U.S. economic growth, still racing at a potentially inflationary pace as other key parts of the world slow, could pose global risks if it forces Federal Reserve officials to raise interest rates higher than currently expected. The Fed's aggressive rate increases last year had the potential to stress the global financial system as the U.S. dollar soared, but the impact was muted by largely synchronized central bank rate hikes and other actions taken by monetary authorities to prevent widespread dollar funding problems for companies and offset the impact of weakening currencies. Now Brazil, Chile and China have begun cutting interest rates, with others expected to follow, actions that international officials and central bankers at last week's Jackson Hole conference said are largely tuned to an expectation the Fed won't raise its rate more than an additional quarter percentage point.

FILE PHOTO: Kansas City Federal Reserve Bank's annual Economic Policy Symposium in Jackson HoleJACKSON HOLE, Wyoming - U.S. economic growth, still racing at a potentially inflationary pace as other key parts of the world slow, could pose global risks if it forces Federal Reserve officials to raise interest rates higher than currently expected.

That sort of policy shock, at a moment of U.S. economic divergence with the rest of the world, could have significant ripple effects. Yet Fed officials remain puzzled, and somewhat concerned, over conflicting signals in the incoming data. Quizzed about the divergence after a speech here, European Central Bank President Christine Lagarde noted after the Russian invasion of Ukraine last year, the outlook was for a euro-area recession, and a potentially deep one in parts of it.

China may also play a role, economists say. Its slowdown after a short-lived growth burst earlier this year could pinch Germany's exports and slow Europe's growth, for instance.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Jackson Hole roundup: Fed Chair Powell, Fed Presidents, key advisers, and moreFederal Reserve Chair Jerome Powell delivered his annual speech at the Jackson Hole Economic Symposium on Friday morning. Yahoo Finance spoke to experts across the industry to break down Powell's speech, what it means for inflation and interest rates at the Fed meeting in September, the impact on the economy, and more. Video highlights: 00:00:04 - Yahoo Finance's Jennifer Schonberger 00:00:27 - Federal Reserve Board Chair Jerome Powell 00:00:57 - Philadelphia Federal Reserve President Patrick Harker 00:01:18 - Former St. Louis Fed President 00:01:50 - Council of Economic Advisers Chair Jared Berstein 00:02:07 - Boston Fed President Susan Collins 00:02:25 - Former Fed Vice Chair Alan Blinder

Jackson Hole roundup: Fed Chair Powell, Fed Presidents, key advisers, and moreFederal Reserve Chair Jerome Powell delivered his annual speech at the Jackson Hole Economic Symposium on Friday morning. Yahoo Finance spoke to experts across the industry to break down Powell's speech, what it means for inflation and interest rates at the Fed meeting in September, the impact on the economy, and more. Video highlights: 00:00:04 - Yahoo Finance's Jennifer Schonberger 00:00:27 - Federal Reserve Board Chair Jerome Powell 00:00:57 - Philadelphia Federal Reserve President Patrick Harker 00:01:18 - Former St. Louis Fed President 00:01:50 - Council of Economic Advisers Chair Jared Berstein 00:02:07 - Boston Fed President Susan Collins 00:02:25 - Former Fed Vice Chair Alan Blinder

Lire la suite »

Fed 'clearly going to hold through the end of the year': Fed's HarkerFederal Reserve members, including chair Jerome Powell, are sending a clear message - they want to get rates down to two percent. However, some are taking a more hawkish stance than others. Philadelphia Federal Reserve President Patrick Harker wants to let 'things work through the economy.' Harker tells Yahoo Finance's Jennifer Schonberger what he is hearing from people who live in his district that they want to be able to digest all the rate increases the Fed has done this year. However, Harker stresses that 'not raising rates right now still means we are in a restrictive stance, we're still putting pressure on the economy,' and that data will dictate his decisions. Right now, Harker doesn't see a re-acceleration in inflation and that he would like to 'hold and see how things turn out.'The Fed is 'clearly going to hold through the end of the year,' Harker said, and that next year, data will dictate whether or not the Fed cuts rates. In order to get to a point where the Fed will cut, Harker says there needs to be 'clear signs' inflation is moving towards the Fed's two percent target, something he says 'is gong to take some time.' Overall, Harker says a soft landing scenario is the 'most probable,' but it's not guaranteed. Key video moments 00:00:22 Harker's current thinking on rates 00:02:00 Harker's on the September meeting 00:02:19 How long will the Fed keep rates high? 00:03:45 When could the Fed cut rates? 00:04:45 Harker on a soft landing 00:05:30 Relationship between wages and inflation 00:06:45 How demographics are impacting the economy and what the Fed does 00:10:00 Harker discusses what he is hearing at the symposium

