Americans for Tax Reform President Grover Norquist discusses Biden's latest IRS push and the impact it will have on independent contractors and those who have a 'side hustle.'

They stuck this in that rescue plan, March 11 last year when they said, oh no, we're just giving money to people. Inside was this incredibly increased reporting device for, PayPal, Airbnb, Venmo, Etsy, Facebook Marketplace, all of these places that you buy and sell things online. Well, they'll be reporting $600 one time to the government.It will affect your taxes this year.

They're swamped with what they have. And now this new thing has been added on. It will cost you more to do your taxes because if you have a tax preparer who charge it by how much paperwork there is, this is all new paperwork that they're adding in.…People who have a side hustle, you know, the independent contractors, all of these people are being swept up. Those people cannot be unionized. Yeah, the administration doesn't like them. They just shouldn't make them all go away.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

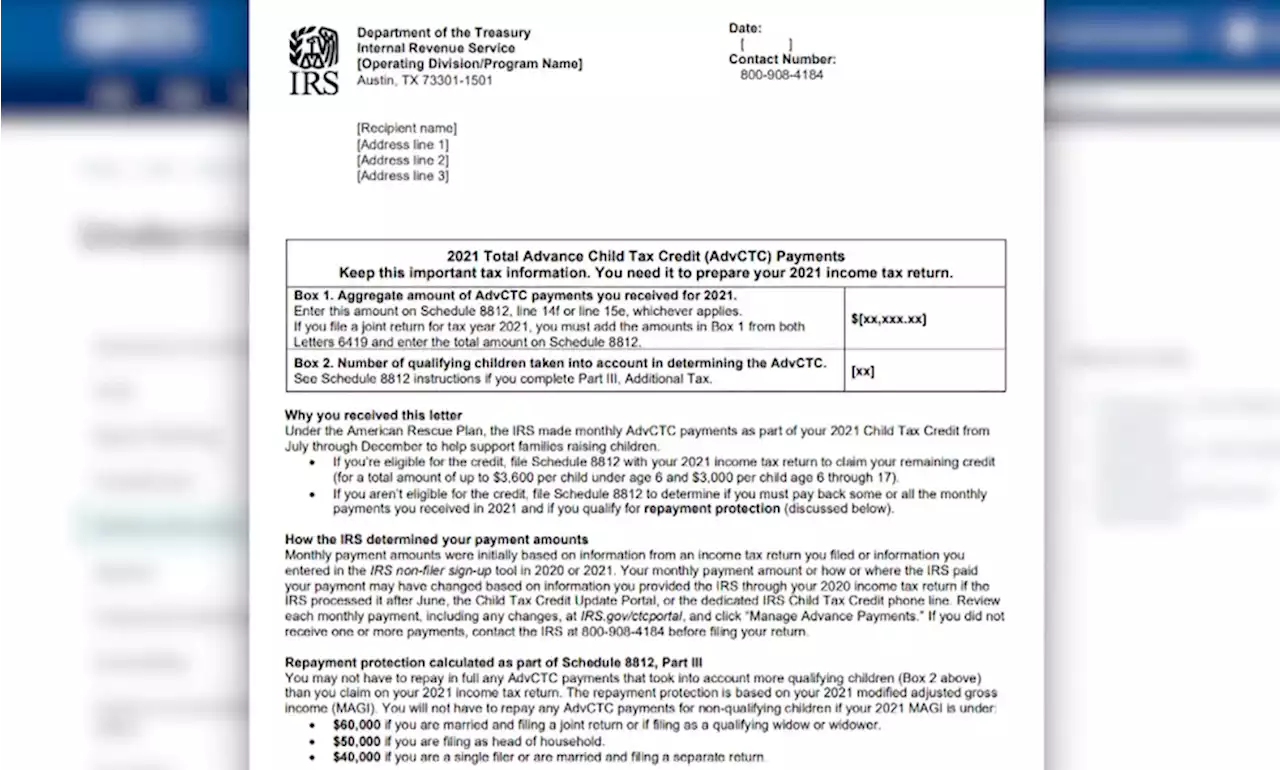

IRS warns some taxpayers may have received incorrect Child Tax Credit letterThe issue could create tax refund delays for parents if they rely on faulty information to complete their tax returns.

IRS warns some taxpayers may have received incorrect Child Tax Credit letterThe issue could create tax refund delays for parents if they rely on faulty information to complete their tax returns.

Lire la suite »

Tax Experts Warn You to Prepare for a Smaller IRS Refund — Best LifeWith several changes going into effect for this year's tax season, experts say some taxpayers should expect a smaller refund from the IRS.

Tax Experts Warn You to Prepare for a Smaller IRS Refund — Best LifeWith several changes going into effect for this year's tax season, experts say some taxpayers should expect a smaller refund from the IRS.

Lire la suite »

The IRS faces backlogs from last year as a new tax filing season beginsThe IRS is 'in the roughest shape it's been in in 50 years,' says former commissioner Mark Everson. The agency, he says, is understaffed, has more work than it can handle and is underfunded.

The IRS faces backlogs from last year as a new tax filing season beginsThe IRS is 'in the roughest shape it's been in in 50 years,' says former commissioner Mark Everson. The agency, he says, is understaffed, has more work than it can handle and is underfunded.

Lire la suite »

Taxpayers, brace yourselves: Tax filing season starts amid IRS crisis, COVID-related complicationsU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Taxpayers, brace yourselves: Tax filing season starts amid IRS crisis, COVID-related complicationsU.S. taxpayers, brace yourselves because tax filing season starts Monday and you can expect the task to be more cumbersome than usual this year.

Lire la suite »

Taxpayers face overloaded IRS as filing season opens MondayAn IRS worker shortage, an enormous workload from administering pandemic-related programs and stalled legislation that would have given the agency billions of dollars for more expeditiously processing returns will combine to cause taxpayers pain this filing season.

Taxpayers face overloaded IRS as filing season opens MondayAn IRS worker shortage, an enormous workload from administering pandemic-related programs and stalled legislation that would have given the agency billions of dollars for more expeditiously processing returns will combine to cause taxpayers pain this filing season.

Lire la suite »

IRS warns parents not to toss important tax documentLetter 6419 from the IRS will help parents accurately report the amount of money they received upfront in 2021 for the child tax credit.

IRS warns parents not to toss important tax documentLetter 6419 from the IRS will help parents accurately report the amount of money they received upfront in 2021 for the child tax credit.

Lire la suite »