Investors have piled back into bonds in Pakistan and Argentina following cash infusions and optimism over multilateral support, but the two nations have secured only enough help to limp to autumn elections, experts said.

This fresh cash means Pakistan is unlikely to default on its debt in the next six to nine months, said de Sousa. Elections in theReserves remain precariously low at $9.8 billion as of 7 July, only roughly two months of imports. JPMorgan pegs its external financing needs at greater than $30 billion.

The real challenge for Pakistan, which is still recovering financially and physically from last year's, comes after the contentious elections, when it will likely need to secure a longer-term IMF program. Reflecting the challenges ahead, the Pakistan bond rally was heavily skewed towards shorter-dated maturities.In Argentina, infamous for its chaotic cycles of debt and default, problems are even more deeply rooted. South America's second-largest economy is teetering on the edge of recession, with inflation topping 100% and a currency that keeps depreciating in official and parallel markets.44 billionBattling an acute dollar scarcity, in June it paid part of $2.

Investors and pollsters said the tough times could force Pakistan and Argentina's leaders to reckon with needed fiscal reforms."The Peronist government faces a high chance of losing the election," said Alejandro Catterberg, director of Buenos Aires-based polling firm Poliarquia. "The disappointment and frustration among Argentines are running at the highest level in the last two decades".

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

As inflation cools, here’s how investors can move money back into stocks and bondsThe days of money-market and CD yields of 5%-plus may soon be over.

As inflation cools, here’s how investors can move money back into stocks and bondsThe days of money-market and CD yields of 5%-plus may soon be over.

Lire la suite »

‘A sinking ship’: Celsius CEO charged with defrauding investors as crypto lender came crashing downCelsius CEO Alexander Mashinsky heavily manipulated the price of the crypto lender’s token through secret and well-timed purchases – and made an extra $40 million in profit, investigators alleged.

‘A sinking ship’: Celsius CEO charged with defrauding investors as crypto lender came crashing downCelsius CEO Alexander Mashinsky heavily manipulated the price of the crypto lender’s token through secret and well-timed purchases – and made an extra $40 million in profit, investigators alleged.

Lire la suite »

Nikola stock jumps as retail investors scoop up shares after BayoTech deal - AutoblogShares of Nikola Corp jumped 15.8% in premarket trading on Friday, a day after a short squeeze sent the electric-truck maker's shares soaring.

Nikola stock jumps as retail investors scoop up shares after BayoTech deal - AutoblogShares of Nikola Corp jumped 15.8% in premarket trading on Friday, a day after a short squeeze sent the electric-truck maker's shares soaring.

Lire la suite »

Gold Price Forecast: XAU/USD remains subdued around $1,960 as investors expect consecutive skip from FedGold Price Forecast: XAU/USD remains subdued around $1,960 as investors expect consecutive skip from Fed – by Sagar_Dua24 Gold Fed DollarIndex Inflation XAUUSD

Gold Price Forecast: XAU/USD remains subdued around $1,960 as investors expect consecutive skip from FedGold Price Forecast: XAU/USD remains subdued around $1,960 as investors expect consecutive skip from Fed – by Sagar_Dua24 Gold Fed DollarIndex Inflation XAUUSD

Lire la suite »

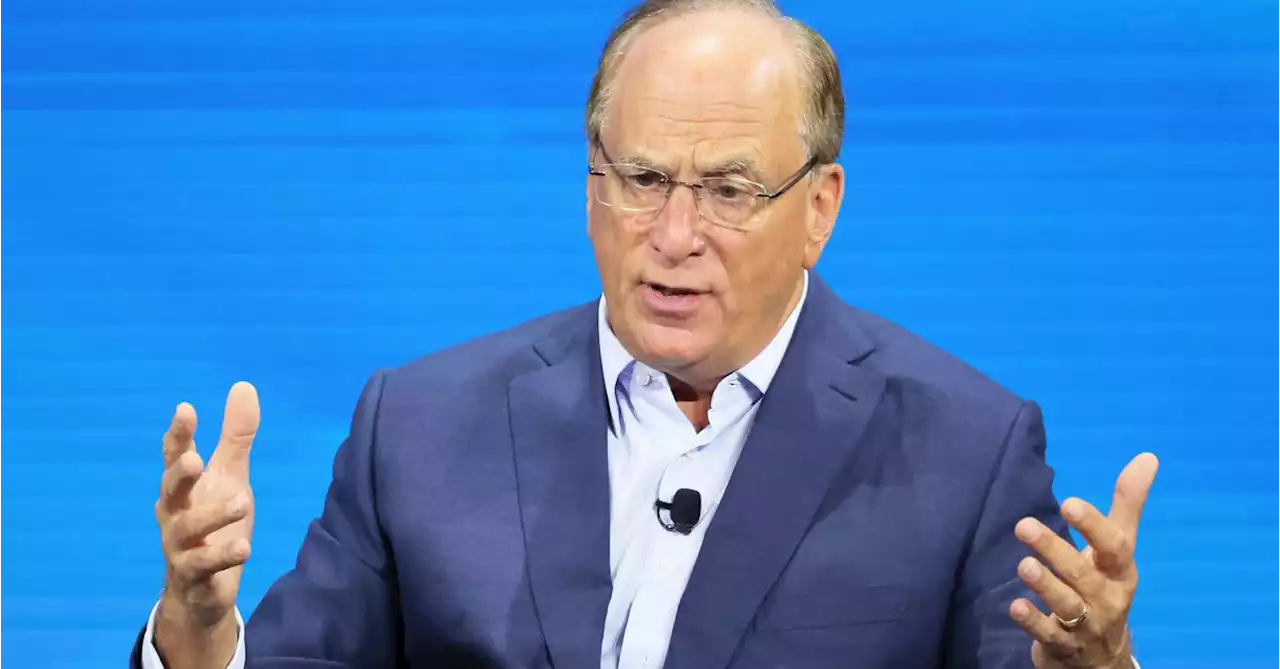

BlackRock CEO Larry Fink Talks Up Crypto Demand From Gold Investors.larryfink was in a bullish mood on Friday as he spoke of the increasing demand he is seeing for crypto among gold investors. $BLK $BTC By JamieCrawleyCD

BlackRock CEO Larry Fink Talks Up Crypto Demand From Gold Investors.larryfink was in a bullish mood on Friday as he spoke of the increasing demand he is seeing for crypto among gold investors. $BLK $BTC By JamieCrawleyCD

Lire la suite »

BTC, ETH, and BNB Price Analysis for July 12Can BTC and BNB follow the sharp rise of ETH? crypto Ethereum ETH $ETH cryptoexchange VitalikButerin ethereum cz_binance Binance Binance_Info nceSG BinanceUpdates

BTC, ETH, and BNB Price Analysis for July 12Can BTC and BNB follow the sharp rise of ETH? crypto Ethereum ETH $ETH cryptoexchange VitalikButerin ethereum cz_binance Binance Binance_Info nceSG BinanceUpdates

Lire la suite »