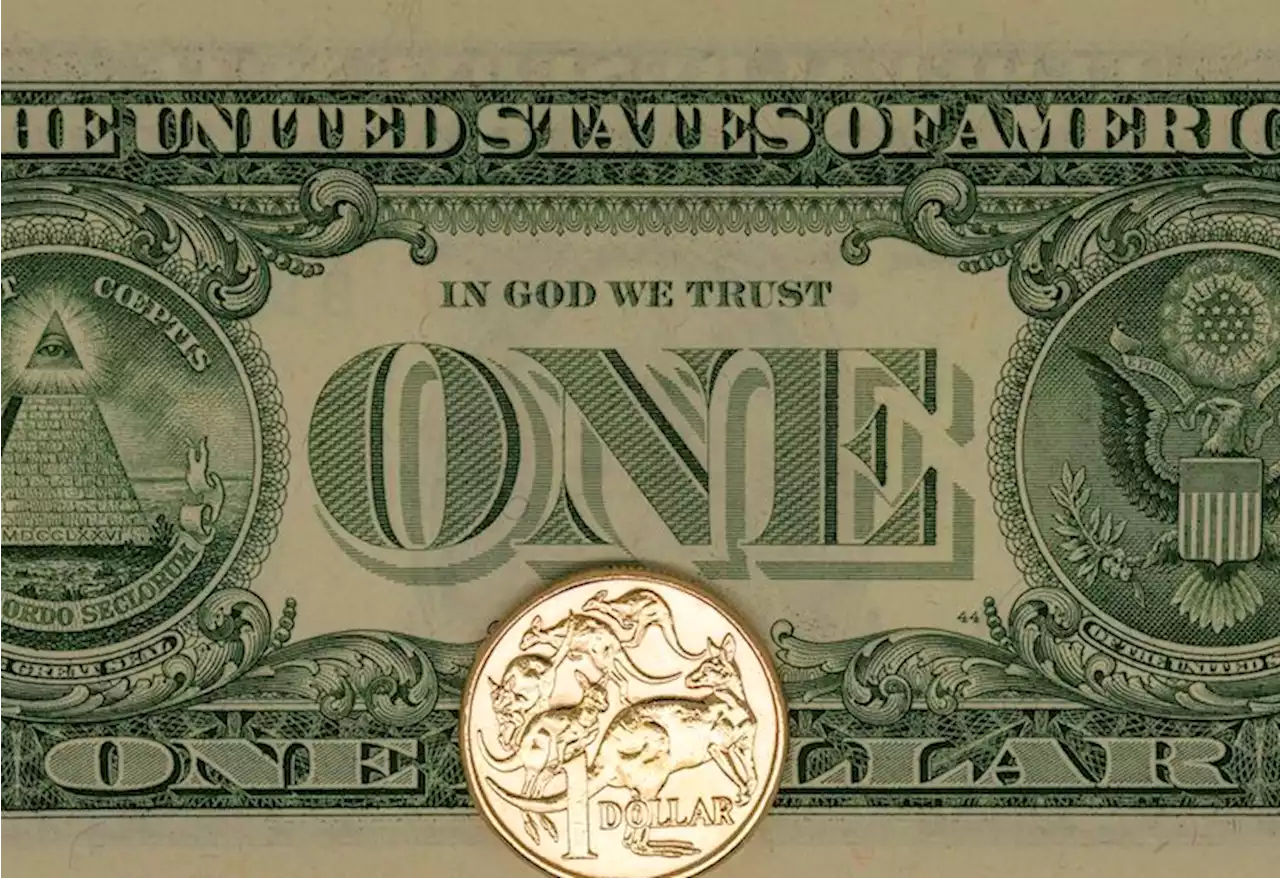

AUD/USD retreats towards 0.6950 ahead of RBA Governor Lowe’s speech, US Retail Sales – by anilpanchal7 AUDUSD RiskAppetite RBA Fed Inflation

e US inflation data offered a volatile Tuesday. Other than the cautious mood ahead of the data/events, recently hawkish Federal Reserve comments also weigh on the risk-barometer Aussie pair.

