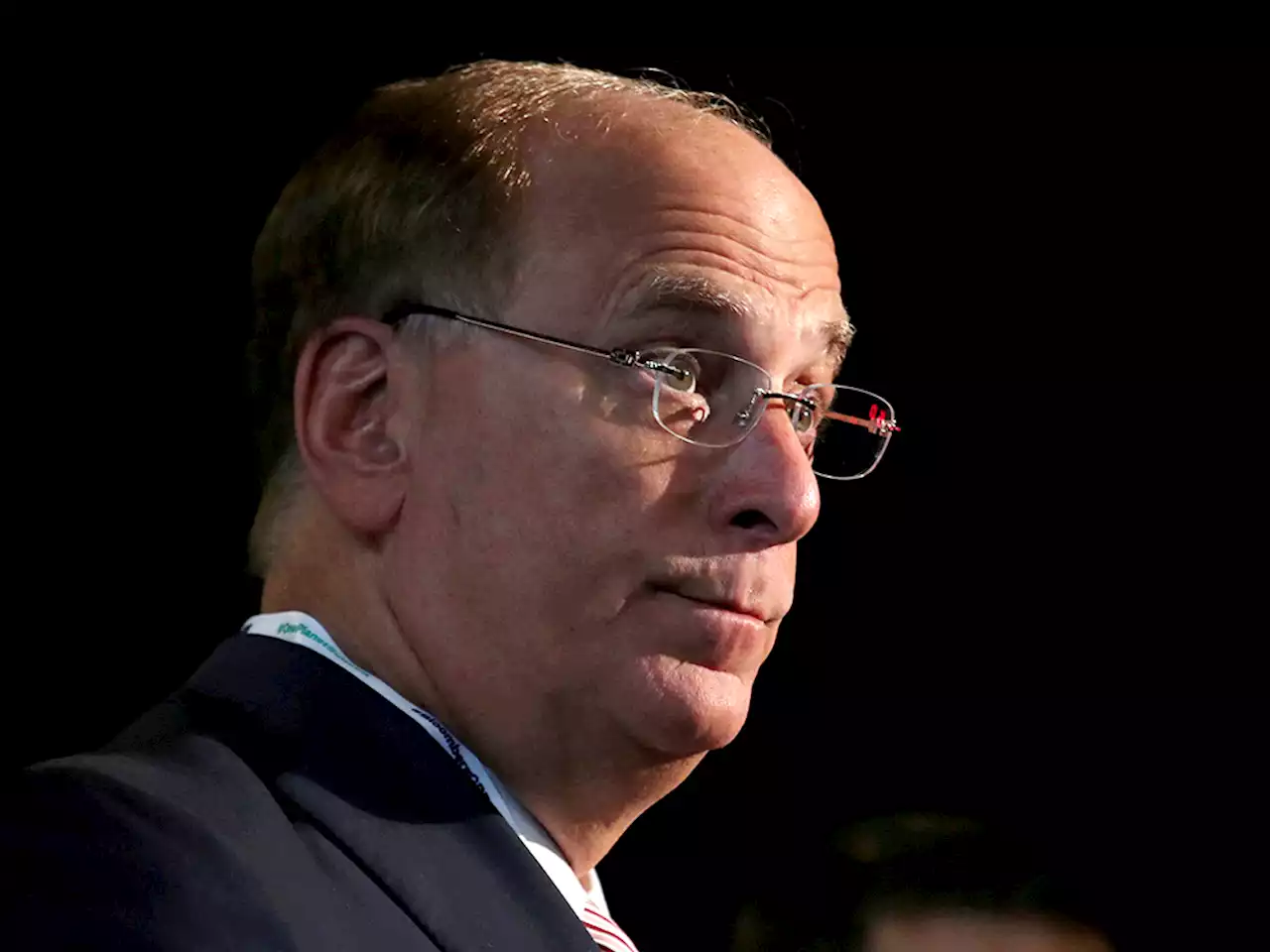

BlackRock\u0027s CEO warned more pain is coming in the U.S. financial system following the failure of Silicon Valley Bank. Read on.