Fed 'clearly going to hold through the end of the year': Fed's HarkerFederal Reserve members, including chair Jerome Powell, are sending a clear message - they want to get rates down to two percent. However, some are taking a more hawkish stance than others. Philadelphia Federal Reserve President Patrick Harker wants to let 'things work through the economy.' Harker tells Yahoo Finance's Jennifer Schonberger what he is hearing from people who live in his district that they want to be able to digest all the rate increases the Fed has done this year. However, Harker stresses that 'not raising rates right now still means we are in a restrictive stance, we're still putting pressure on the economy,' and that data will dictate his decisions. Right now, Harker doesn't see a re-acceleration in inflation and that he would like to 'hold and see how things turn out.'The Fed is 'clearly going to hold through the end of the year,' Harker said, and that next year, data will dictate whether or not the Fed cuts rates. In order to get to a point where the Fed will cut, Harker says there needs to be 'clear signs' inflation is moving towards the Fed's two percent target, something he says 'is gong to take some time.' Overall, Harker says a soft landing scenario is the 'most probable,' but it's not guaranteed. Key video moments 00:00:22 Harker's current thinking on rates 00:02:00 Harker's on the September meeting 00:02:19 How long will the Fed keep rates high? 00:03:45 When could the Fed cut rates? 00:04:45 Harker on a soft landing 00:05:30 Relationship between wages and inflation 00:06:45 How demographics are impacting the economy and what the Fed does 00:10:00 Harker discusses what he is hearing at the symposium

Lire la suite »

As the U.S. Federal Reserve registers gains, Powell may take a lay low approachJerome Powell’s speech topic is listed as ‘Economic Outlook’ on the central bank’s public calendar, but Fed chairs are given a wide berth in how they use the Jackson Hole platform and the global attention it gets

As the U.S. Federal Reserve registers gains, Powell may take a lay low approachJerome Powell’s speech topic is listed as ‘Economic Outlook’ on the central bank’s public calendar, but Fed chairs are given a wide berth in how they use the Jackson Hole platform and the global attention it gets

Lire la suite »

Fed's Powell says central bank may need to raise interest rates furtherNEW YORK/LONDON (Reuters) - The U.S. Federal Reserve may need to raise interest rates further to ensure inflation is contained, U.S. Federal Reserve ...

Fed's Powell says central bank may need to raise interest rates furtherNEW YORK/LONDON (Reuters) - The U.S. Federal Reserve may need to raise interest rates further to ensure inflation is contained, U.S. Federal Reserve ...

Lire la suite »

