Several Southeast Asian companies are considering listing in the United States, banking on strong investor appetite for emerging market growth in the absence of Chinese stock offerings. Senior executives in leading SME digital financing platform Funding Societies, Singapore-based entertainment firm Gushcloud International and Thai insurance technology firm Sunday told Reuters they were looking into New York as one of their initial public offering (IPO) venues. This comes on top of recently announced plans by Vietnamese internet company VNG Corp and Philippine real estate company DoubleDragon Corp's Hotel101 Global to list in the U.S., filling a void left by Chinese companies which hit the pause button on U.S. IPOs after political tensions with Washington intensified, Beijing tightened scrutiny of domestic firms seeking overseas listings and China's own economy slowed.

SINGAPORE/SYDNEY - Several Southeast Asian companies are considering listing in the United States, banking on strong investor appetite for emerging market growth in the absence of Chinese stock offerings.

"China's shadow into the ASEAN region has shrunk since the world reopened after the pandemic," said Leif Schneider, senior legal adviser at law firm DFDL Vietnam. Southeast Asian firms have raised about $101 million via IPOs in the U.S. so far this year, way below last year's $919 million, but bankers expect the pace to pick up over the next 12 months as companies hunt for new sources of capital after relying on private funds for the last few years.In contrast, Chinese firms have raised $463.7 million via U.S listings so far this year, slightly above 2022 levels but a fraction of the $12.96 billion and $12.

Some Southeast Asia companies seeking listings in the U.S. look to raise between $300 million and $1 billion, with valuations ranging from $1.5 billion to $8 billion, bankers said, without naming any firms. "With the current cautious stance around China, these investors are on the lookout for some of the other emerging markets names," he added.Funding Societies' co-founder and group CEO Kelvin Teo told Reuters the U.S. was one of the company's preferred options because of it would provide a deep pool of capital and global investor base.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

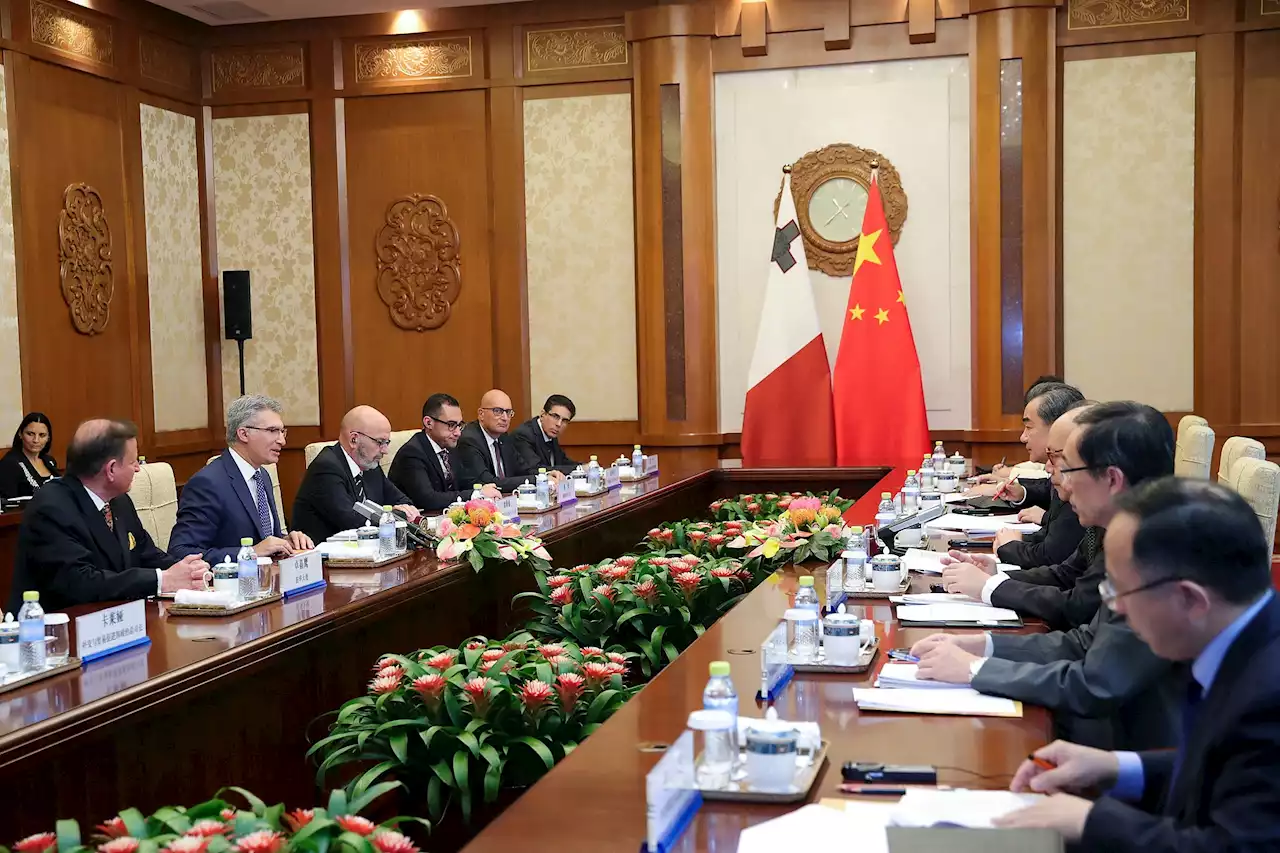

China, EU should maintain open attitude, reject protectionism -Chinese state mediaBEIJING (Reuters) - China and the European Union (EU) should continue to maintain an

China, EU should maintain open attitude, reject protectionism -Chinese state mediaBEIJING (Reuters) - China and the European Union (EU) should continue to maintain an