Most of the Fed policymakers were in favor of further rate hikes even as the US inflation failed to match “positive surprise” hopes. The same propelled the US Treasury bond yields and US Dollar. At home, upbeat Aussie data and cautious optimism allowed the quote to remain firmer before the US data. That said, Australia’s NAB Business Confidence rose to 6.0 in January, from -1.0 prior and 1.0 expected while the NAB Business Conditions rallied to 18.0 compared to 8.0 expected and 12.0 prior. It’s worth noting that Australia’s Westpac Consumer Confidence, flashed earlier on Tuesday, dropped to -6.9% for February versus 5.0% prior. rose past market expectations to 6.4% YoY but posted the slowest increase since 2021 while easing below 6.5% prior.

Despite the unimpressive increase in inflation, Dallas Federal Reserve President Lorie Logan stated that they must remain prepared to continue rate increases for a longer period than previously anticipated. On the same line was New York Fed President John Williams who noted that the work to control too high inflation is not yet done. Additionally, PhiladelphiaAgainst this backdrop, US 10-year Treasury bond yields seesaw around 3.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

AUD/USD is firm nearby 0.6950 ahead of Aussie’s data, US CPIThe AUD/USD edges high in the North American session by 0.75%, spurred by a risk-on impulse, ahead of the release of US inflation data on Tuesday, whi

AUD/USD is firm nearby 0.6950 ahead of Aussie’s data, US CPIThe AUD/USD edges high in the North American session by 0.75%, spurred by a risk-on impulse, ahead of the release of US inflation data on Tuesday, whi

Lire la suite »

AUD/USD pokes 0.6900 amid anxiety over unidentified objects, Fed, focus on US inflation, Aussie employmentAUD/USD pokes 0.6900 amid anxiety over unidentified objects, Fed, focus on US inflation, Aussie employment – by anilpanchal7 AUDUSD Inflation Employment Fed China

AUD/USD pokes 0.6900 amid anxiety over unidentified objects, Fed, focus on US inflation, Aussie employmentAUD/USD pokes 0.6900 amid anxiety over unidentified objects, Fed, focus on US inflation, Aussie employment – by anilpanchal7 AUDUSD Inflation Employment Fed China

Lire la suite »

AUD/USD Price Analysis: Approaches H&S neckline below 0.6900The AUD/USD pair has shown a responsive buying action after surrendering the round-level support of 0.6900 in the Asian session. The Aussie asset has

AUD/USD Price Analysis: Approaches H&S neckline below 0.6900The AUD/USD pair has shown a responsive buying action after surrendering the round-level support of 0.6900 in the Asian session. The Aussie asset has

Lire la suite »

AUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtickAUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtick – by hareshmenghani AUDUSD Fed Inflation Recession Currencies

AUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtickAUD/USD bounces off multi-day low, climbs to 0.6925-30 region amid modest USD downtick – by hareshmenghani AUDUSD Fed Inflation Recession Currencies

Lire la suite »

AUD/USD to trade modestly lower in 12M at 0.67 – Danske BankThe reopening in China has continued to support AUD in early 2022, but relative rates have been a headwind. Economists at Danske Bank expect the AUD/U

AUD/USD to trade modestly lower in 12M at 0.67 – Danske BankThe reopening in China has continued to support AUD in early 2022, but relative rates have been a headwind. Economists at Danske Bank expect the AUD/U

Lire la suite »

AUD/USD Forecast - Aussie Weak, So Sell the Rallies: LookingAussie Weak, So Sell the Rallies: Looking Bearish Below the $0.7000 Handle AUDUSD FOREX Trading

AUD/USD Forecast - Aussie Weak, So Sell the Rallies: LookingAussie Weak, So Sell the Rallies: Looking Bearish Below the $0.7000 Handle AUDUSD FOREX Trading

Lire la suite »