Banks will inevitably pull back on lending, which will prompt more companies to turn to the capital markets — creating opportunities for investors and asset managers, Fink predicted.

As the world’s largest money manager, BlackRock has large shareholdings in most U.S. companies and Fink’s annual letter has become required reading for corporate executives.However, his outspoken support for tackling climate change via investment has made the New York fund manager a target of conservatives.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

BlackRock's Larry Fink warns 'more seizures and shutdowns coming' in wake of SVB failureBlackRock\u0027s CEO warned more pain is coming in the U.S. financial system following the failure of Silicon Valley Bank. Read on.

BlackRock's Larry Fink warns 'more seizures and shutdowns coming' in wake of SVB failureBlackRock\u0027s CEO warned more pain is coming in the U.S. financial system following the failure of Silicon Valley Bank. Read on.

Lire la suite »

SVB collapse is not a repeat 08-09 financial crisis: John Zechner - BNN BloombergBank stocks have come under pressure following the collapse of Silicon Valley Bank (SVB), but one financial expert is advising that now is an opportune time to put money into the sector.

SVB collapse is not a repeat 08-09 financial crisis: John Zechner - BNN BloombergBank stocks have come under pressure following the collapse of Silicon Valley Bank (SVB), but one financial expert is advising that now is an opportune time to put money into the sector.

Lire la suite »

Stocks steady as investors bet SVB collapse will force Fed to halt hikesTraders bet the collapse of SVB will compel the Federal Reserve to halt interest rate hikes. Read more

Stocks steady as investors bet SVB collapse will force Fed to halt hikesTraders bet the collapse of SVB will compel the Federal Reserve to halt interest rate hikes. Read more

Lire la suite »

Safe-haven gold accelerates as traders assess SVB falloutGold raced towards the key $1 900 level on Monday as investors sought cover from the uncertainty triggered by the collapse of Silicon Valley Bank, emboldened by bets that the Federal Reserve may now have to tone down its rate hikes. Spot gold was up 0.9% at $1 885.37 per ounce, as of 09:04 GMT. Earlier in the session, prices hit their highest since early February at $1 893.96. US gold futures GCv1 gained 1.2% to $1 889.50. On Friday, gold gained 2% after California regulators closed tech startup-focused Silicon Valley Bank (SVB). Regulators also shuttered New York-based Signature Bank on Sunday.

Safe-haven gold accelerates as traders assess SVB falloutGold raced towards the key $1 900 level on Monday as investors sought cover from the uncertainty triggered by the collapse of Silicon Valley Bank, emboldened by bets that the Federal Reserve may now have to tone down its rate hikes. Spot gold was up 0.9% at $1 885.37 per ounce, as of 09:04 GMT. Earlier in the session, prices hit their highest since early February at $1 893.96. US gold futures GCv1 gained 1.2% to $1 889.50. On Friday, gold gained 2% after California regulators closed tech startup-focused Silicon Valley Bank (SVB). Regulators also shuttered New York-based Signature Bank on Sunday.

Lire la suite »

Stocks steady as investors bet SVB collapse will force Fed to halt hikesTraders bet the collapse of SVB will compel the Federal Reserve to halt interest rate hikes. Read more

Stocks steady as investors bet SVB collapse will force Fed to halt hikesTraders bet the collapse of SVB will compel the Federal Reserve to halt interest rate hikes. Read more

Lire la suite »

MKR sees green as regulators move to restore deposits at failed SVBFollowing the announcements to make Silicon Valley Bank (SVB) depositors whole, MKR’s price rallied by double digits. Due to DAI depeg, MakerDAO’s fee income slipped by 10% over the weekend. In response to recent developments, Maker’s [MKR] price experienced a substantial increase of nearly 30% in the last 24 hours. This surge followed the announcement […]

MKR sees green as regulators move to restore deposits at failed SVBFollowing the announcements to make Silicon Valley Bank (SVB) depositors whole, MKR’s price rallied by double digits. Due to DAI depeg, MakerDAO’s fee income slipped by 10% over the weekend. In response to recent developments, Maker’s [MKR] price experienced a substantial increase of nearly 30% in the last 24 hours. This surge followed the announcement […]

Lire la suite »