Lire la suite »

China, EU should maintain open attitude, reject protectionism -Chinese state mediaBEIJING (Reuters) - China and the European Union (EU) should continue to maintain an

China, EU should maintain open attitude, reject protectionism -Chinese state mediaBEIJING (Reuters) - China and the European Union (EU) should continue to maintain an

Lire la suite »

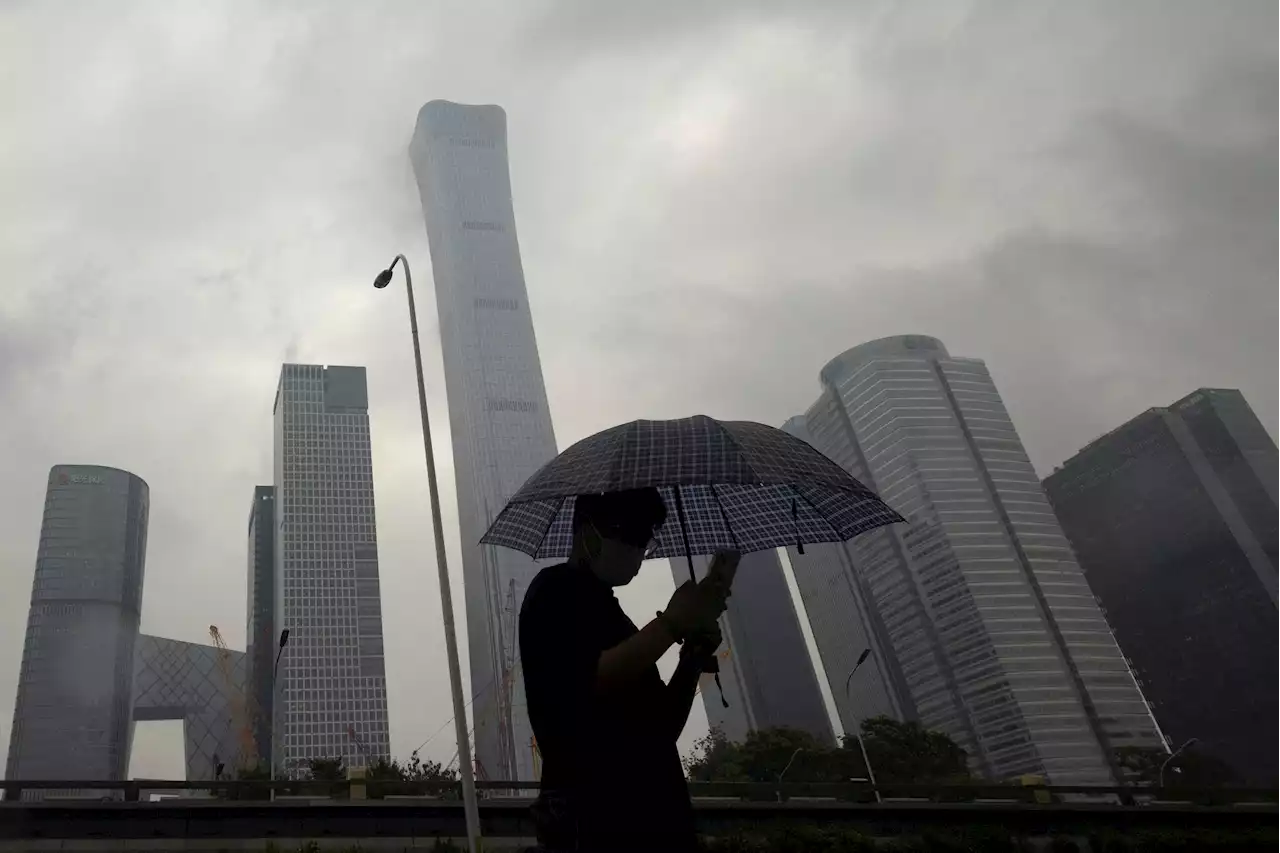

Chinese state firms' help to troubled shadow bank does little to address investor concernsThe involvement of two Chinese state-owned financial firms in Zhongrong International Trust Co's operations and management may diffuse risk at the troubled shadow bank but does little to ease concerns about missed payments, analysts and investors said. The shadow bank, which traditionally had sizable real estate exposure, missed payments on dozens of so-called trust products since late July, roiling markets and raising fears that China's financial system may be at risk from the property sector crisis. Angry retail investors in Zhongrong's trust products last month held protests in Beijing and lodged complaint letters with regulators, pleading with the authorities to step in after the missed payments.

Chinese state firms' help to troubled shadow bank does little to address investor concernsThe involvement of two Chinese state-owned financial firms in Zhongrong International Trust Co's operations and management may diffuse risk at the troubled shadow bank but does little to ease concerns about missed payments, analysts and investors said. The shadow bank, which traditionally had sizable real estate exposure, missed payments on dozens of so-called trust products since late July, roiling markets and raising fears that China's financial system may be at risk from the property sector crisis. Angry retail investors in Zhongrong's trust products last month held protests in Beijing and lodged complaint letters with regulators, pleading with the authorities to step in after the missed payments.

Lire la suite »

Chinese state firms' help to troubled shadow bank does little to address investor concernsBEIJING (Reuters) - The involvement of two Chinese state-owned financial firms in Zhongrong International Trust Co's operations and management may ...

Chinese state firms' help to troubled shadow bank does little to address investor concernsBEIJING (Reuters) - The involvement of two Chinese state-owned financial firms in Zhongrong International Trust Co's operations and management may ...

Lire la suite »

Chinese state firms' help to troubled shadow bank does little to address investor concernsMarket News

Chinese state firms' help to troubled shadow bank does little to address investor concernsMarket News

Lire la suite »