Bank of England hikes rates again to 3.5% – what it means for your money

is meant to encourage people to save, rather than spend, which in theory should help bring rampant inflation under control.Inflation is a measure of how the price of goods and services has changed over the past year.

The average two-year fixed deal is 5.84% and the average five-year deal sits at 5.67%, according to Moneyfacts.Other mortgages, such as a tracker or standard variable rate mortgage, could be impacted straight away. Around 2.2million households are on SVRs and the 0.5 percentage point hike today will add £62 a month to mortgage bills - or £744 a year.But the exact amount depends on your borrowing and your loan-to-value.

People with fixed-rate mortgage deals due to expire at the end of 2023 face £250 a month bill hikes when they are forced to refinance on to a higher rate. After consecutive rate rises by the BoE interest rates on credit cards and personal loans have already hit a record high,Many big banks - like Lloyds Bank, MBNA, Halifax and Barclaycard - link their credit card rates directly to the Bank of England base rate.

Certain loans you already have like a personal loan or car financing will usually stay the same, as you've already agreed on the rate.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Millions face £3,000 bill rise as Bank of England set to hike ratesMILLIONS of households face £3,000 a year bill hikes as interest rates are set to rise again this week. Four million mortgage holders are set to see their monthly payments jump by the end…

Millions face £3,000 bill rise as Bank of England set to hike ratesMILLIONS of households face £3,000 a year bill hikes as interest rates are set to rise again this week. Four million mortgage holders are set to see their monthly payments jump by the end…

Lire la suite »

Bank of England interest rates raised to 3.5 per cent reaching 14-year highBank of England interest rates have been raised to 3.5 per cent, reaching a 14-year high.

Bank of England interest rates raised to 3.5 per cent reaching 14-year highBank of England interest rates have been raised to 3.5 per cent, reaching a 14-year high.

Lire la suite »

Bank of England imposes ninth consecutive interest rate rise to tackle inflation'This is a slight improvement on the bleakness of the situation only a few months ago.' Sky's economics and data editor EdConwaySky gives his analysis on the BoE's decision to raise the interest rate from 3% to 3.5%. 📺 Sky 501 and YouTube

Bank of England imposes ninth consecutive interest rate rise to tackle inflation'This is a slight improvement on the bleakness of the situation only a few months ago.' Sky's economics and data editor EdConwaySky gives his analysis on the BoE's decision to raise the interest rate from 3% to 3.5%. 📺 Sky 501 and YouTube

Lire la suite »

Bank of England poised to hike UK interest rates to 3.5% in another blow for mortgage-holdersThe increase will cost anyone on a tracker mortgage an extra £300 a month on average

Bank of England poised to hike UK interest rates to 3.5% in another blow for mortgage-holdersThe increase will cost anyone on a tracker mortgage an extra £300 a month on average

Lire la suite »

Mediawatch 'welcomes' back an old favourite on sacking that serial England loser Gareth Southgate - Football365‘As for poor old Harry, after all that social virtue signalling and captain’s pastoral care for his team-mates he has been left to carry the can...' Talk about a tell...

Mediawatch 'welcomes' back an old favourite on sacking that serial England loser Gareth Southgate - Football365‘As for poor old Harry, after all that social virtue signalling and captain’s pastoral care for his team-mates he has been left to carry the can...' Talk about a tell...

Lire la suite »

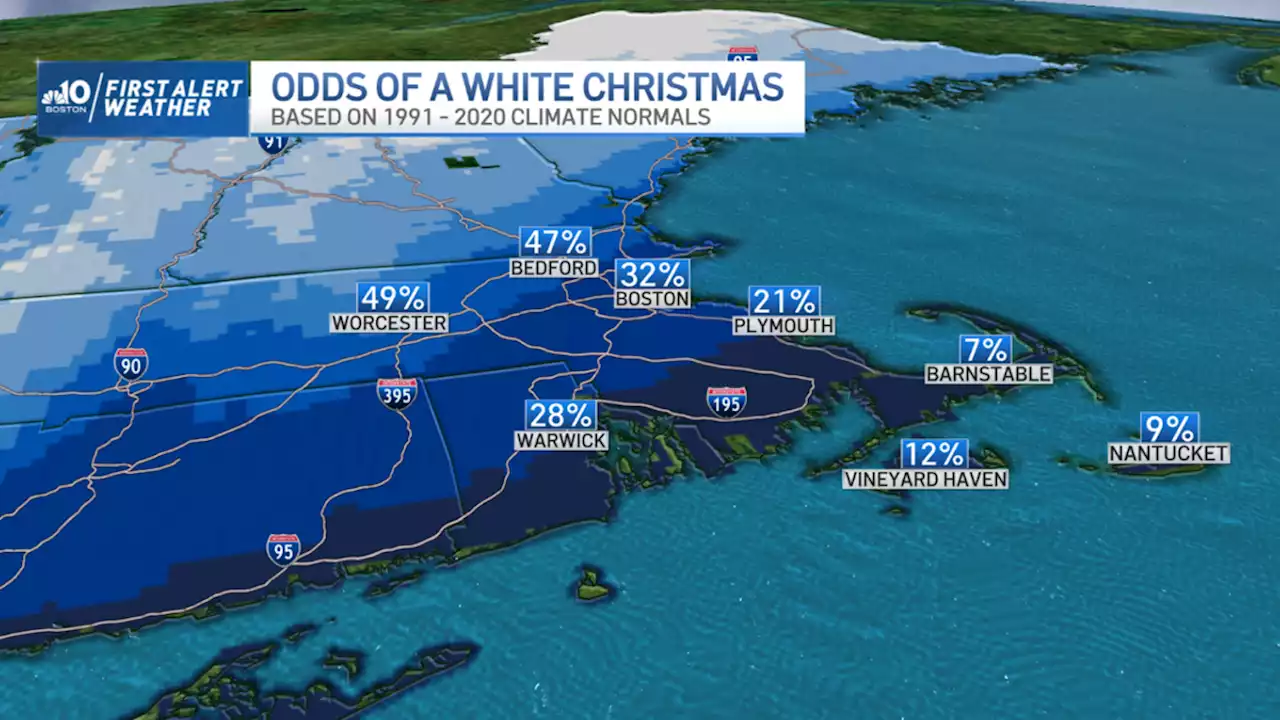

Will We Have White Christmas in New England This Year?If you’re been blaring “I’m dreaming of a white Christmas…” this holiday season, odds are, you’re not alone. But the odds of actually seeing a white Christmas are actually historically slim.

Will We Have White Christmas in New England This Year?If you’re been blaring “I’m dreaming of a white Christmas…” this holiday season, odds are, you’re not alone. But the odds of actually seeing a white Christmas are actually historically slim.

Lire la suite »