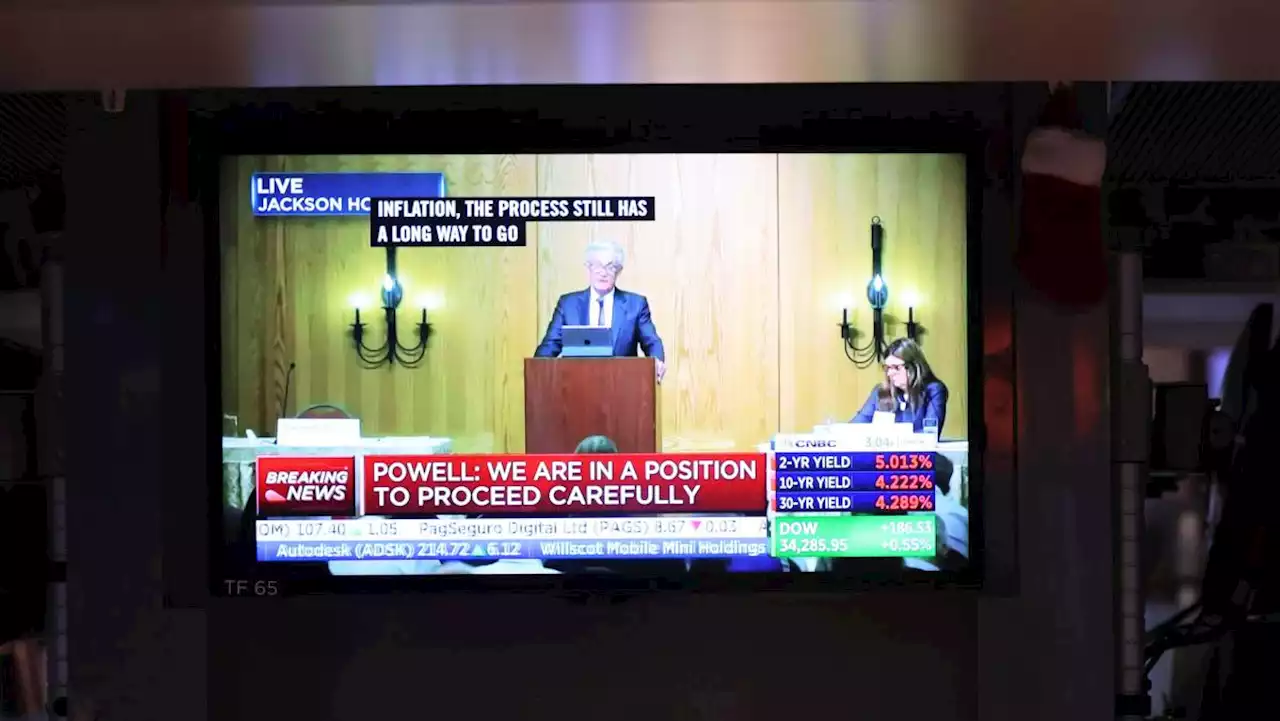

Powell: Inflation is still high, Fed ready to raise rates if neededIn his annual speech at the Jackson Hole Economic Symposium, Federal Reserve Chairman Jerome Powell warned that the Fed is ready to raise rates again if it's needed. Powell stressed that though inflation has come down, 'it remains too high.' As a result, the Fed is prepared to 'raise rates further if appropriate' and will 'hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,' Powell said. Going forward, the Fed chair says they will 'proceed carefully' as they assess incoming data. Powell notes the road ahead, stating 'there is substantial further ground to cover to get back to price stability.'You can watch full comments made by Federal Reserve Chair Jerome Powell here

Powell: Inflation is still high, Fed ready to raise rates if neededIn his annual speech at the Jackson Hole Economic Symposium, Federal Reserve Chairman Jerome Powell warned that the Fed is ready to raise rates again if it's needed. Powell stressed that though inflation has come down, 'it remains too high.' As a result, the Fed is prepared to 'raise rates further if appropriate' and will 'hold policy at a restrictive level until we are confident that inflation is moving sustainably down toward our objective,' Powell said. Going forward, the Fed chair says they will 'proceed carefully' as they assess incoming data. Powell notes the road ahead, stating 'there is substantial further ground to cover to get back to price stability.'You can watch full comments made by Federal Reserve Chair Jerome Powell here

Lire la suite »

Powell says Fed 'prepared to raise rates further' to bring inflation downFed Chair Jay Powell reiterated his message that the Fed will keep monetary policy tight until the Fed brings inflation back to its 2% target.

Powell says Fed 'prepared to raise rates further' to bring inflation downFed Chair Jay Powell reiterated his message that the Fed will keep monetary policy tight until the Fed brings inflation back to its 2% target.

Lire la suite »