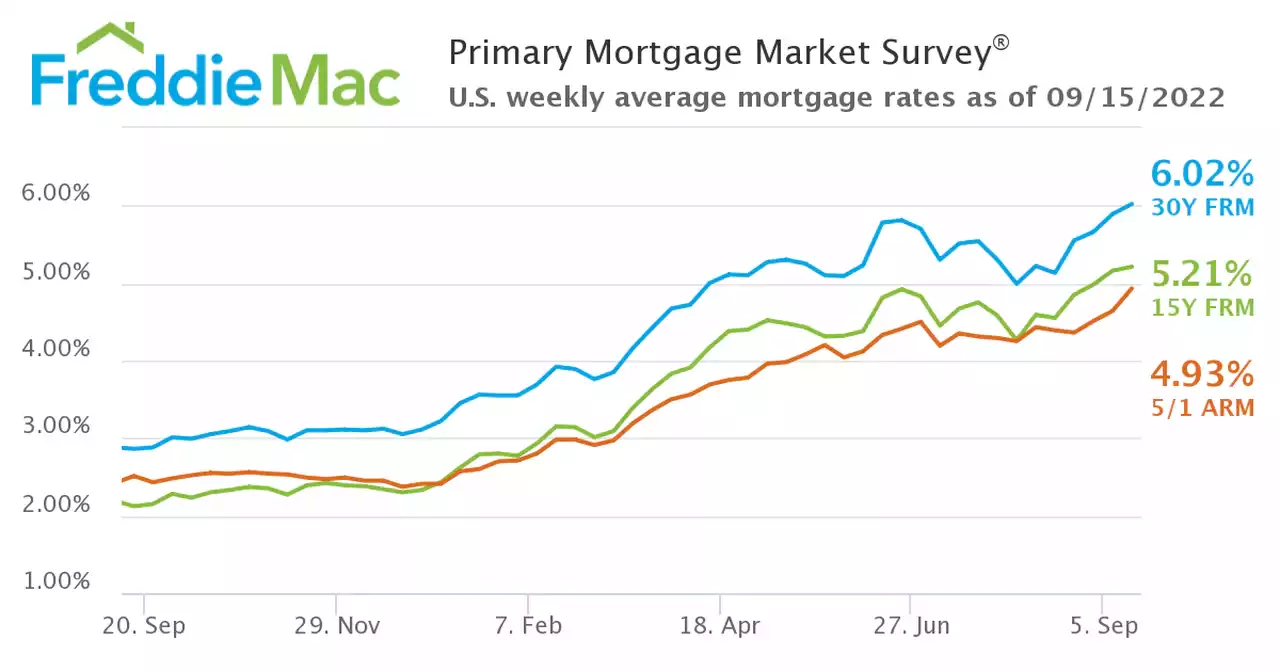

Less than a year removed from historically low interest, the average rate on a 30-year fixed rate mortgage nationally is now higher than its been since 2008.

Sean McDonnell, cleveland.com

CLEVELAND, Ohio — The average rate on a 30-year fixed mortgage was 6.02% Thursday, up from 5.89% a week ago, according to Freddie Mac, a government-sponsored home-loan agency. Rates on a 15-year fixed mortgage were 5.21%, down from 5.16% last week. Note to readers: if you purchase something through one of our affiliate links we may earn a commission.

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

US mortgage interest rates top 6% for first time since 2008The average interest rate on the most popular U.S. home loan rose above 6% for the first time since 2008 and is now more than double the level it was one year ago, Mortgage Bankers Association data showed on Wednesday.

US mortgage interest rates top 6% for first time since 2008The average interest rate on the most popular U.S. home loan rose above 6% for the first time since 2008 and is now more than double the level it was one year ago, Mortgage Bankers Association data showed on Wednesday.

Lire la suite »

Mortgage rates top 6% for the first time since 2008Mortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Mortgage rates top 6% for the first time since 2008Mortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Lire la suite »

US mortgage rates hit 6% high for first time since 2008The rate is more than double what it was just a year ago, according to new data out this week from the Mortgage Bankers Association.

US mortgage rates hit 6% high for first time since 2008The rate is more than double what it was just a year ago, according to new data out this week from the Mortgage Bankers Association.

Lire la suite »

Mortgage rates top 6% for the first time since 2008 | CNN BusinessMortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Mortgage rates top 6% for the first time since 2008 | CNN BusinessMortgage rates jumped again, surpassing the 6% mark and reaching the highest level since the fall of 2008.

Lire la suite »

Mortgage rates rise above 6% for the first time since 2008The average 30-year mortgage rate has climbed to 6.02% — the first time the figure has surpassed 6% since 2008, according to new data from mortgage giant Freddie Mac.

Mortgage rates rise above 6% for the first time since 2008The average 30-year mortgage rate has climbed to 6.02% — the first time the figure has surpassed 6% since 2008, according to new data from mortgage giant Freddie Mac.

Lire la suite »

Mortgage rates climb above 6%, first time since 2008The average interest rate for a 30-year fixed mortgage is now about 6% for the first time since the financial crisis, more than double what it was a year ago.

Mortgage rates climb above 6%, first time since 2008The average interest rate for a 30-year fixed mortgage is now about 6% for the first time since the financial crisis, more than double what it was a year ago.

Lire la suite »