listed shares, which trade until later in the day.

Lire la suite »

UBS seeks $6 billion in govt guarantees for Credit Suisse takeover -source By Reuters*UBS SEEKS $6B IN SWISS GOVERNMENT GUARANTEES AS WEEKEND TALKS ENTER CRUNCH TIME FOR CREDIT SUISSE TAKEOVER $UBS $CS 🇨🇭🇨🇭

UBS seeks $6 billion in govt guarantees for Credit Suisse takeover -source By Reuters*UBS SEEKS $6B IN SWISS GOVERNMENT GUARANTEES AS WEEKEND TALKS ENTER CRUNCH TIME FOR CREDIT SUISSE TAKEOVER $UBS $CS 🇨🇭🇨🇭

Lire la suite »

Crunch time for Credit Suisse talks as UBS seeks Swiss assurances By Reuters*CRUNCH TIME FOR CREDIT SUISSE AS UBS AND SWISS REGULATORS RUSH TO SEAL TAKEOVER DEAL AS SOON AS SUNDAY: REPORTS

Crunch time for Credit Suisse talks as UBS seeks Swiss assurances By Reuters*CRUNCH TIME FOR CREDIT SUISSE AS UBS AND SWISS REGULATORS RUSH TO SEAL TAKEOVER DEAL AS SOON AS SUNDAY: REPORTS

Lire la suite »