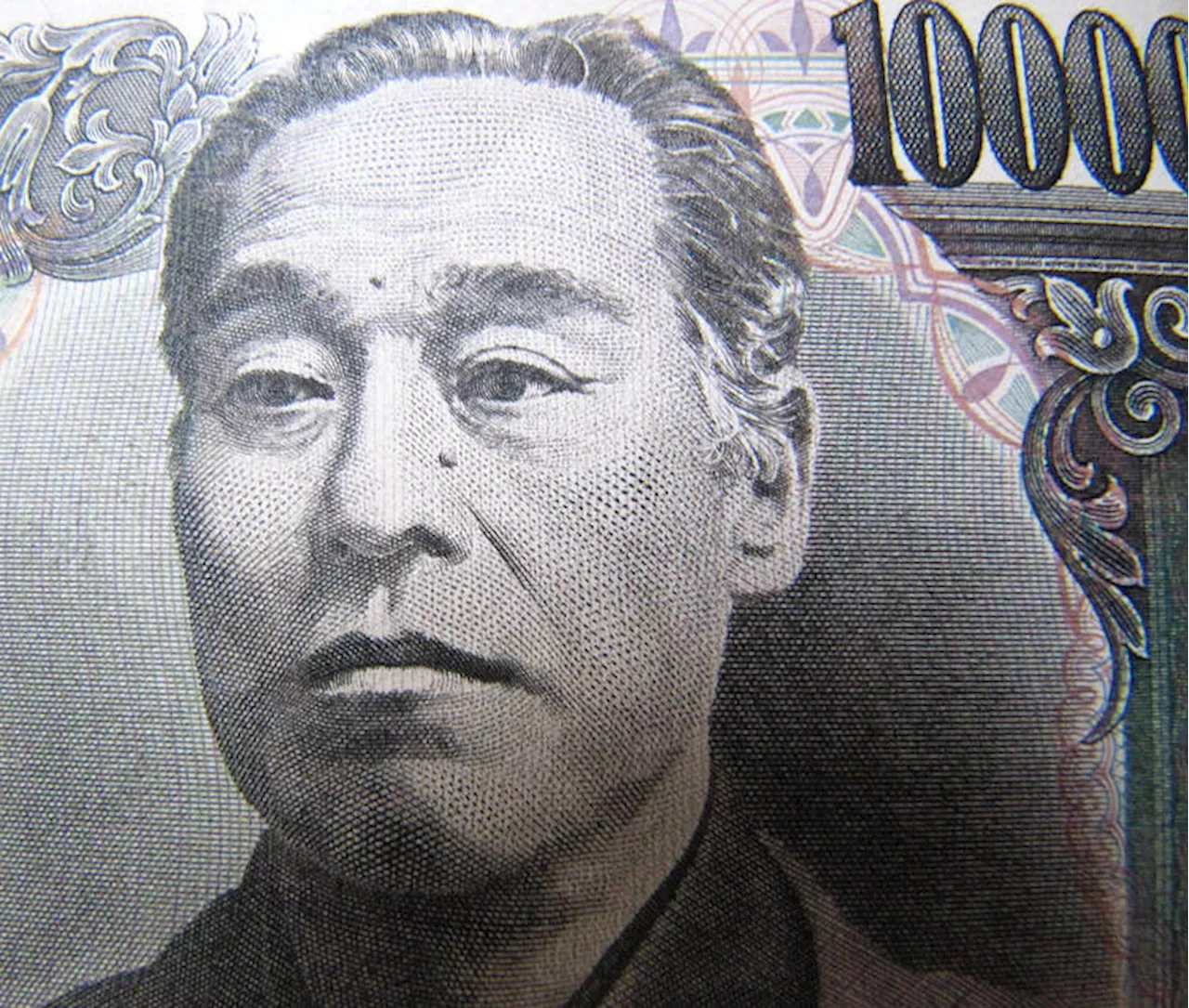

The Bank of Japan (BoJ) will consider whether to abandon its negative interest rate policy at a meeting beginning Monday as pay hikes by large companies bring the central bank's 2% price target within reach, per Nikkei.

The Bank of Japan will consider whether to abandon its negative interest rate policy at a meeting beginning Monday as pay hikes by large companies bring the central bank's 2% price target within reach, per Nikkei.

BoJ policymakers are also discussing scrapping the yield curve control, which sets a reference cap for long-term interest rates to about 1%. Following that, it would continue to buy Japanese government bonds to prevent rates from rising. Market reaction At the time of writing,USD/JPYis trading 0.06% lower on the day at 147.65.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Frost Bank to donate $1M to Alamo, becoming ‘official bank’ of historic siteFrost Bank's $1 million donation is the latest large gift to the Alamo, which is undergoing a roughly $500 million expansion.

Frost Bank to donate $1M to Alamo, becoming ‘official bank’ of historic siteFrost Bank's $1 million donation is the latest large gift to the Alamo, which is undergoing a roughly $500 million expansion.

Lire la suite »

BoJ considers ending yield control to focus on JGB buying size — JijiAccording to Jiji Press, the Bank of Japan (BoJ) is considering ending its yield curve control programme and instead indicating in advance the amount of government bonds it plans to purchase.

BoJ considers ending yield control to focus on JGB buying size — JijiAccording to Jiji Press, the Bank of Japan (BoJ) is considering ending its yield curve control programme and instead indicating in advance the amount of government bonds it plans to purchase.

Lire la suite »

What will follow after a first rate hike is the important question for the JPYEconomists at Commerzbank analyze what is relevant regarding the upcoming Bank of Japan’s (BoJ) meeting next week.

What will follow after a first rate hike is the important question for the JPYEconomists at Commerzbank analyze what is relevant regarding the upcoming Bank of Japan’s (BoJ) meeting next week.

Lire la suite »

USD/JPY Sinks on Bets BoJ Will End Negative Rates Soon, US Inflation in FocusUSD/JPY extends losses on speculation that the Bank of Japan may be warming up to the idea of ending negative rates during its March monetary policy meeting.

USD/JPY Sinks on Bets BoJ Will End Negative Rates Soon, US Inflation in FocusUSD/JPY extends losses on speculation that the Bank of Japan may be warming up to the idea of ending negative rates during its March monetary policy meeting.

Lire la suite »

Japanese Yen Surges Against USD As Markets Again Mull BoJ Policy ExitCould March be the month when the Bank of Japan finally tightens policy, or at least looks serious about doing so? Bets are increasing.

Japanese Yen Surges Against USD As Markets Again Mull BoJ Policy ExitCould March be the month when the Bank of Japan finally tightens policy, or at least looks serious about doing so? Bets are increasing.

Lire la suite »

Japanese Yen stands tall near one-month top against USD on hawkish BoJ talksThe Japanese Yen (JPY) rallied to the highest level since early February against its American counterpart on Friday amid bets for an imminent shift in the Bank of Japan's (BoJ) policy stance.

Japanese Yen stands tall near one-month top against USD on hawkish BoJ talksThe Japanese Yen (JPY) rallied to the highest level since early February against its American counterpart on Friday amid bets for an imminent shift in the Bank of Japan's (BoJ) policy stance.

Lire la suite »