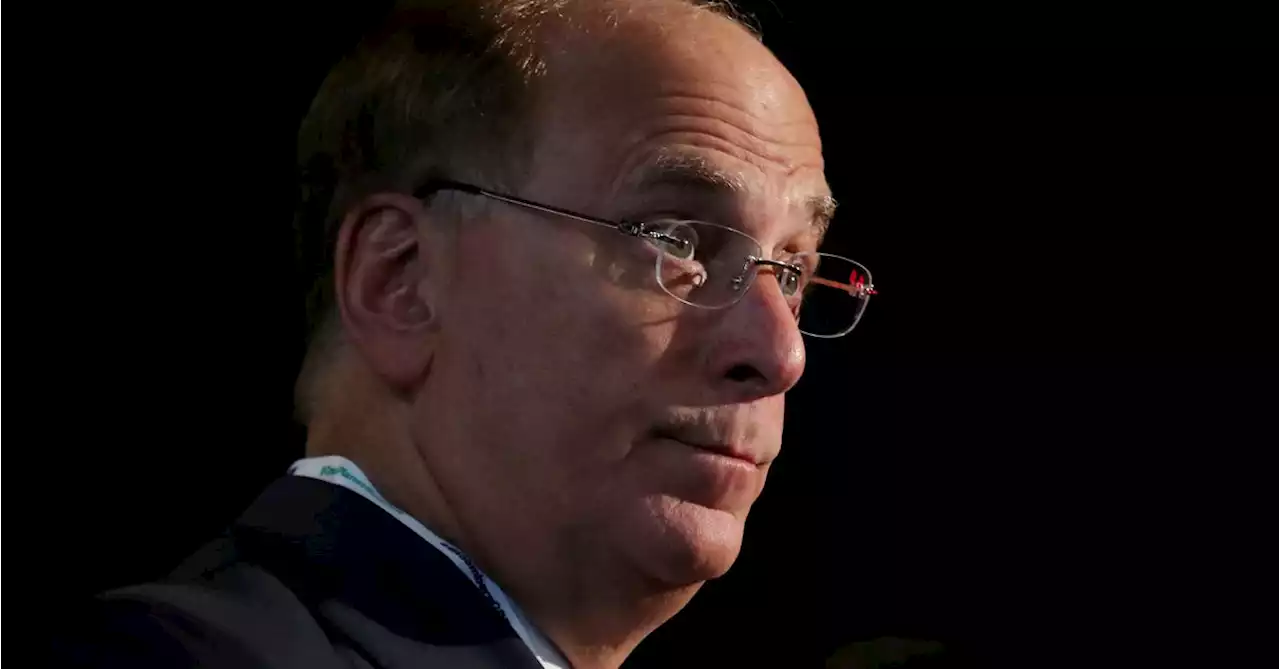

As the political backlash increased with the anti-ESG movement, BlackRock CEO Larry Fink appeared to have taken a different approach in his annual letter to investors regarding environmental, social, and governance investing.

the leftist ESG investing policies as the practice of sustainable investing, Fink did not use the acronym ESG once in his letter. In fact, BlackRock’s CEO pushed the idea that the asset manager wants it to be the investor’s own choice concerning sustainable investing and the energy transition:

Our job is to think through and model different scenarios to understand implications for our clients’ portfolios. My letters to CEOs are written with a single goal: to ensure companies are going to generate durable, long-term investment returns for our clients.Fink also alleged that the asset managers’ clients “want our help to understand the likely future paths of carbon emissions” and “how government policy will impact these paths, and what that means in terms of investment risks and opportunities.”

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Larry Fink: BlackRock is not the 'environmental police'In his annual letter, CEO Larry Fink said BlackRock's recognition of the import of climate risk on finance does not make the company a political chess piece.

Larry Fink: BlackRock is not the 'environmental police'In his annual letter, CEO Larry Fink said BlackRock's recognition of the import of climate risk on finance does not make the company a political chess piece.

Lire la suite »

Breakingviews - Larry Fink finds way to dodge ESG crosshairsSeismic events elsewhere are making it easier for BlackRock to inch away from the environmental, social and governance crosshairs. The $8 trillion asset manager’s chair Larry Fink used his annual investor letter to theorise that inflation might stay around 4%, predict stricter bank capital requirements, and namecheck his favourite 80’s band, Talk Talk. Less front and centre than in previous years was a preoccupation with climate change.

Breakingviews - Larry Fink finds way to dodge ESG crosshairsSeismic events elsewhere are making it easier for BlackRock to inch away from the environmental, social and governance crosshairs. The $8 trillion asset manager’s chair Larry Fink used his annual investor letter to theorise that inflation might stay around 4%, predict stricter bank capital requirements, and namecheck his favourite 80’s band, Talk Talk. Less front and centre than in previous years was a preoccupation with climate change.

Lire la suite »

BlackRock CEO Fink warns of financial risks, persistent inflationBlackRock Inc Chief Executive Laurence Fink warned on Wednesday the U.S. regional banking sector remains at risk after the collapse of Silicon Valley Bank and that inflation will persist and rates would continue to rise.

BlackRock CEO Fink warns of financial risks, persistent inflationBlackRock Inc Chief Executive Laurence Fink warned on Wednesday the U.S. regional banking sector remains at risk after the collapse of Silicon Valley Bank and that inflation will persist and rates would continue to rise.

Lire la suite »

BlackRock CEO Fink says more bank seizures could follow SVB shutdownBlackRock's Larry Fink says the US banking system may face 'more seizures and shutdowns' after Silicon Valley Bank's collapse

Lire la suite »

BlackRock's Larry Fink warns of 'slow rolling crisis' as Fed's inflation fight drags on for yearsBlackRock Inc. co-founder and CEO Larry Fink warned his firm's investors that the Federal Reserve's aggressive interest-rate hikes were the "first...

BlackRock's Larry Fink warns of 'slow rolling crisis' as Fed's inflation fight drags on for yearsBlackRock Inc. co-founder and CEO Larry Fink warned his firm's investors that the Federal Reserve's aggressive interest-rate hikes were the "first...

Lire la suite »

Dow Plunges 600 Points As BlackRock Chief Warns SVB Collapse Merely ‘First Domino To Drop’Inflation will persist at nearly 4% for years to come due to the “dramatic changes in financial markets,” cautioned Blackrock CEO Larry Fink as stock futures plunged.

Dow Plunges 600 Points As BlackRock Chief Warns SVB Collapse Merely ‘First Domino To Drop’Inflation will persist at nearly 4% for years to come due to the “dramatic changes in financial markets,” cautioned Blackrock CEO Larry Fink as stock futures plunged.

Lire la suite »