Bank of Canada Governor Tiff Macklem keeps benchmark interest rate at five per cent, but signals rate hikes are unlikely due to a slowing economy. Macklem says more assurance is needed that inflation is decreasing before considering easing monetary policy.

Bank of Canada Governor Tiff Macklem keeps benchmark interest rate at five per cent, but signals rate hikes are unlikely due to a slowing economy. Macklem says more assurance is needed that inflation is decreasing before considering easing monetary policy .

Bank Of Canada Interest Rate Tiff Macklem Inflation Monetary Policy Economy

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Bank of Canada Expected to Cut Interest Rate by 2025The Bank of Canada is predicted to cut its policy interest rate to 2.25% by 2025, reducing the current rate of 5% by more than half. This would be beneficial for borrowers with high mortgage payments. Home sale numbers have decreased due to high interest rates.

Bank of Canada Expected to Cut Interest Rate by 2025The Bank of Canada is predicted to cut its policy interest rate to 2.25% by 2025, reducing the current rate of 5% by more than half. This would be beneficial for borrowers with high mortgage payments. Home sale numbers have decreased due to high interest rates.

Lire la suite »

Bank of Canada Rate Hikes Impacting Economy, Survey FindsThe Bank of Canada's rate hikes have put the brakes on the nation's economy, according to 90% of senior business leaders recently surveyed by Chartered Professional Accountants Canada.

Bank of Canada Rate Hikes Impacting Economy, Survey FindsThe Bank of Canada's rate hikes have put the brakes on the nation's economy, according to 90% of senior business leaders recently surveyed by Chartered Professional Accountants Canada.

Lire la suite »

Economists Warn Bank of Canada About Interest Rate CutsFar too many indicators, inflation included, are still too erratic for the BoC to approach the topic of interest rate cuts, economists warn.

Economists Warn Bank of Canada About Interest Rate CutsFar too many indicators, inflation included, are still too erratic for the BoC to approach the topic of interest rate cuts, economists warn.

Lire la suite »

Luxury Consignment Chain Offers First-Rate Second-Hand Shopping in CanadaDiscover the best second-hand stores across Canada, offering vintage fashion and sustainable chic luxury. Explore the sleekly designed Vancouver boutiques of a luxury consignment chain, where you can find trendy items and earn store credit through their Influencer Program.

Luxury Consignment Chain Offers First-Rate Second-Hand Shopping in CanadaDiscover the best second-hand stores across Canada, offering vintage fashion and sustainable chic luxury. Explore the sleekly designed Vancouver boutiques of a luxury consignment chain, where you can find trendy items and earn store credit through their Influencer Program.

Lire la suite »

Brokers warn against locking-in longer-term mortgages as rates dropAs fixed-rate mortgage rates start to come down, some brokers are warning against locking-in longer-term mortgages. Rates have dropped by a full percentage point in the past few months, opening up an opportunity for Canadians eyeing the spring housing market. While experts say there’s little downside to securing a cheaper rate today, committing to a long-term mortgage with rate cuts in the forecast might end up costing some households more.

Brokers warn against locking-in longer-term mortgages as rates dropAs fixed-rate mortgage rates start to come down, some brokers are warning against locking-in longer-term mortgages. Rates have dropped by a full percentage point in the past few months, opening up an opportunity for Canadians eyeing the spring housing market. While experts say there’s little downside to securing a cheaper rate today, committing to a long-term mortgage with rate cuts in the forecast might end up costing some households more.

Lire la suite »

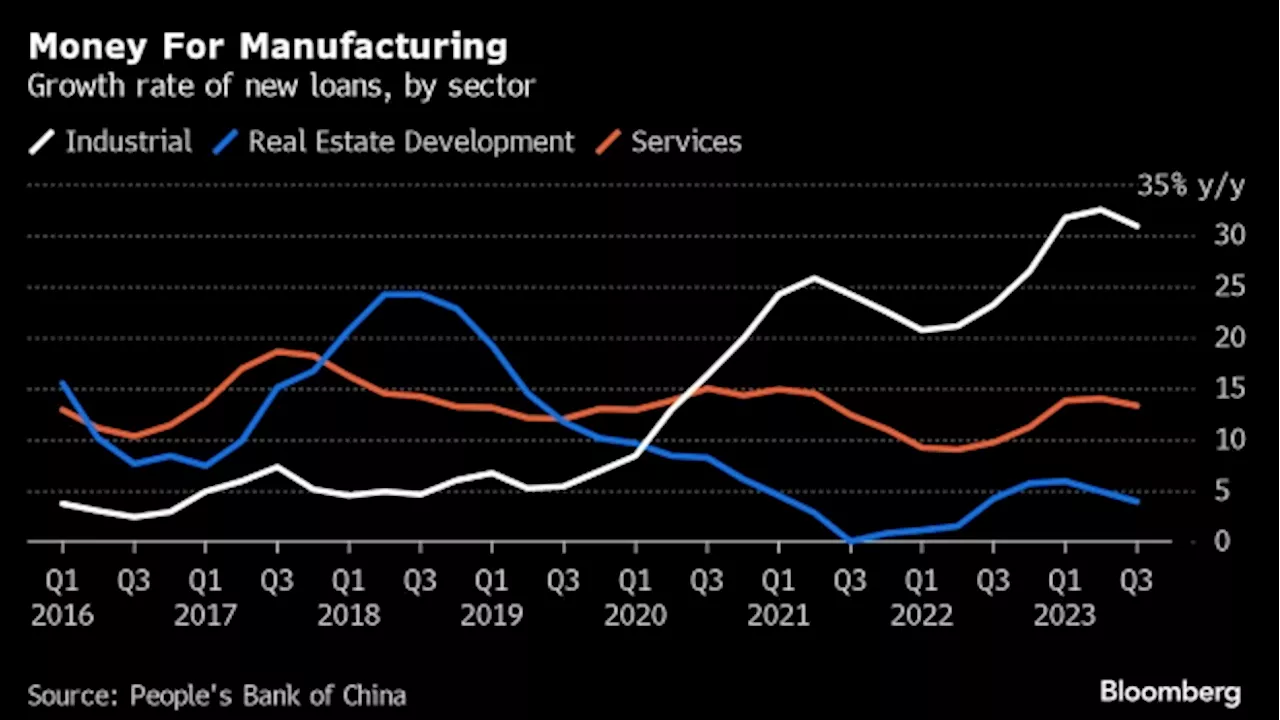

Xi’s Solution for China’s Economy Risks Triggering New Trade WarChastened Economists Hopeful for US Soft Landing, Fed Rate CutsZimbabwe Rescues All 15 Trapped Miners Alive: Mines MinisterCanada job gains miss forecast, jobless rate steady at 5.8%Expect 2024 downturn followed by a rate-cut rebound: economistsU.S

Xi’s Solution for China’s Economy Risks Triggering New Trade WarChastened Economists Hopeful for US Soft Landing, Fed Rate CutsZimbabwe Rescues All 15 Trapped Miners Alive: Mines MinisterCanada job gains miss forecast, jobless rate steady at 5.8%Expect 2024 downturn followed by a rate-cut rebound: economistsU.S

Lire la suite »