Benchmark 10-year U.S. Treasury yields rose to their highest in over 11 years on Monday as investors braced for the Federal Reserve's policy decision on Wednesday, where it is expected to deliver another large interest rate hike.

The 10-year yield, the most significant interest rate benchmark globally, rose as much as six basis points to 3.508%, the highest since April 2011.

The Fed meets on Wednesday. Money markets are pricing in around an 80% chance of a 75 basis-point move, and a 20% chance of a larger, 100 basis-point rate hike.Reporting by Yoruk Bahceli, editing by Alun John

France Dernières Nouvelles, France Actualités

Similar News:Vous pouvez également lire des articles d'actualité similaires à celui-ci que nous avons collectés auprès d'autres sources d'information.

Treasury Yields Tick Higher as Traders Anticipate the Fed's Next MoveTreasury yields ticked higher early Monday as traders anticipated the U.S. Federal Reserve’s next move in the face of persistently high inflation.

Treasury Yields Tick Higher as Traders Anticipate the Fed's Next MoveTreasury yields ticked higher early Monday as traders anticipated the U.S. Federal Reserve’s next move in the face of persistently high inflation.

Lire la suite »

As Treasury yields spike, short-duration ETFs are beating the market and raking in cashShort-duration income ETFs have been winners in 2022, and an inverted yield curve could help them stay ahead.

As Treasury yields spike, short-duration ETFs are beating the market and raking in cashShort-duration income ETFs have been winners in 2022, and an inverted yield curve could help them stay ahead.

Lire la suite »

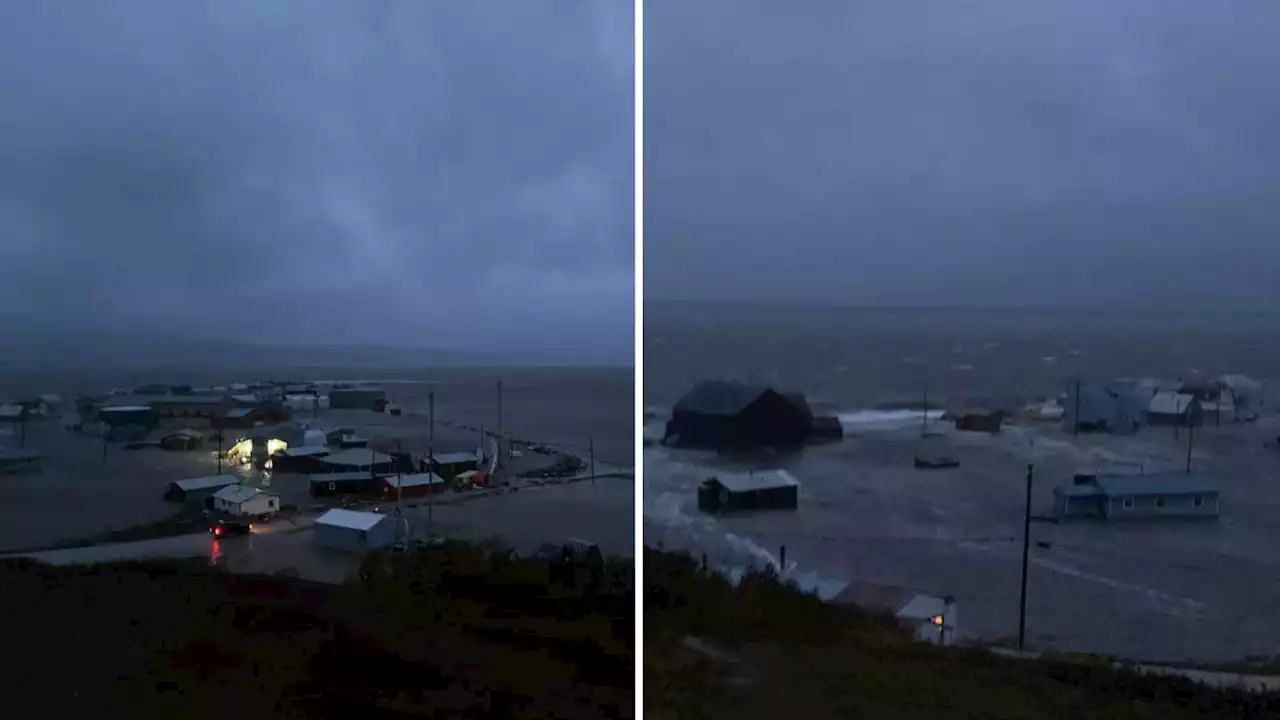

Alaska governor declares disaster after ‘historic-level storm’ floods coastal townsNome has reported a tide height of over 10 feet. The highest tide in the area was 12 feet in 1974.

Alaska governor declares disaster after ‘historic-level storm’ floods coastal townsNome has reported a tide height of over 10 feet. The highest tide in the area was 12 feet in 1974.

Lire la suite »

Alaska governor declares disaster as state braces for ‘historic-level storm’Nome has reported a tide height of over 10 feet. The highest tide in the area was 12 feet in 1974.

Alaska governor declares disaster as state braces for ‘historic-level storm’Nome has reported a tide height of over 10 feet. The highest tide in the area was 12 feet in 1974.

Lire la suite »

Alaska Prepares For 'Historic-Level' Storm Barreling Towards Coast“In 10 years, people will be referring to the September 2022 storm as a benchmark storm.”

Alaska Prepares For 'Historic-Level' Storm Barreling Towards Coast“In 10 years, people will be referring to the September 2022 storm as a benchmark storm.”

Lire la suite »