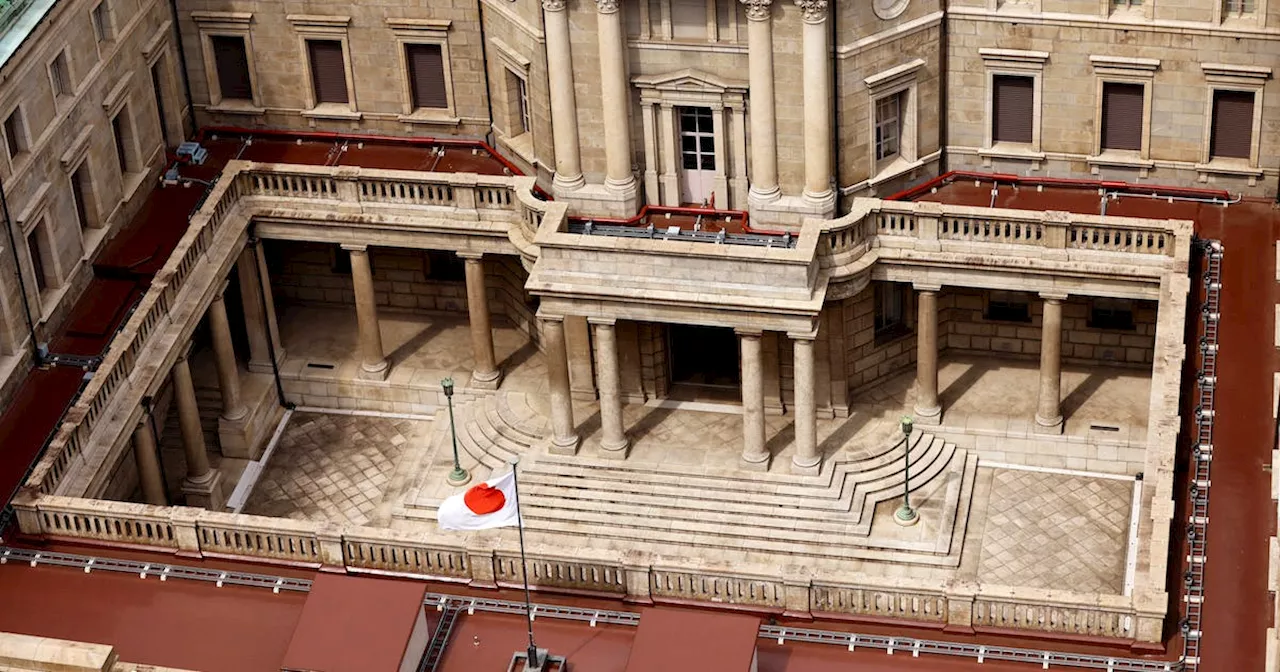

(Bloomberg) -- Bank of Japan officials are pondering the question of whether to tweak the settings of the yield-curve control program as domestic long-term...

-- Bank of Japan officials are pondering the question of whether to tweak the settings of the yield-curve control program as domestic long-term interest rates float higher in tandem with those in the US, the Nikkei newspaper reported on Sunday, without saying where it obtained the information.The topic will probably be discussed at the next two-day board meeting that ends Oct. 31, with some officials cautious about the idea as they continue to monitor wage trends, the Nikkei said.

Governor Kazuo Ueda is closely watching wage hike trends. The nation’s largest labor union federation, Rengo, began the annual negotiation process by calling for companies to raise pay by at least 5% in principle next year, potentially providing the key element needed for the central bank to move toward policy normalization.

Meiji Yasuda Life insurance is looking at a 7% increase in compensation and Bic Camera plans to raise base wages by the most since 2004, NHK reported last week, without attribution. ‘The buildings don’t go away … but the owners do’: Warren Buffett and Charlie Munger warn that a storm is brewing in the US real estate market — here’s where they'll seek refuge

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

BOJ's Ueda vows to 'patiently' maintain ultra-loose policyExplore stories from Atlantic Canada.

BOJ's Ueda vows to 'patiently' maintain ultra-loose policyExplore stories from Atlantic Canada.

Lire la suite »

BOJ will debate pros, cons of unconventional policy at workshopExplore stories from Atlantic Canada.

BOJ will debate pros, cons of unconventional policy at workshopExplore stories from Atlantic Canada.

Lire la suite »

Japan's property market shows signs of overheating -BOJExplore stories from Atlantic Canada.

Japan's property market shows signs of overheating -BOJExplore stories from Atlantic Canada.

Lire la suite »

BOJ’s Ueda Says Need for Risk Management of Rates Is IncreasingBank of Japan Governor Kazuo Ueda urged Japanese credit unions to undertake proper management of interest rate risks, citing the banking crisis that shook the US financial system earlier this year as well as high uncertainties related to the domestic economy.

BOJ’s Ueda Says Need for Risk Management of Rates Is IncreasingBank of Japan Governor Kazuo Ueda urged Japanese credit unions to undertake proper management of interest rate risks, citing the banking crisis that shook the US financial system earlier this year as well as high uncertainties related to the domestic economy.

Lire la suite »

10-year U.S. Treasury yield set for biggest weekly rise since April 2022It’s been a brutal week of bond-market selling

10-year U.S. Treasury yield set for biggest weekly rise since April 2022It’s been a brutal week of bond-market selling

Lire la suite »

10-year Treasury yield crosses 5%, stocks close big week of earnings: Yahoo Finance LiveYields are in focus today after the 10-year Treasury crossed 5% for the first time since 2007. The recent surge in bond yields is raising concerns about the ...

10-year Treasury yield crosses 5%, stocks close big week of earnings: Yahoo Finance LiveYields are in focus today after the 10-year Treasury crossed 5% for the first time since 2007. The recent surge in bond yields is raising concerns about the ...

Lire la suite »