Investor interest fades from this year’s biggest Wall Street launch

) were down 5.4% on Tuesday, on track for their third decline out of the stock’s first four sessions as a listed company, as investor interest faded in the biggest initial public offering for the year so far.

Investors were also monitoring grocery delivery service Instacart, another high profile IPO, which was due to start trading on Tuesday. Instacart was recently indicated to open at $39.11, well above $30 IPO price. Initially with a new stock “there is often a lot of data missing, so there is a reasonable expectation that the real number is higher,” Ortex co-founder Peter Hillerberg said in an email.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Arm shares eye third straight day of losses as post-IPO buzz fizzlesData from analytics company Ortex on Tuesday suggested that short sellers had started taking bets against the stock with slightly more than 5 million shares of the newly listed chip designer 'on loan,' or 2.7% of the stock's free float. Short sellers need to borrow a stock to short it, and the relationship between shares on loan and shorted is normally quite close, according to Ortex. Initially with a new stock 'there is often a lot of data missing, so there is a reasonable expectation that the real number is higher,' Ortex co-founder Peter Hillerberg said in an email.

Arm shares eye third straight day of losses as post-IPO buzz fizzlesData from analytics company Ortex on Tuesday suggested that short sellers had started taking bets against the stock with slightly more than 5 million shares of the newly listed chip designer 'on loan,' or 2.7% of the stock's free float. Short sellers need to borrow a stock to short it, and the relationship between shares on loan and shorted is normally quite close, according to Ortex. Initially with a new stock 'there is often a lot of data missing, so there is a reasonable expectation that the real number is higher,' Ortex co-founder Peter Hillerberg said in an email.

Lire la suite »

Arm shares eye third straight day of losses as post-IPO buzz fizzles(Reuters) - Shares in Arm Holdings were down 6.1% on Tuesday, on track for their third decline out of the stock's first four sessions as a listed ...

Arm shares eye third straight day of losses as post-IPO buzz fizzles(Reuters) - Shares in Arm Holdings were down 6.1% on Tuesday, on track for their third decline out of the stock's first four sessions as a listed ...

Lire la suite »

Klaviyo, Instacart raise IPO price rangesAfter Arm Holdings' (ARM) strong IPO debut, Klaviyo (KVYO) raised its IPO price range to between $27 and $29 per share. This comes after Instacart (CART) raised its own IPO price range as well, to between $28 and $30 per share. Yahoo Finance Live discusses what these debuts could mean for the IPO market.

Klaviyo, Instacart raise IPO price rangesAfter Arm Holdings' (ARM) strong IPO debut, Klaviyo (KVYO) raised its IPO price range to between $27 and $29 per share. This comes after Instacart (CART) raised its own IPO price range as well, to between $28 and $30 per share. Yahoo Finance Live discusses what these debuts could mean for the IPO market.

Lire la suite »

Arm's debut isn't a barometer for the IPO marketIt's Instacart's debut that could serve as a pivotal moment for the IPO market after the success of Arm's listing a week ago.

Arm's debut isn't a barometer for the IPO marketIt's Instacart's debut that could serve as a pivotal moment for the IPO market after the success of Arm's listing a week ago.

Lire la suite »

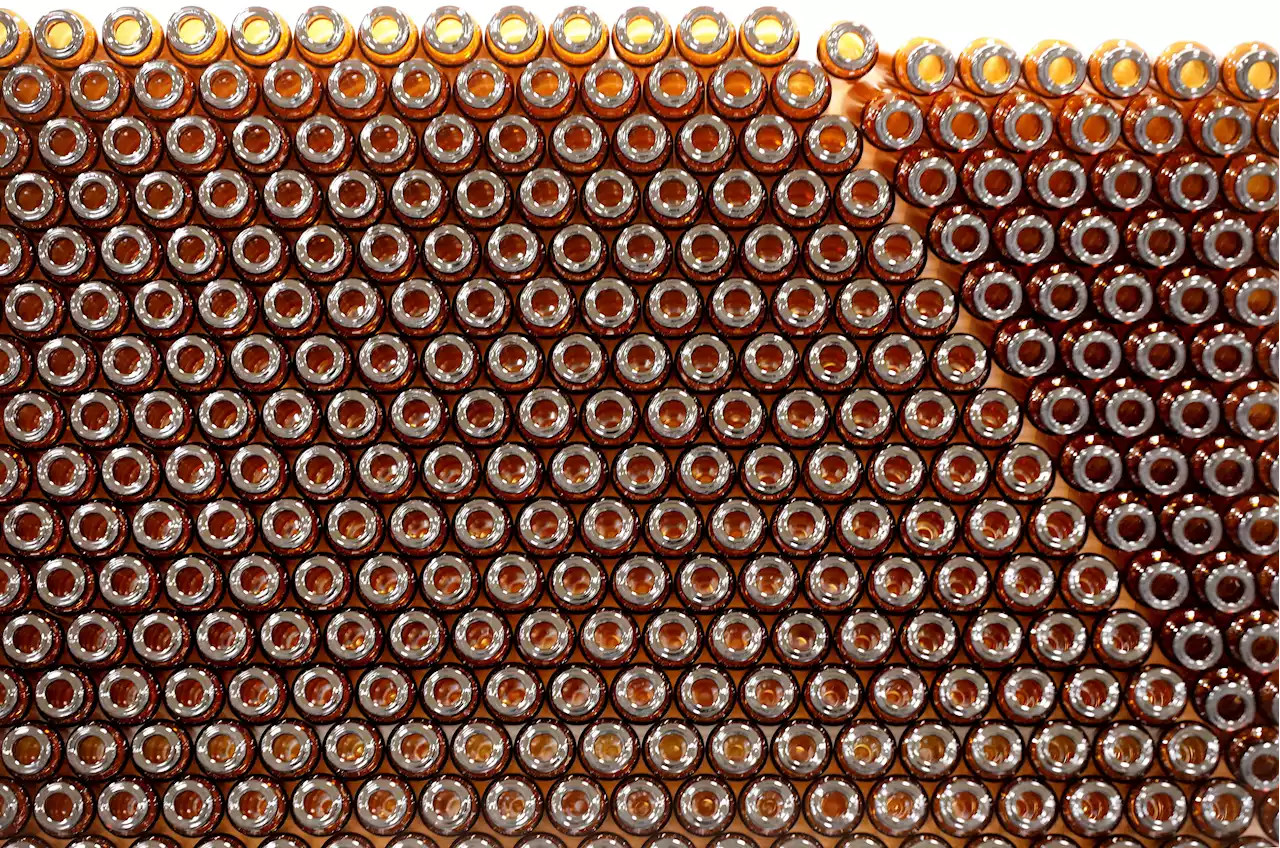

Schott Pharma IPO's investor demand exceeds deal size -bookrunnersBERLIN (Reuters) - Investor demand for shares in the medical vials division of Schott AG exceeds the deal size in its initial public offering, ...

Schott Pharma IPO's investor demand exceeds deal size -bookrunnersBERLIN (Reuters) - Investor demand for shares in the medical vials division of Schott AG exceeds the deal size in its initial public offering, ...

Lire la suite »

Schott Pharma IPO's investor demand exceeds deal size -bookrunnersBERLIN (Reuters) - Investor demand for shares in the medical vials division of Schott AG exceeds the deal size in its initial public offering, ...

Schott Pharma IPO's investor demand exceeds deal size -bookrunnersBERLIN (Reuters) - Investor demand for shares in the medical vials division of Schott AG exceeds the deal size in its initial public offering, ...

Lire la suite »