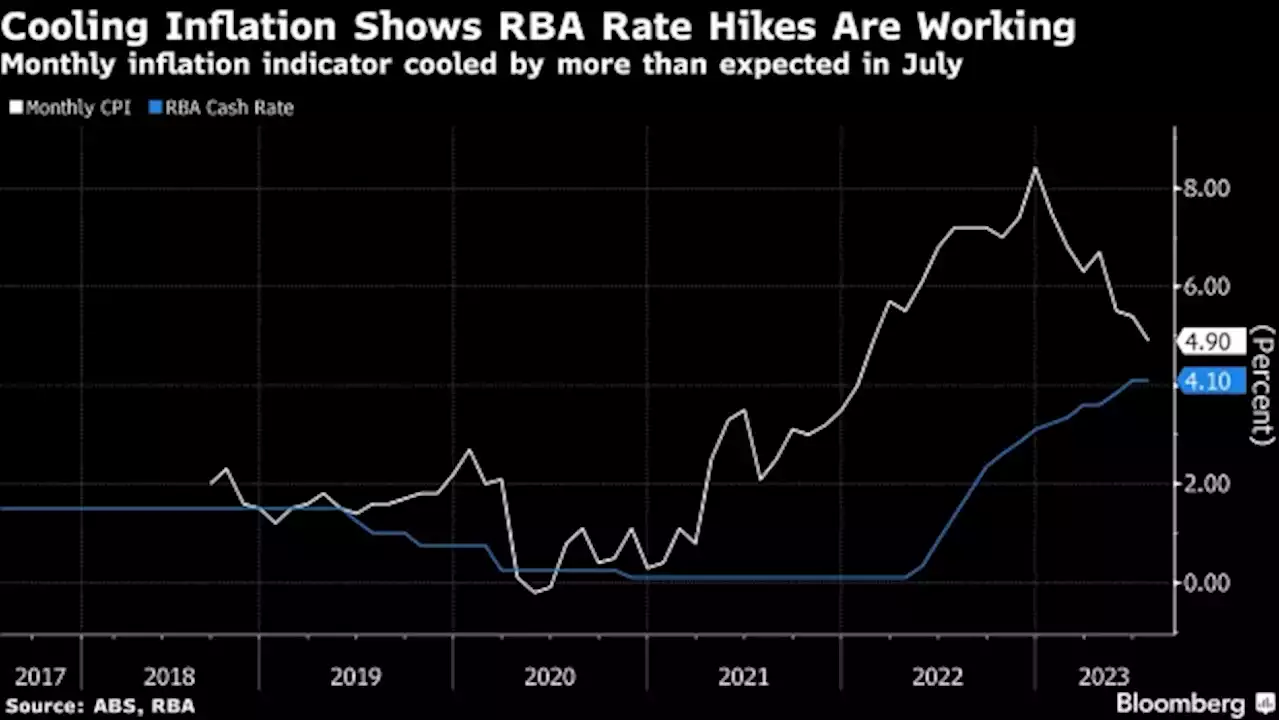

Australia’s monthly inflation gauge eased more than expected, reflecting global trends and bolstering the case for the Reserve Bank to extend a pause in tightening at next week’s policy meeting.

The consumer price indicator rose 4.9% in July from a year earlier, compared with economists’ estimate of 5.2%, Australian Bureau of Statistics data showed Wednesday. The result was the third consecutive slowdown in the pace with the RBA predicting inflation will fall back inside its 2-3% target by late-2025.

Wednesday’s report showed that when excluding volatile items, the easing in annual inflation was a more modest 5.8% in July, compared with 6.1% in June. The data comes after US consumer prices rose modestly, marking the smallest back-to-back gains in more than two years. Australia’s CPI reading follows reports suggesting its economy remains resilient, putting the central bank on track to engineer a soft landing.

The central bank paused this month to assess the impact of its tightening campaign amid a mixed economic picture — consumers have slowed spending as they are forced to allocate a rising proportion of their incomes to repayments while corporate confidence is still holding up.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Britain’s Food Inflation Cools to Lowest Level in Almost a YearThe slowest increase in grocery bills in almost a year drove down inflation in British shops in August, relieving some of the pressure on the Bank of England to keep raising interest rate hikes.

Britain’s Food Inflation Cools to Lowest Level in Almost a YearThe slowest increase in grocery bills in almost a year drove down inflation in British shops in August, relieving some of the pressure on the Bank of England to keep raising interest rate hikes.

Lire la suite »

Premarket: World shares rally as China offers markets a handU.S. payrolls, EU inflation, China PMI due this week

Premarket: World shares rally as China offers markets a handU.S. payrolls, EU inflation, China PMI due this week

Lire la suite »

Futures edge higher as focus shifts to inflation, jobs dataStocks ended a volatile session higher on Friday after Fed Chair Jerome Powell at the Jackson Hole meet said the U.S. central bank may need to raise interest rates further to ensure inflation is contained. The personal consumption expenditures price index, the Fed's preferred inflation gauge, is set to be released on Thursday and the non-farm pay rolls data is due on Friday. 'While our base case is that the Fed has already reached the end of its tightening cycle, views on the Fed could continue to shift in response to data over coming weeks,' Mark Haefele, chief investment officer at UBS Global Wealth Management, said.

Futures edge higher as focus shifts to inflation, jobs dataStocks ended a volatile session higher on Friday after Fed Chair Jerome Powell at the Jackson Hole meet said the U.S. central bank may need to raise interest rates further to ensure inflation is contained. The personal consumption expenditures price index, the Fed's preferred inflation gauge, is set to be released on Thursday and the non-farm pay rolls data is due on Friday. 'While our base case is that the Fed has already reached the end of its tightening cycle, views on the Fed could continue to shift in response to data over coming weeks,' Mark Haefele, chief investment officer at UBS Global Wealth Management, said.

Lire la suite »

Futures edge higher as focus shifts to inflation, jobs data(Reuters) - U.S. stock index futures edged higher on Monday, with investor focus on key inflation data and employment readings that are due later this ...

Futures edge higher as focus shifts to inflation, jobs data(Reuters) - U.S. stock index futures edged higher on Monday, with investor focus on key inflation data and employment readings that are due later this ...

Lire la suite »

Futures rise as focus shifts to inflation, jobs dataKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Futures rise as focus shifts to inflation, jobs dataKitco News collects and features the top financial, economic and geopolitical news from around the world. Kitco's aggregated sources include some of the top newswires in the world including the Association Press, Canadian Press, Japanese Economic Newswire, and United Press International.

Lire la suite »

India inflation must be visibly on downward path for cenbank to slacken: MPC member VarmaMarket News

India inflation must be visibly on downward path for cenbank to slacken: MPC member VarmaMarket News

Lire la suite »